11 February, 2021

India, like many markets in the pandemic, experienced a difficult 2020, with its economy contracting the most since 19521. However, recent data points to the conclusion that the worst may be over as new COVID-19 cases decline and economic activity accelerates. In this 2021 Outlook, Rana Gupta (Senior Portfolio Manager and Indian Equities Specialist) and Koushik Pal (Senior Analyst), present their views on how a sharp growth comeback is likely this year given favourable structural government policies and cyclical tailwinds that support two transformative medium-term trends: formalisation through a digital economy and reinvestment in manufacturing.

Despite the economic and societal challenges of the COVID-19 pandemic, we believe that the worst is likely behind us and the stage is set for growth in India to make a strong comeback in 20212. This will be driven by the government's long-term policy framework and the Reserve Bank of India's (RBI) supportive monetary policies. The growth outlook is further underpinned by benign monetary conditions and low real rates resulting from substantial inward capital flows seeking to participate in India's long-term growth story. An end to the economic disruptions caused by the COVID-19 pandemic in India is now clearly visible: active cases have consistently declined over the past three months, and a large-scale vaccination programme commenced in January 2021.

Indeed, the focus should now turn to medium and long-term growth themes that are receiving further impetus through government policy action during the pandemic and the recently released 2021 Union Budget.

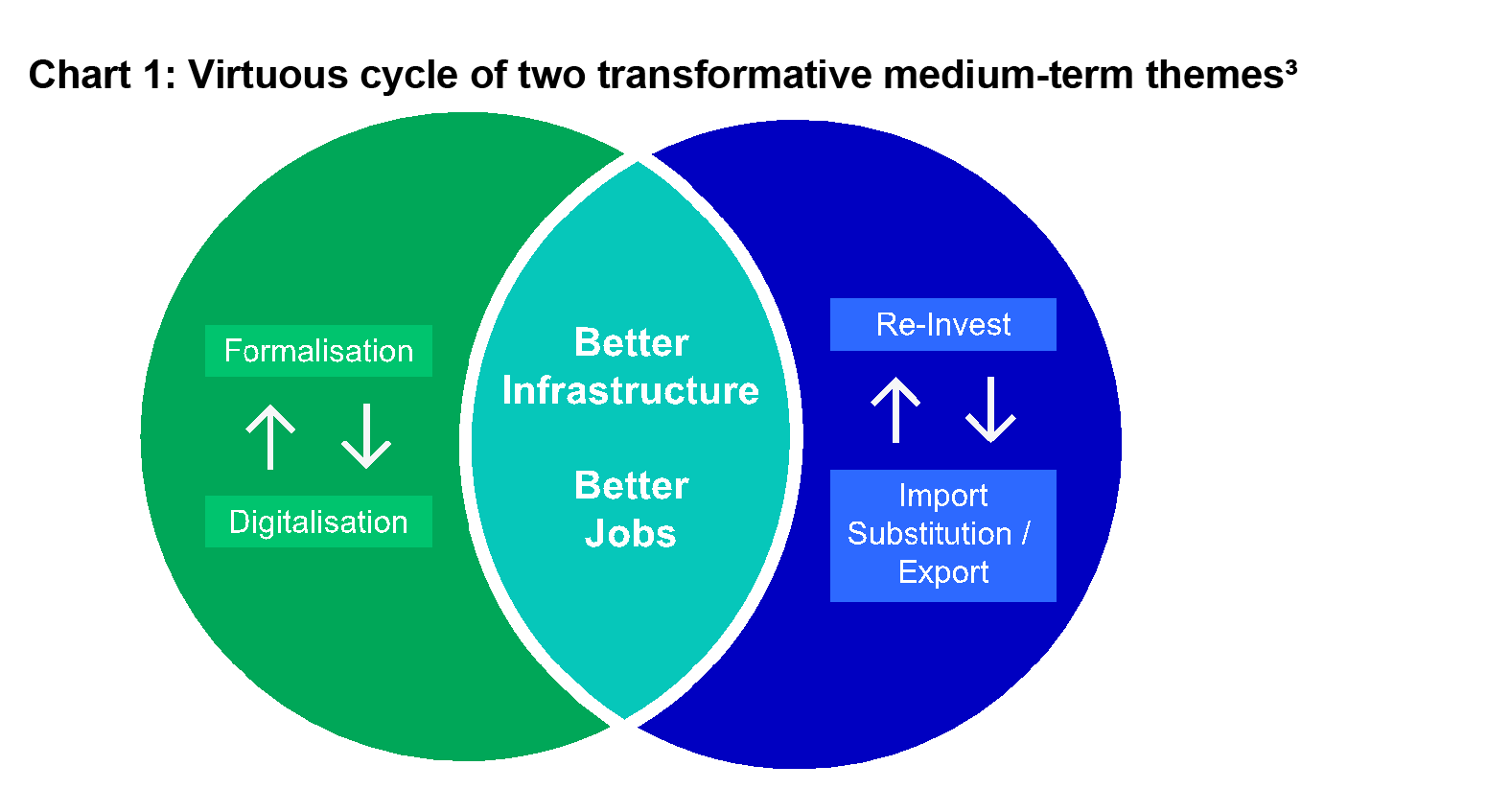

Two powerful themes have emerged from the focused policy agenda of the past six years (see Chart 1). We believe these will drive India's medium-term growth potential:

1. Formalisation through a digital economy;

2.Reinvestment in manufacturing.

These two themes should serve as primary tailwinds for the country's growth potential over the medium term. Both can also feed off each other to create a virtuous cycle that should generate more jobs, improve domestic savings, and enable reinvestment in better infrastructure. On the one hand, formalisation is driving the growth of a massive digital economy; at the same time, the digital economy is itself driving the formalisation process by boosting productivity.

We also believe that manufacturing growth is at an inflexion point. India should continue to benefit from global capital inflows, as trade tensions and the diversification of supply chains outside of China are trends that are likely to persist in the medium term. International firms have already committed large investments in areas like electronics manufacturing, and the Indian government has turned its policy agenda firmly toward incentivising the localisation of manufacturing. As manufacturing grows, more formal jobs will be created, which we believe will drive income growth and consumption, thereby unleashing another virtuous cycle of growth.

In our past investment notes, we have consistently highlighted that despite the challenges of the COVID-19 pandemic in 2020 and the cyclical slowdown that preceded it, India remains a local, bottom-up story that is supported by a host of structural reforms already in place to promote formalisation: the JAM4 trinity, lower corporate taxes, indirect tax reform (GST), real estate regulations (the RERA Act), and the Bankruptcy Act.

We had also argued that with the fundamental building block of formalisation in place, the Indian government has a unique opportunity to revitalise economic growth through a policy framework we called the "3 Rs":

1. Recycle: Funding government spending needs through the privatisation of state-owned enterprise (SOE) assets.

2. Rebuild: Aggregating savings by providing tax cuts to the private sector and households. Further augmenting savings by opening various sectors to FDI.

3. Reinvest: Providing incentives for manufacturing firms and global capital to reinvest such savings to substitute imports and increase the country's global market share of exports.

While the Recycle initiatives briefly took a backseat in 2020 amid the disruption posed by the pandemic, the government has consistently moved ahead on Rebuild and Reinvest policy agenda over the past 18 months, focusing on long-term policies during the pandemic to reduce the corporate tax rate, simplify labour laws, and incentivise localisation of manufacturing, rather than just concentrating on fiscal stimulus5.

The latest Union Budget presented on 1 February 2021 privileged growth over near-term fiscal discipline. It also avoided any sudden tax increases that could have affected investor sentiment. We believe this is the right policy agenda, as the fledgling economic recovery needs spending and policy support. Benign global monetary conditions and bottom-up factors favour India, meaning that markets can support more near-term borrowing from the government.

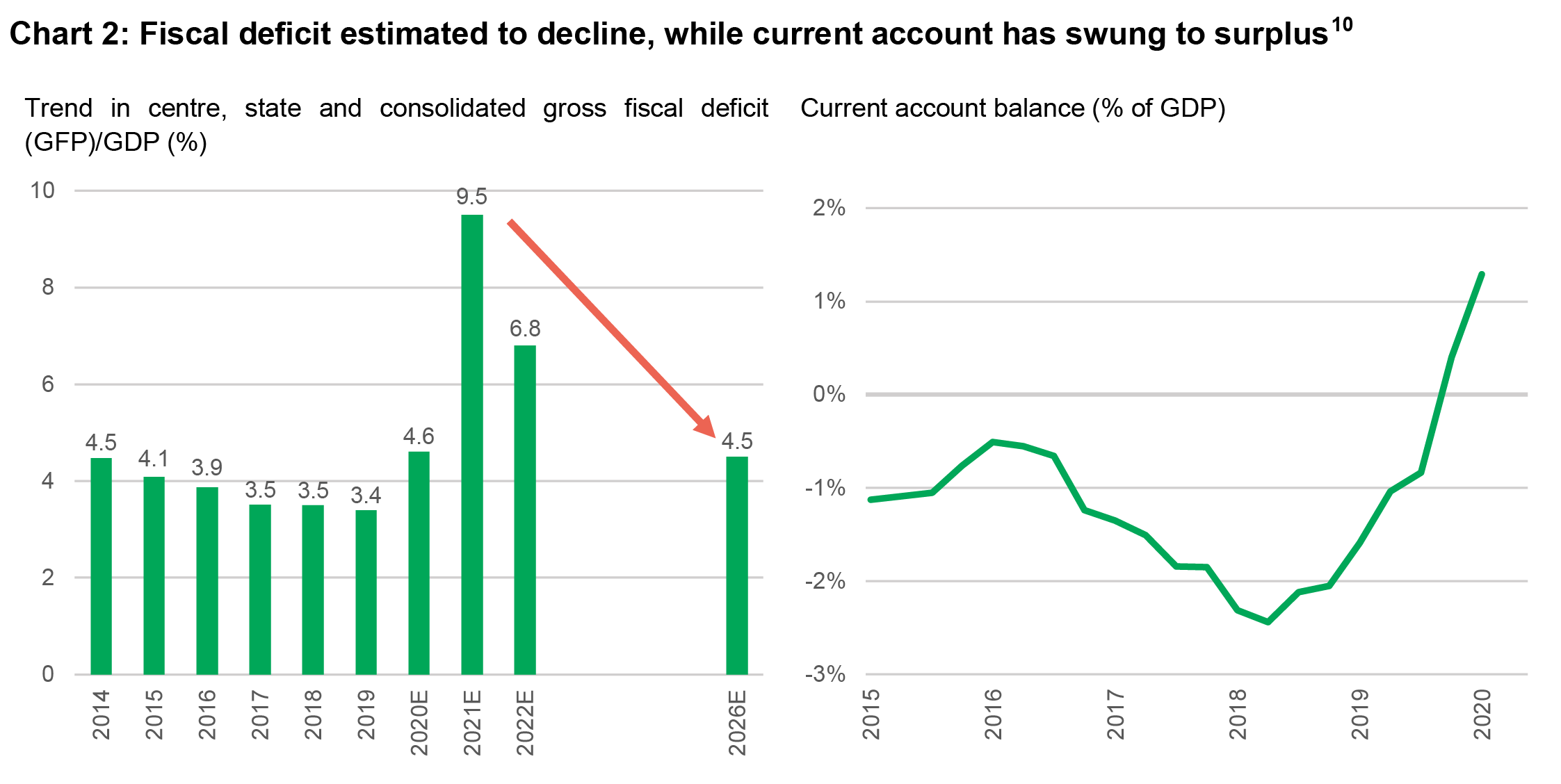

While some near-term fiscal relaxation has been taken, the medium-term fiscal consolidation path remains intact and consistent. Despite being higher than previous targets, the fiscal deficit is still projected to fall to 6.8% in FY2021-2022 from 9.5% in FY2020-20216. The medium-term fiscal consolidation path has also been defined with a targeted deficit of less than 4.5% over the next five years7.

We believe next year's targets are conservative. The actuals are likely to surprise positively, as we find both the nominal GDP growth estimates and tax growth targets conservative given the tailwind to tax collection and high-frequency indicators that we have seen over the past few months.

More importantly, we see that government spending and policy aims should have a better multiplier effect rather than just providing short-term stimulus; and multiple policy announcements in our 3R framework should strengthen medium-term growth potential and attract foreign capital:

Recycle: The budget has gone big in this category with an ambitious asset-monetisation programme:

Rebuild:

Reinvest:

A growth agenda driven by successful 3R policies (formalisation, digitisation, and manufacturing) should increase domestic savings. As formal employment and capital formation improve, so should tax collection and capital inflows, giving the government more room spend, but without the cost of higher deficits. Indeed, these factors should potentially help reduce the estimated fiscal deficit quicker after reaching its peak of 9.5% of GDP in FY 2021 towards the medium-term goal of 4.5% (see Chart 2).

As a result of successful 3R policies, we have already seen a rise in India's share of net exports in areas such as electronics and chemicals. India has also garnered a higher regional share of FDI and FPI flows over the past 12 months11. This has augmented domestic savings, pushed the current account to surplus, and propelled forex reserves to an all-time high . As growth improves in 2021, we expect the current account surplus to moderate due to higher consumer demand. However, we believe that the structural trend of a higher share of foreign flows to India will continue, and this should keep external account balances manageable, despite higher growth.

Given the favourable structural backdrop, we also see three key cyclical factors turning positive, which augurs well for a V-shaped growth recovery in growth in FY 2021-2022, with real GDP growth projected to reach double digits.

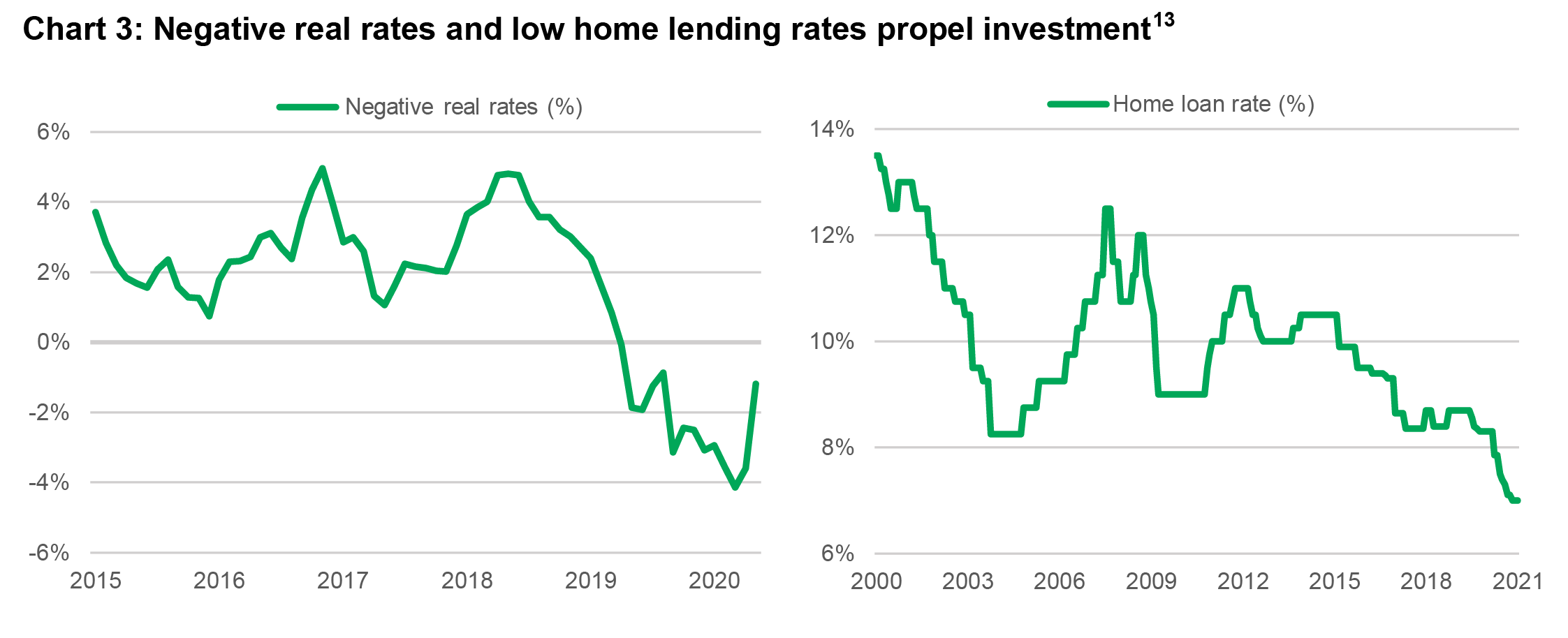

1. Monetary conditions remain benign

Real rates have come down due to higher foreign flows (capital account), supportive central-bank policies, and gains in the share of net exports (current account) that are augmenting domestic savings and liquidity. The RBI has supported the recovery with various policy tools, including market interventions, to ensure that both the pricing and credit availability are adequate for growth to recover. This has pushed real rates into negative territory and consumer lending rates to decade-low levels (see Chart 3).

We expect low real rates to be a strong catalyst for capex. We have already seen this in household capex where low rates and targeted incentives have catalysed a nascent recovery in the real-estate market across major cities. The volume of property sales has crossed pre-COVID levels, and listed developers are posting strong year-on-year growth.

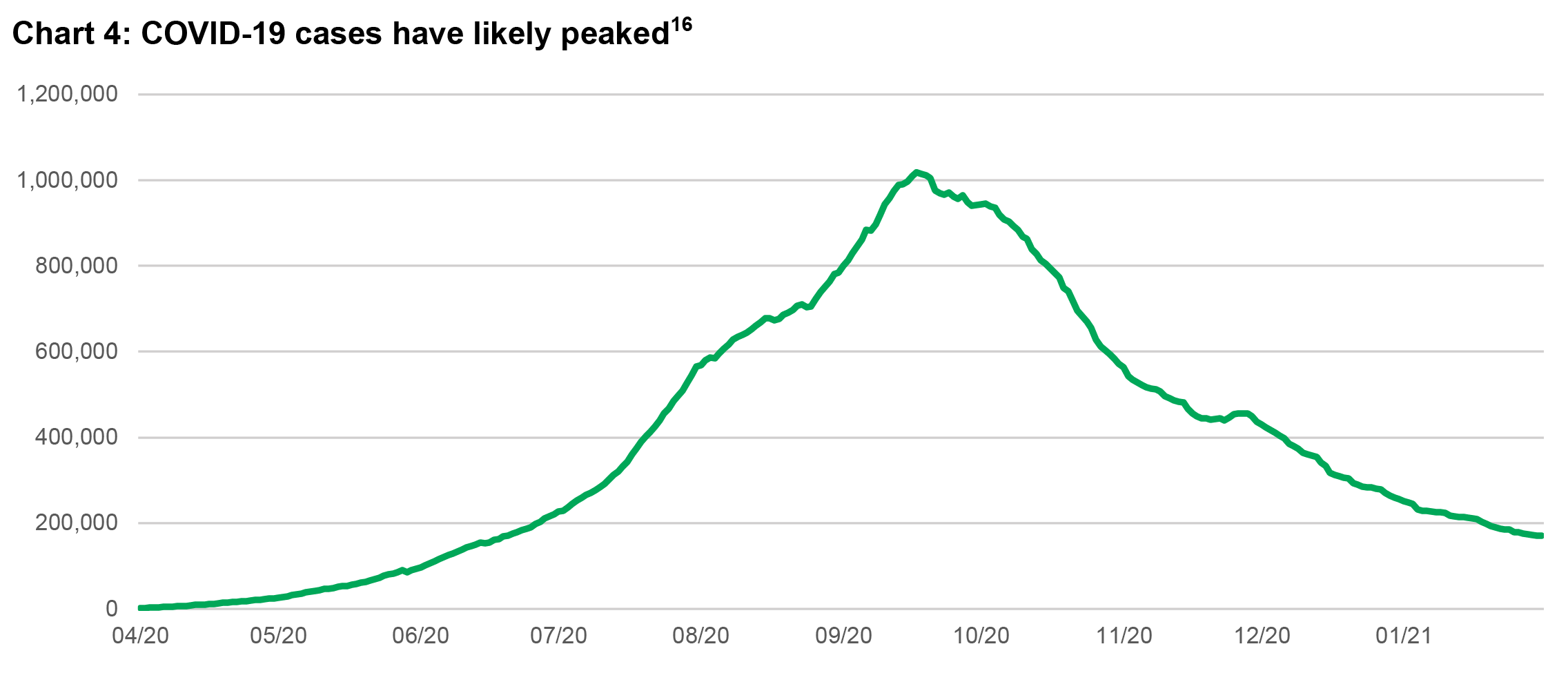

2. The COVID-19 pandemic situation has improved quite sharply

Since peaking in mid-September 2020, active COVID-19 cases have continued their sustained downward trajectory (as of the end of January 2021- see Chart 4). India has already started a mega vaccination programme that targets a goal of 300 million people by the end of July – this includes 30 million healthcare and other frontline workers, and those aged over 50 or with pre-existing medical conditions14. As of 30 January 2021, 3.74 million people had been vaccinated15. In our view, India has enough domestic capacity to produce COVID-19 vaccines. As the vaccination drive picks up pace, we anticipate improvements in more sectors, especially on the services side, which should further boost the recovery.

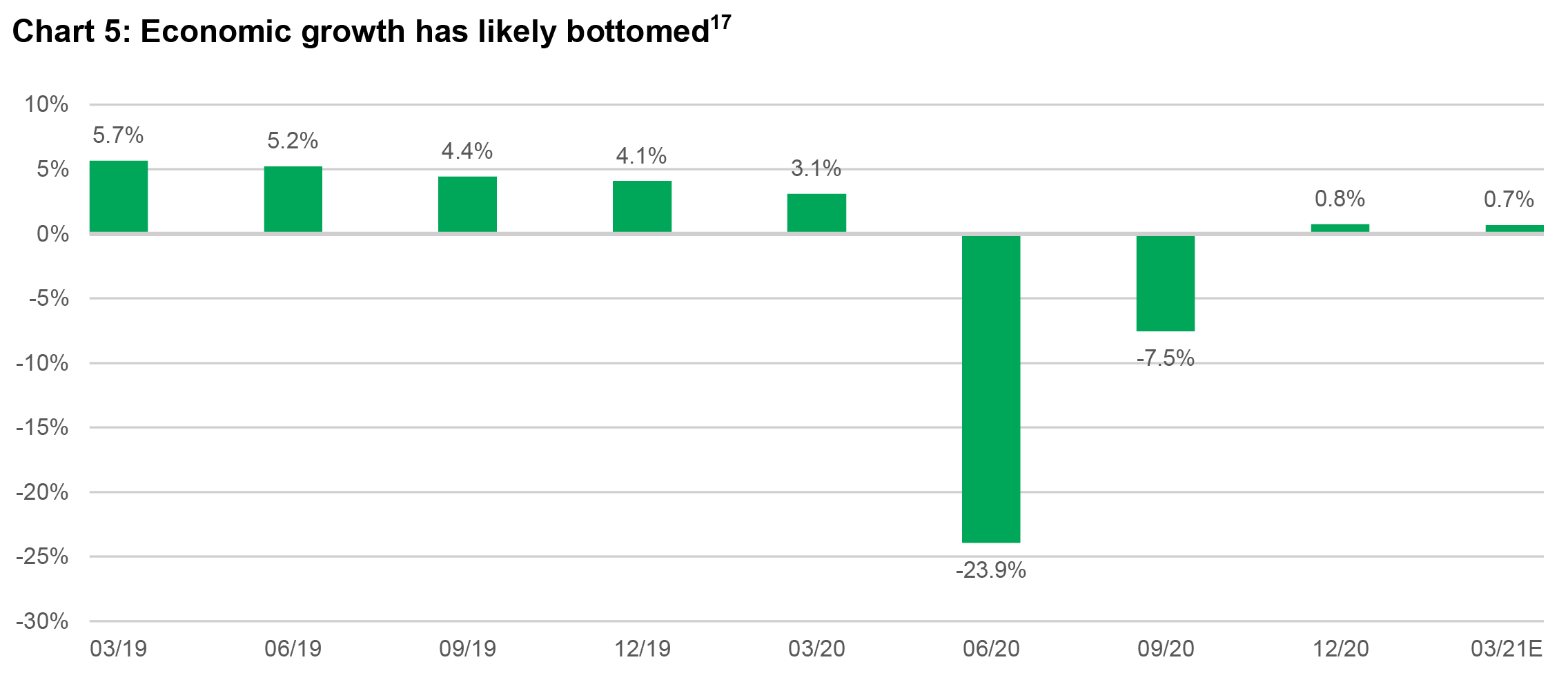

3. Economic conditions have likely bottomed

We have seen both a pickup in high-frequency indicators and an upgrade of GDP estimates for FY2021-2022 at the RBI's recent monetary policy meeting. As the pandemic situation sharply improves, economic activity has normalised faster than expected: over the past few months, high-frequency indicators have surprised positively (see Chart 5). We expect this trend to continue, as economic activity completely normalises over the next few quarters.

Given our view that India should experience a sharp growth recovery in 2021 based on cyclical tailwinds supporting the two medium-term growth drivers, we have a positive outlook for the following sectors:

Financials should benefit from both a cyclical upturn, such as a growth revival in vehicle sales and housing, as well as longer-term structural trends including higher spending through the formal channels like digital (e.g., credit cards) and an increasing savings pool in the country. We expect banking-asset quality to remain under control, as large private banks have raised capital to strengthen their balance sheets, pandemic-related stress has been lower than expected, and the RBI has actively intervened in the market to prevent systemic issues.

In our view, these sectors directly benefit from economic recovery, increased government spending on infrastructure, and an upturn in real estate through cement, building materials, and commercial vehicles.

As economic growth rebounds, this sector should continue to do well with higher sales of discretionary items like consumer durables, electronics, and automobiles.

We remain constructive on macro themes, like import substitution plays, that benefit from the government's supportive domestic manufacturing (EMS companies, auto ancillaries) policies, and a production diversification away from China due to the trade war (speciality chemicals). These companies are present across both the consumer discretionary and materials sectors.

We hold a more cautious view on:

Valuations have rerated ahead of growth expectations, as they were seen to benefit from the lockdown. We see better opportunities in more cyclical sectors like consumer discretionary and financials.

Most companies in this sector have weak ESG characteristics and uncertain growth outlooks.

To conclude, we believe that the worst is behind us and the stage has been set for a strong comeback in 2021 as cyclical challenges are behind us and the recovery will be two pronged, i.e. formalisation will continue to boost the digital economy and reinvest policies which should lead to a revival in manufacturing. Given favourable structural government policies and cyclical tailwinds that support the two transformative medium-term trends, we believe the medium to long-term investment outlook for Indian equities remain compelling.

1 Source: Bloomberg, 7 January 2021.

2 National Statistical Office: First Advance Estimates of National Income: The growth in real GDP during 2020-21 is estimated at -7.7 per cent as compared to the growth rate of 4.2 per cent in 2019-20.

3 Source: Manulife Investment Management.

4 JAM stands for "Jan Dhan Yojana, Aadhaar and Mobile", which is a government initiative to link Jan Dhan accounts, mobile numbers and Aadhar cards.

5 The government reduced the corporate tax rate to 22%, consolidated 44 different labour laws into four labour codes, and introduced production-linked incentive schemes in key electronic and pharmaceutical manufacturing segments.

6 India Ministry of Finance: https://www.indiabudget.gov.in/.

7 India Ministry of Finance: https://www.indiabudget.gov.in/.

8 Source: India Ministry of Finance: https://www.indiabudget.gov.in/.

9 Source: India Ministry of Finance: https://www.indiabudget.gov.in/.

10 Fiscal Deficit- Source: RBI, MoF, Kotak Economics Research estimates, as of 2 February 2021.

11 Source: https://timesofindia.indiatimes.com/business/india-business/fdi-inflows-into-india-jump-by-13-to-57bn-in-2020-un/articleshow/80460076.cms

12 Bloomberg, as of 31 December 2020.

13 Negative real rates- RBI and Bloomberg, as of 31 December 2020. Home rates- SBI, HDFC, Jefferies, as of 31 December 2020.

14 Reuters, 15 January 2021.

15 Our World in Data, as of 31 January 2021.

Asset allocation outlook - Q1 2026

Read more2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Outlook Series: Manulife Global Multi-Asset Diversified Income Fund

In 2026, a clearer macroeconomic outlook is expected as momentum improves following strong 2025 drivers such as AI growth, energy transition, anticipated Fed rate cuts, and wider fiscal support. While the US Federal Reserve is likely to continue easing policy, diverse income opportunities remain across global markets, extending beyond traditional government bonds to high yield assets and option writing. Within this environment, the Manulife Global Fund – Global Multi‑Asset Diversified Income Fund (GMADI) remains with a clear and heightened focus towards income generation. The Fund seeks to deliver a high and consistent distribution income while maintaining exposure to long term capital growth opportunities.