23 January 2024

Endre Pedersen, Deputy Chief Investment Officer, Fixed Income, Global

Murray Collis, Chief Investment Officer, Fixed Income(Asia ex-Japan)

Chris Lam, Portfolio Manager, Asia Fixed Income

Eric Lo, Portfolio Manager, Fixed Income, Pan-Asian Bonds

Further monetary tightening by the US Federal Reserve (Fed) and the ongoing ructions in China’s real estate sector again weighed on Asian Fixed Income in 2023. However, a potential pivot from the Fed in late 2023 and Asia’s resiliency led to positive returns and outperformance for the year. As Endre Pedersen, Murray Collis, and the Pan-Asian Fixed Income team argue, a changing global rates environment positions the asset class to accelerate in 2024 with attractive nominal yields and carry opportunities. Credit is slated to continue posting a positive performance amid a diversifying investment universe, with potential upside for selective markets and sectors with strong credit fundamentals.

Investors entered 2023 with arguably greater certainty than the previous year. The threat of inflation was well known, and it continued to dominate the macroeconomic landscape and monetary policy. Indeed, after the Fed hiked rates by a historic 425-450 basis points (bps) in 2022, the US central bank delivered a further 100 bps of hikes last year, bringing the federal funds rate to 5.25%-5.50% by August 2023. The US central bank subsequently paused from September onwards.

However, uncertainty persisted, as investors wondered when the Fed would halt and whether the US economy could ultimately achieve a ‘soft landing’. As a result, US Treasuries experienced significant volatility, particularly longer-duration bonds. The 10-year Treasury, which began the year at 3.88% peaked at around 5%, before receding at the year’s end. The MOVE Index, a measure of US Treasury option volatility across maturities, spiked in 2023 to the highest level since 2008.

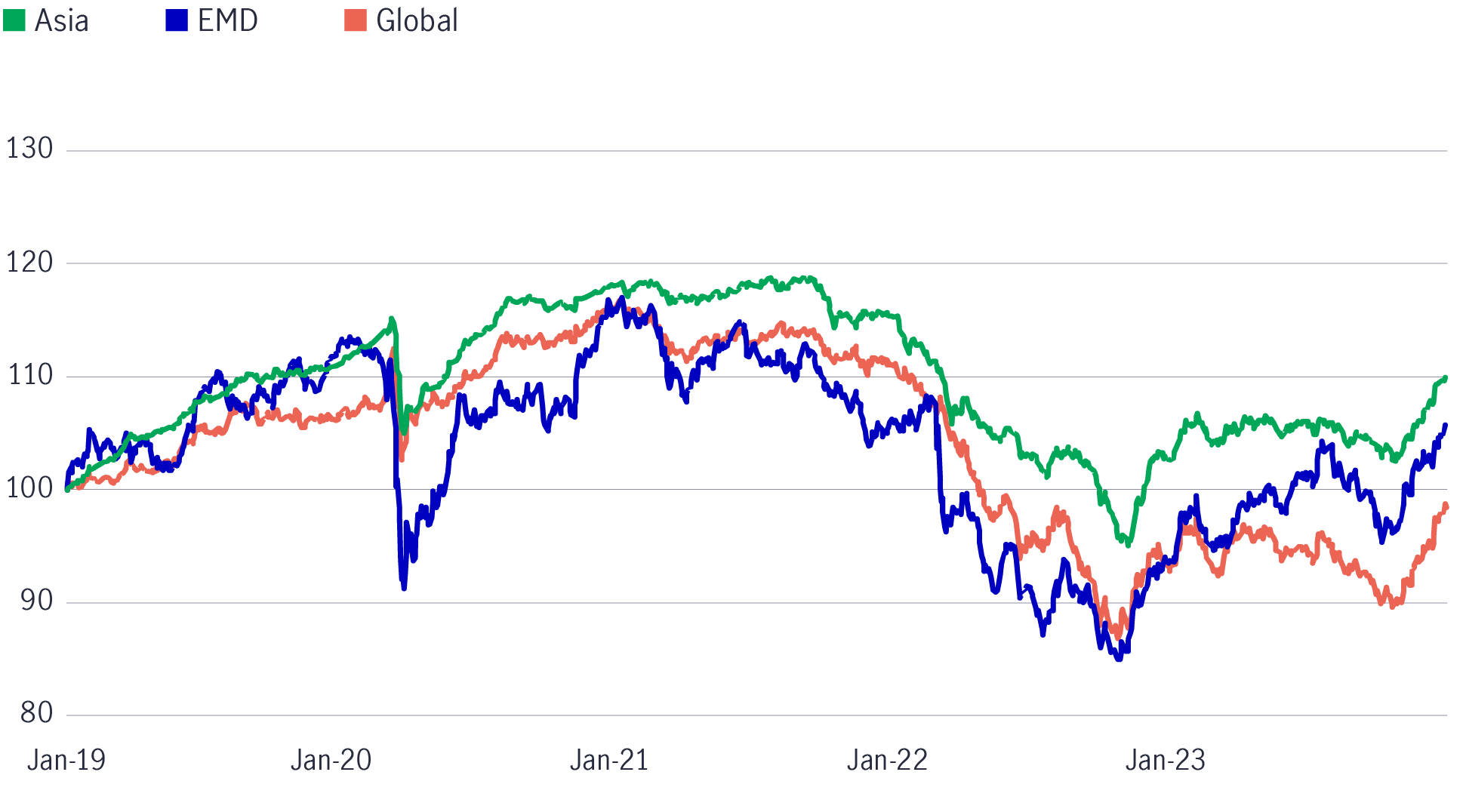

Against this backdrop and despite heightened volatility, Asian fixed income outperformed global fixed income and the broader emerging market universe (See Chart 1).

Chart 1: Global fixed income performance (2019-2023)1

From a credit spread perspective, Asian investment- grade (IG) bonds continued demonstrating resilience, tightening by roughly 32 bps in 20232. This was mainly due to a shorter duration profile and an investment universe containing a greater concentration of state-owned firms in more resilient regional economies. IG’s total return grew by 7.4%, driven by solid credit fundamentals and falling US Treasury yields towards the end of 20233.

Asian high yield (HY) also posted a positive return, albeit at a slower pace of 4.8%, amid the strong performance of regional sectors such as Indian renewables and Macau gaming, offsetting the volatility and adverse sentiment of China’s property sector4.

As we move into 2024, the interest-rate environment is likely to stabilise after the high volatility experienced over the past two years.

Our base case is that the Fed is near or at the end of its current rate hiking cycle. Once this is confirmed, we believe several positive catalysts will emerge to stabilise the macroeconomic environment and benefit Asia.

Indeed, even as the IMF estimates global economic growth to decelerate this year to 2.9%, Asia is projected to be the fastest-growing global region at 4.2% in 2024 due to its diversified growth profile.

China’s economic growth lagged market expectations in 2023. Still, we believe that recent signals of strengthening fiscal and monetary policy and more targeted measures to help the property sector, such as recent reports of a list of developers eligible for financing, are constructive.

Equally important, economies, such as India and Indonesia, have developed new sources of growth that can add to the region’s resiliency.

India posted the fastest growth in Asia among large economies in 2023 due to robust government investment in infrastructure and successful manufacturing onshoring schemes like the Production Linked Incentives. Meanwhile, Indonesia is developing a domestic supply chain to produce electric vehicle batteries that allow value-added activities pertaining to key minerals, such as bauxite and nickel, to remain onshore.

In the next section, we will break down our 2024 Asian fixed-income outlook into three areas: credit, rates, and currency.

Asian IG credit posted resilient performance in 2023 despite a volatile global market due to strong credit fundamentals and robust regional economic growth, both are expected to continue in the new year.

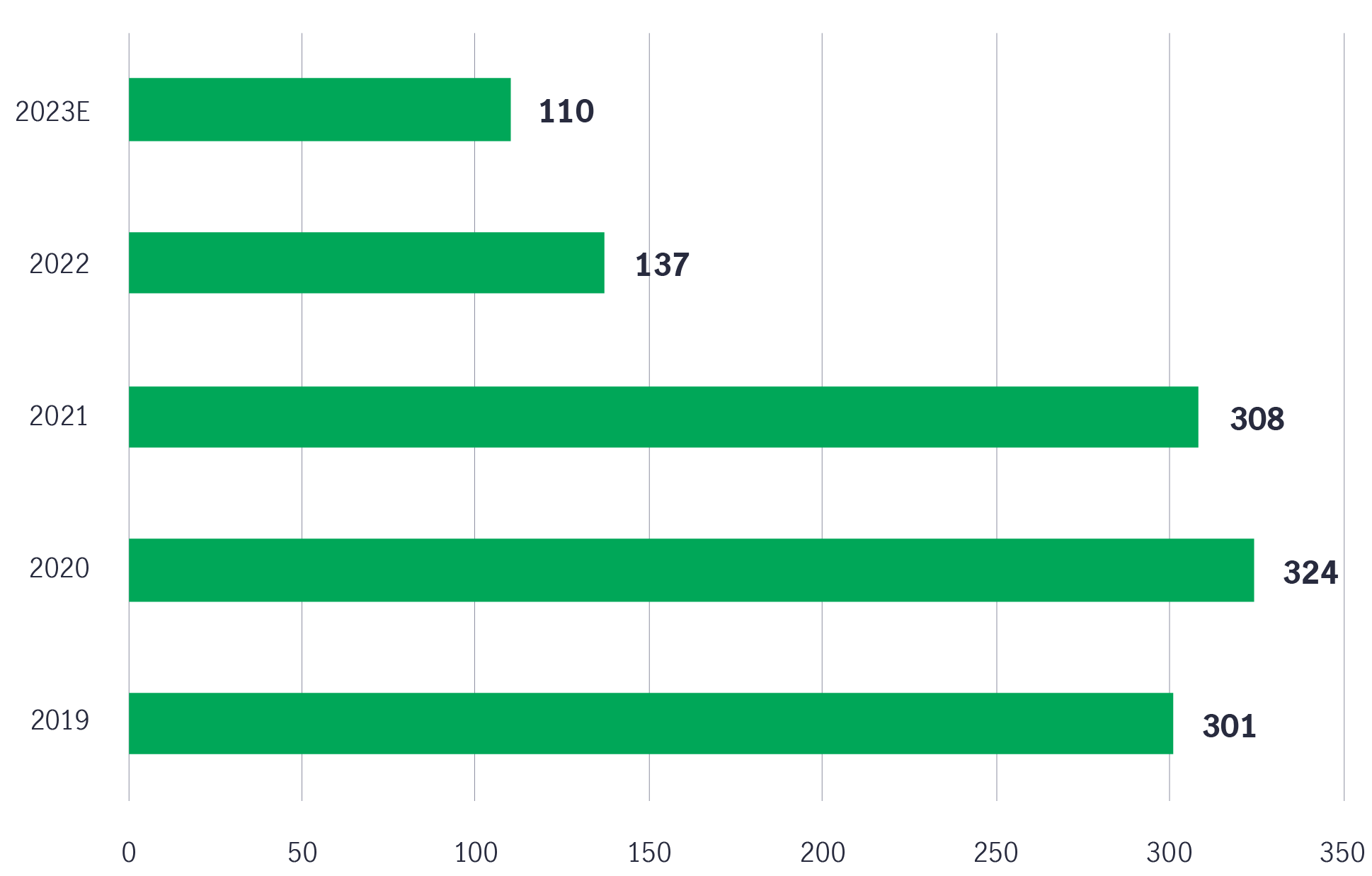

Supply-side factors also played a role: Asian credit issuance declined by 22% year-on-year in 2023 (See Chart 2) due to higher yields for US-dollar-denominated bonds, which has led many companies to seek cheaper domestic funding options.

Moving into 2024, although we expect lower yields to incentivize a gradual rise in IG issuance, we don’t expect the net supply of bonds to be positive this year (given maturities) unless the Fed embarks on an aggressive rate cuts cycle.

Chart 2: Asia credit total issuance, 2019-2023 (US $bn)5

Additionally, although we see some potential spread widening for IG bonds if Treasury yields continue to move lower, the overall total return of the market should still be positive as declining nominal yields outweigh the loss due to widening credit spreads.

Based on this backdrop, we are constructive on selective pockets of regional IG opportunities. As always, bottom-up credit selection remains imperative.

China property continued to weigh on HY performance and investor sentiment in 2023. But as we have previously pointed out, China property is playing a less critical role in the HY investment universe as a significant number of firms have defaulted, with some declaring bankruptcy. Since 2021 when the Chinese property sector slump started, 115 defaults totalling US $144 billion have been registered.

We believe the sector will stabilise over the long term amid the continued supportive measures by the government; however, it will not return to the days when it contributed roughly 25-30% of the country’s GDP.

Indeed, we envisage the sector continuing to contract and undergo significant consolidation. The path to this inevitable outcome will likely see continued volatility, that said, the number of defaults is expected to gradually decrease over time.

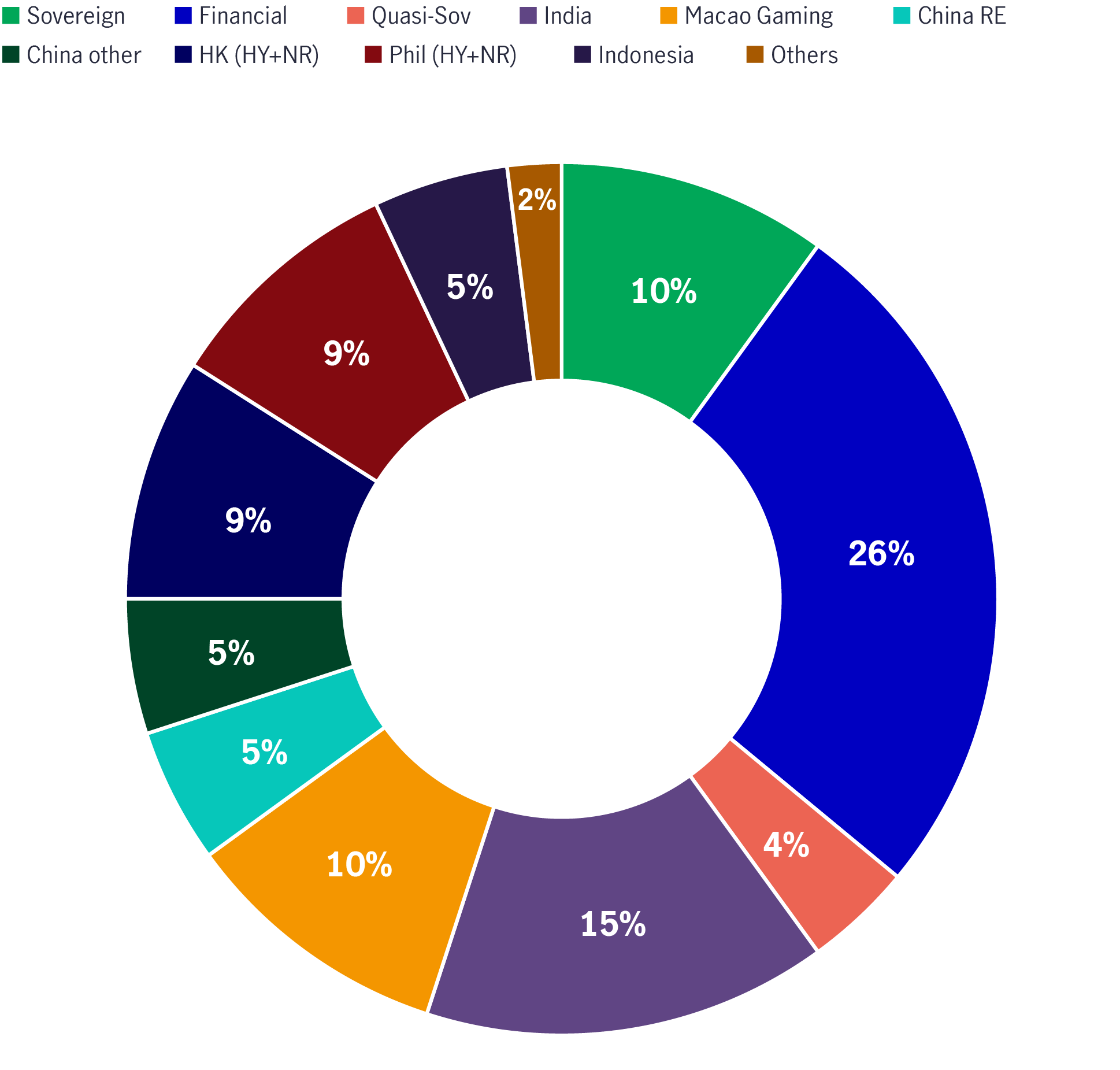

Perhaps more important for investors, with China property only currently accounting for roughly 5% of the J.P. Morgan Asia Credit Index (JACI) HY (approximately 40% at its peak), we expect there are evolving opportunities in a diversifying credit universe. Thus, further volatility in the sector should have less influence on market performance than larger corporate segments such as Indian renewable energy and Macao gaming (See Chart 3).

Chart 3: JACI HY composition by sector6

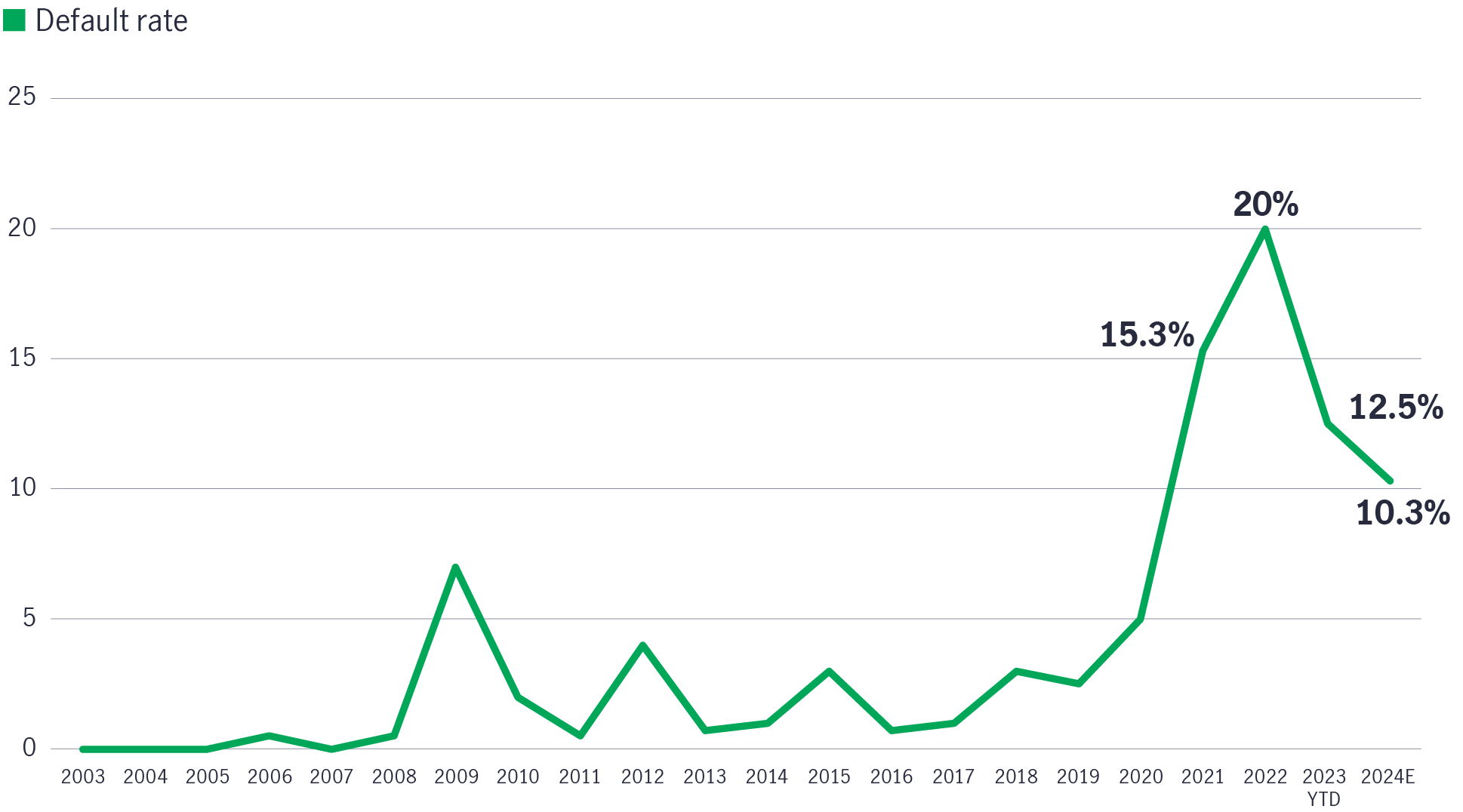

Furthermore, entering 2024, the credit fundamentals of the overall Asian HY space are expected to improve further. While defaults remain elevated at 12.5% (estimated) in 2023, far above the historical average, they are forecast to notably decelerate to 10.3% in 20247 (See Chart 4).

Chart 4: Asian HY historical default rates, 2003-2024E8

Overall, we are constructive on the following HY segments for 2024:

As the Fed is near or at the end of its tightening cycle, we envisage a constructive environment for Asian rates in 2024.

Overall, Asian central banks have varied in their responses to a hiking Fed in 2023: Amid a more benign inflationary environment, some regional central banks, such as those in India and Indonesia, did not match the Fed’s pace with continued rate hikes.

With the Fed and other global central banks likely on pause and receding regional inflationary pressures in 2024, we believe some Asian central banks have room for potential rate cuts.

As Asian local-currency rates markets have largely outperformed US Treasuries due to a more measured approach to inflation this year9, we remain constructive on three high-yielding markets in 2024.

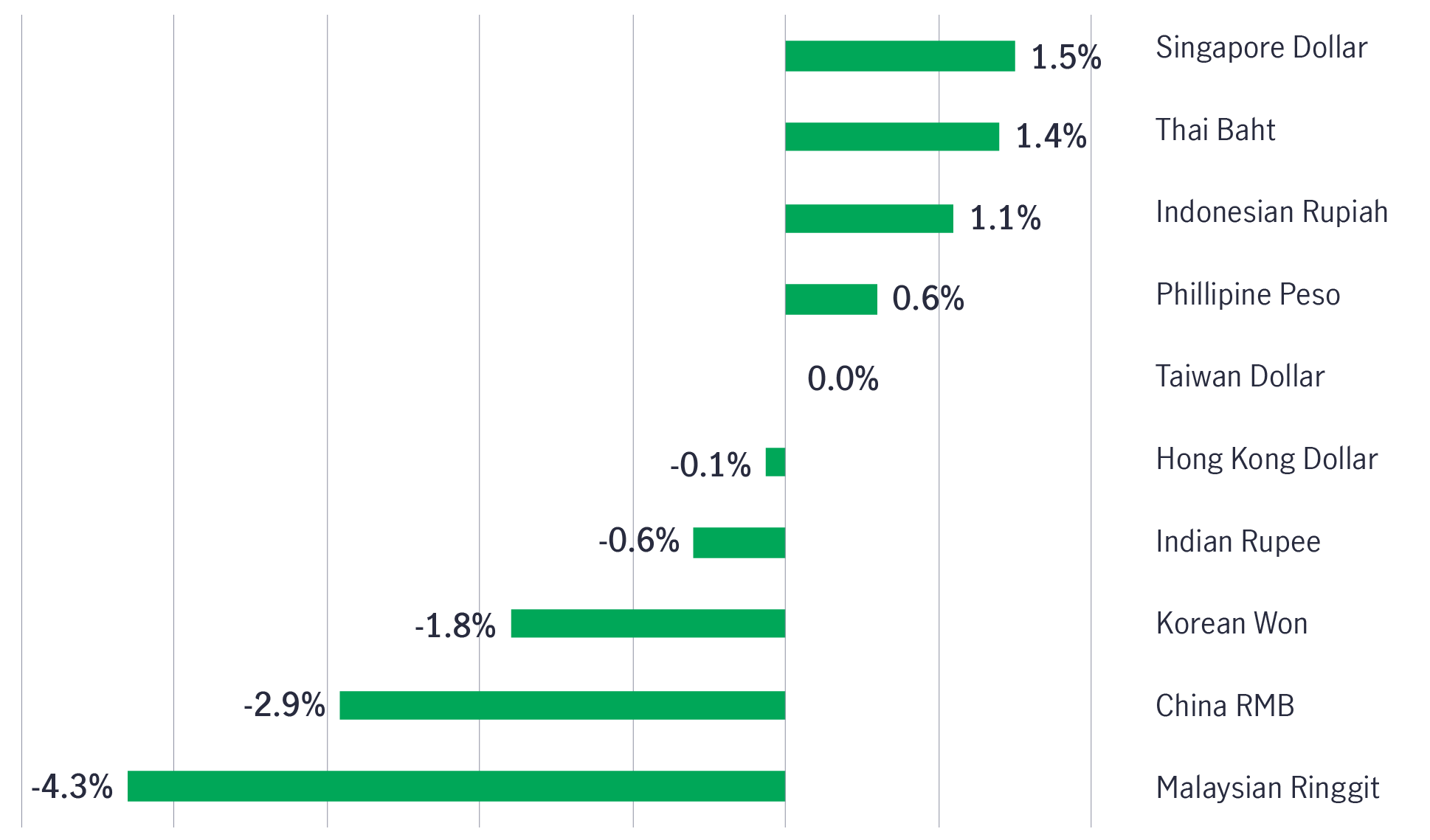

The US dollar had a volatile 2023, with the DXY initially strengthening on the back of higher rate differentials, only to end the year roughly flat. Asian currencies posted a mixed performance, with several markets enjoying gains against the greenback in 2023 (See Chart 5).

Chart 5: Asian currency performance versus US dollar13

We believe that once the Fed signals it has stopped its rate hiking cycle, this will be broadly supportive of Asian currencies in 2024. We are particularly constructive on two currencies:

After 18 months of Fed interest rate hikes and further consolidation in the Chinese property sector, Asian fixed income rebounded into positive territory in 2023 and shows signs of green shoots for 2024.

This momentum can continue in 2024 on the back of a more accommodative Fed, strong regional and corporate economic performance, and resilient credit fundamentals. We believe Asian bond markets have the potential to significantly outperform globally, as we move closer to an ending of the Fed’s monetary tightening cycle and bottoming of the Chinese property sector.

However, markets are likely to remain volatile in the interim. In addition to the potential risks over evolving inflation and monetary policy, Asia will experience key elections this year in India, Indonesia, Taiwan, and South Korea- not to mention significant elections outside the region in the United States.

Bottom-up credit analysis remains imperative as credit is expected to remain challenging as higher rates may lead to slowing economic activity. Selective rate markets and currencies could also contribute based on the back of solid fundamentals.

1 Source Bloomberg, as of 31 December 2023. Asian fixed income= JACICOTR; Emerging Markets fixed income= JGENVUUG; Global fixed income=LEGATRUU. Rebased to 100 as of January 2019.

2 Source: Bloomberg, as of 31 December 2023. JACIIGBS.

3 Source: Bloomberg, as of 31 December 2023. JACIIGTR.

4 Source: Bloomberg, as of 31 December 2023. JACINGTR.

5 Source: J.P. Morgan, as of 29 December 2023.

6 Source: J.P. Morgan, as of 15 November 2023.

7 Source: Goldman Sachs, November 24.

8 Source: Goldman Sachs, November 2023.

9 Bloomberg, as of 31 December 2023.

10 Bloomberg, as of 31 December 2023.

11 Bank of Indonesia web site.

12 Bloomberg, as of 31 December 2023.

13 Source: Bloomberg, as of 31 December 2023.

Asset allocation outlook - Q1 2026

Read more2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Outlook Series: Manulife Global Multi-Asset Diversified Income Fund

In 2026, a clearer macroeconomic outlook is expected as momentum improves following strong 2025 drivers such as AI growth, energy transition, anticipated Fed rate cuts, and wider fiscal support. While the US Federal Reserve is likely to continue easing policy, diverse income opportunities remain across global markets, extending beyond traditional government bonds to high yield assets and option writing. Within this environment, the Manulife Global Fund – Global Multi‑Asset Diversified Income Fund (GMADI) remains with a clear and heightened focus towards income generation. The Fund seeks to deliver a high and consistent distribution income while maintaining exposure to long term capital growth opportunities.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.