26 January 2026

Following a strong 2025, driven by the AI mega trend, energy transition, Fed rate cut expectations and the potential for a new Fed composition, alongside broadening fiscal support, we anticipate a clearer macroeconomic backdrop and improving growth momentum as 2026 progresses. While the US Federal Reserve (Fed) is expected to continue easing monetary policy during the year, income generating opportunities remain abundant across diversified global markets and sources, extending well beyond traditional government bonds, towards high yields and option writing.

Against this backdrop, the main objective of the Manulife Global Fund – Global Multi-Asset Diversified Income Fund (“GMADI” or “the Fund”) remains with a clear and heightened focus towards income generation. Regardless of near-term equity market performance or fluctuations in the monetary policy cycle, the Fund seeks to deliver a high and consistent distribution income while maintaining exposure to long term capital growth opportunities.

In 2026, we see income opportunities across Fixed Income and taking advantage of selling options as we expect periods of heightened volatility. However, we also see broader equity returns and therefore a globally diversified portfolio such as GMADI is well positioned for greater breadth and equity return capture across global markets.

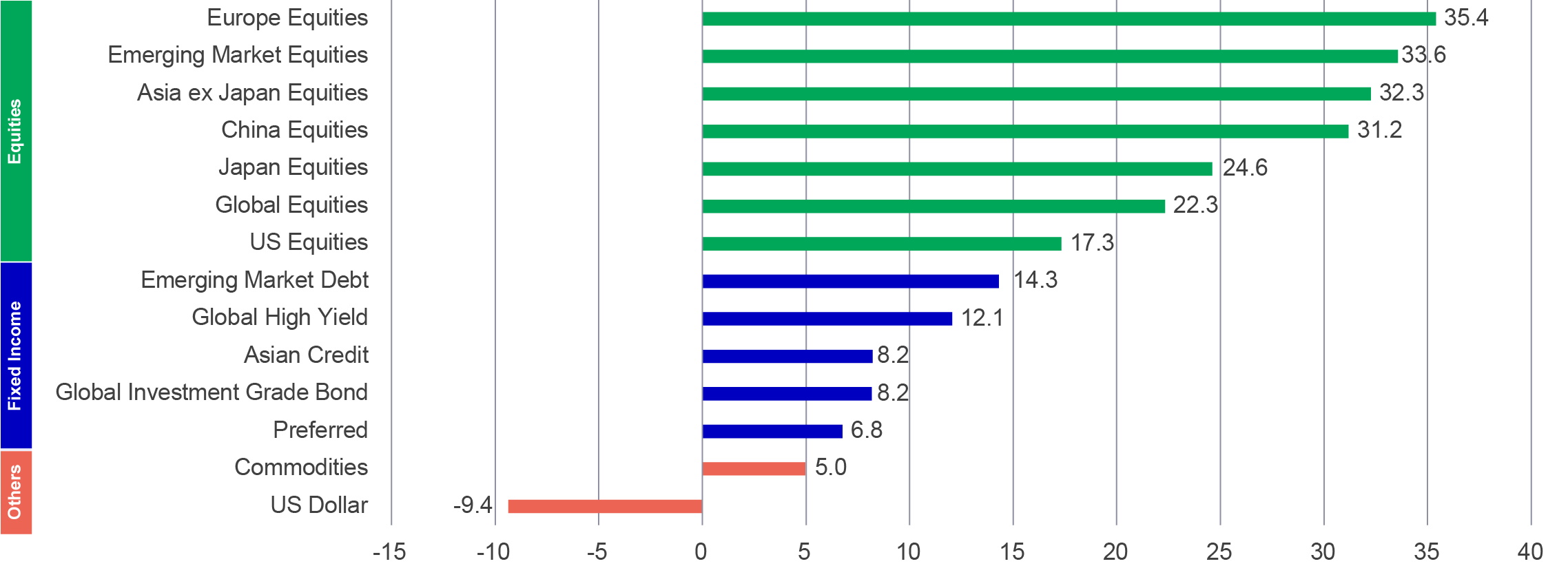

Let us revisit how global asset classes performed in 2025.

Global risk assets delivered strong gains over the year, supported by easing financial conditions and policy expectations that increasingly favoured growth. Emerging Markets outperformed Developed Markets, benefiting from a weaker US Dollar, growing EM Tech attractiveness and improving earnings momentum across Asia Pacific ex Japan and Latin America. Performance in Asia was led by Korea and Taiwan, driven by semiconductor and AI related demand, while Chinese equities rebounded sharply.

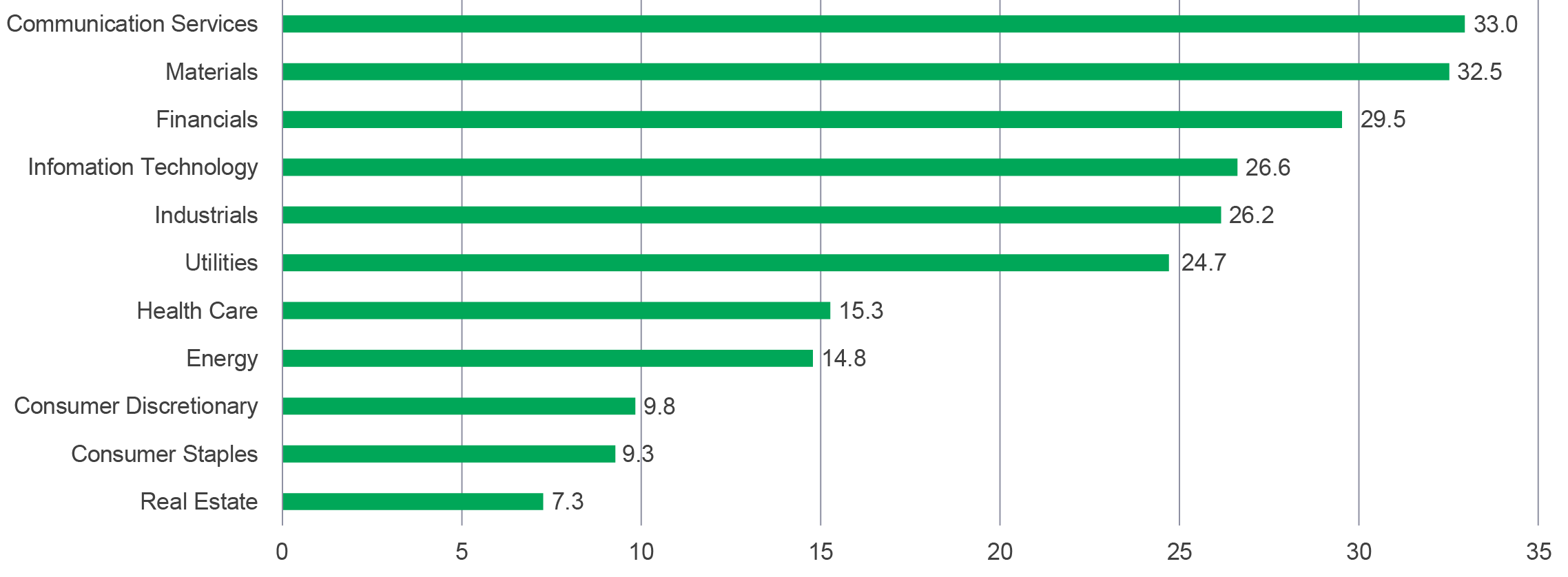

At the sector level within the MSCI World Index, Information Technology remained a key contributor to overall performance. Financials, Industrials, and Materials outperformed, reflecting broadening market participation and improving cyclical confidence, while Utilities and Real Estate lagged amid interest rate sensitivities.

Fixed income returns were broadly positive, whilst remaining a solid contributor to yield. The higher risk segments of Fixed Income outperformed with Emerging Market Debt and Global High Yield achieving strong 2025 results, both of which are important yield contributors to the GMADI portfolio. The portfolio remains anchored around high yielding credits, with an average credit rating of BB, and is therefore less duration sensitive to rate movements – expectations are that lower rates should benefit the more levered high yield corporates in the market and their respective financials, which should place less pressure on significant spread widening.

Commodities, outside of oil, posted strong positive returns, led by strength in precious & base metals as well as agricultural commodities, while oil-related energy prices lagged amid ample supply, although OPEC and geopolitics could see the oil-dynamic change into 2026. The US Dollar Index declined over the year, providing a supportive tailwind for commodities and non-US assets.

Chart 1: 2025 major asset classes cumulative performance (%)1

Chart 2: 2025 global equity sector cumulative performance (%)1

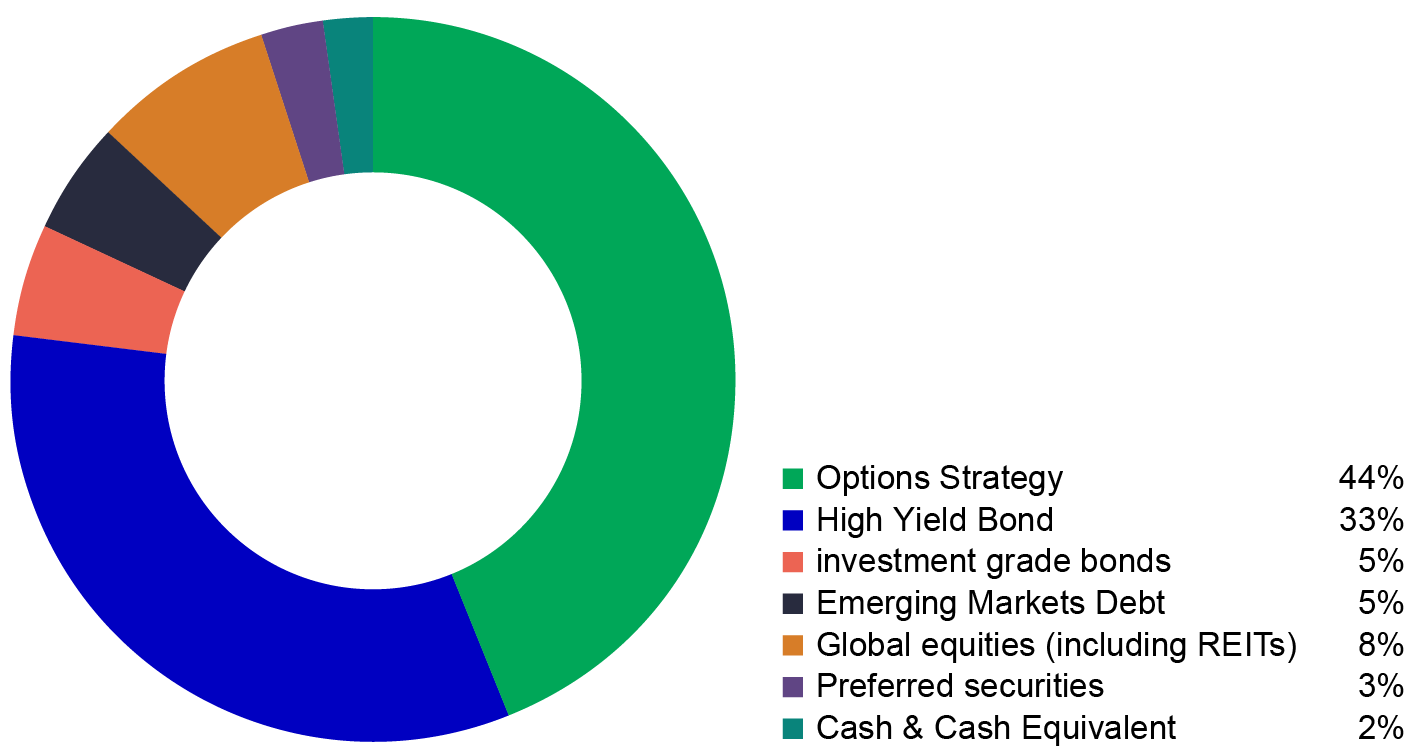

Income capture continues to remain robust across both traditional and non-traditional income sources. GMADI’s payout is currently approximately 8.12%, supported by a natural underlying yield of approximately 7.4%2 from fixed income coupons, equity dividends and option premiums – with less reliance on equity gains to make the income payout.

We continue to expect the US Federal Reserve to deliver two to three rate cuts in 2026, with policy rates gradually trending toward an estimated ~3% by year-end, as the Fed balances moderating – but still above-trend – inflation against a cooling labour market. Against this backdrop, we do not expect the ongoing US rate cutting cycle to have a significant adverse impact on the Fund’s distribution profile. We anticipate the payout will remain competitive, within the high single-digit range, while the natural underlying yield is expected to remain in the 7.0%–8.0% range throughout 2026. The GMADI portfolio has a number of levers across the fixed income, equity and option investment pillars to navigate income capture, capital returns and downside volatility management.

As of 31 December 2025, GMADI’s asset allocation comprised approximately 25% equities (including REITs), 48% fixed income, 23% in equity-related securities/options with the remaining in cash. Looking ahead to 2026, current positioning remains supportive of risk assets with a focus on income generation whilst maintaining a stable NAV. Recent positioning includes:

1. Additional beta opportunities as global growth and sentiment holds up

2. A diversified balanced profile to mitigate sector-driven volatility

3. Potentially taking more credit risk

4. Flexible option-writing to balance between premium harvesting and market upside potential

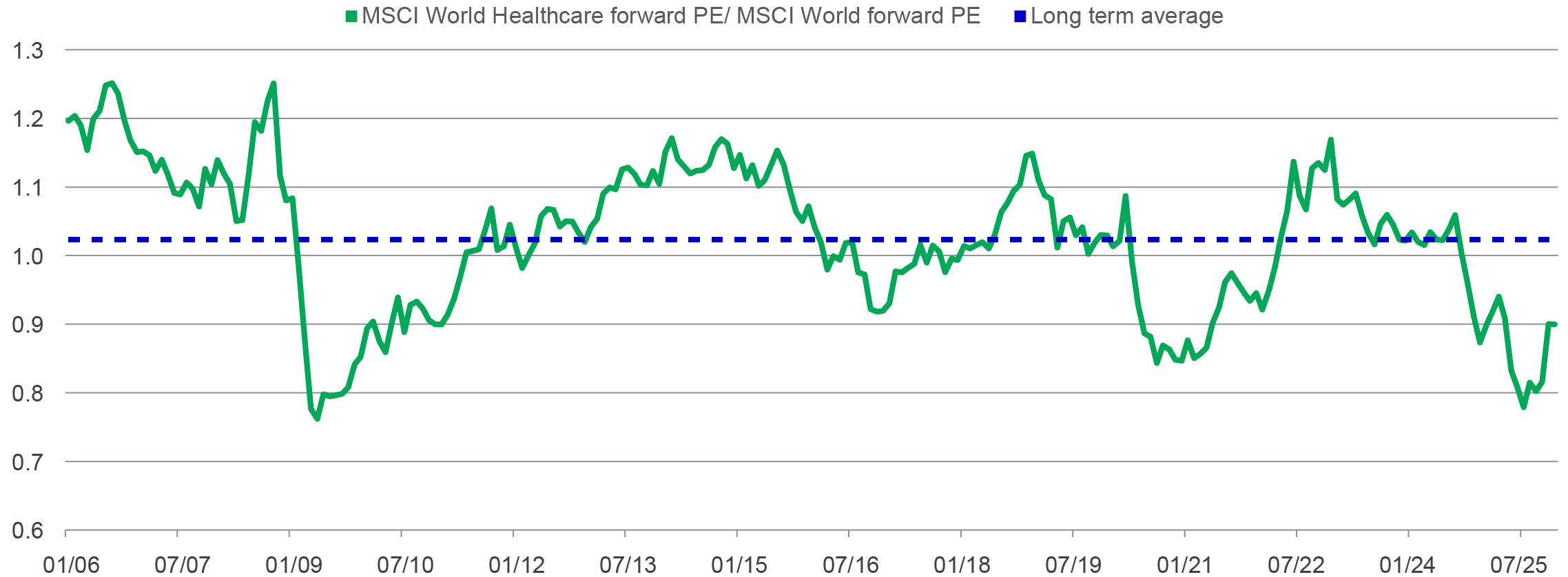

Chart 3: Healthcare sector traded at a meaningful discount to broader markets

Source: Bloomberg, as of 31 December, 2025.

In terms of geographical allocation, we believe broadening global opportunities and regional tailwinds, including a weaker US dollar and improving macro conditions in Europe and Asia (including Japan), reinforce the case for diversified equity exposure. Europe’s recovery, fiscal stimulus, and attractive valuations create a supportive backdrop, although geopolitical wrangling with the US could add to volatility, while Asia offers compelling opportunities in manufacturing and tech-export economies. Japan, South Korea and Taiwan stand out on technology leadership and policy support, and early signs point to a more constructive tactical view on Chinese Mainland. In addition, as growth globally slows, we expect to see more breadth in equity markets beyond growth beneficiaries and technology names, towards more cyclicality and quality value-oriented names which could do better into 2026.

Given current valuations and tight spreads, it is crucial to emphasise the importance of selecting appropriate securities within a capital structure to generate significant income and safeguard capital. Additionally, the flexibility of the portfolio allows for allocation across various fixed income sectors and credit levels, making it easier to navigate softer economic environments. In summary, there are still attractive opportunities to generate income within the credit and spread sectors, with the potential for some spread compression and a limited risk of permanent capital impairment.

The portfolio remains well anchored with approximately 50% fixed income exposure, with the majority of this through global high yield credits across the quality spectrum. Rate cuts should benefit the more levered corporates in the high yield market, given better fundamentals, whilst exposures to higher quality investment grade and preferred securities helps balance allocations for the broad portfolio. The Fixed Income allocation averages around 8 basis points per bond holding, with approximately 700 names, whilst higher conviction names can average 3 times more in terms of allocation sizing. The GMADI portfolio has to meet a high income payout and therefore looks to allocate across B, BB and, where appropriate, CCC names in order to meet the income objective whilst ensuring clients are not overly exposed to outsize risks.

We expect spreads to remain stable so do not see enormous upside but see US high yield as solid yield contributors. Duration is naturally low with the portfolio given the high yield allocations. Credit and default risk is the risk the team are managing over rate-sensitivity/duration risk.

Further opportunities for GMADI we see in hybrid bonds, in the utilities and energy sector issued by investment grade companies, where we get extra income for junior to unsecured bonds for example. Furthermore, within Global high yield and Emerging Market credit, compressed spreads mean the opportunity is to avoid and minimise impact from defaults.

Although credit spreads across many fixed income sectors remain historically tight, Emerging Market Debt stands out as an area where we are selectively constructive. This view is supported by a weakening US Dollar and the disciplined policy response from emerging market central banks, many of which tightened monetary policy earlier and more aggressively than their developed market peers. As a result, inflation has been relatively well contained, providing EM central banks with greater scope to ease policy if required. Compared with developed markets, EM assets also offer more attractive real yield opportunities. The team are looking for further opportunities in local EM Debt profiles into 2026.

GMADI will continue to emphasise diversified, higher‑quality income streams, including preferred securities and junior subordinated bonds. These instruments are well positioned to benefit from an ongoing rate‑cutting environment, while allowing the Fund to balance elevated income generation with issuer quality considerations.

Lower policy rates are also expected to be supportive for more leveraged high‑yield corporates, improving their interest‑coverage metrics and reducing refinancing risk. This dynamic should help limit the likelihood of significant spread widening within the high‑yield segment.

GMADI maintains a globally diversified set of exposures designed to deliver a range of coupon and dividend income opportunities through fixed income and equity holdings, complemented by an active option-writing strategy. Option-writing has consistently been a core contributor to the Fund’s income profile, currently accounting for approximately 40% of the Fund’s natural underlying yield , and we expect it to remain a key driver of income in 2026.The team shall look to balance premium capture and income generation alongside equity returns through 1) more or less equities with a call writing structure attached 2) widening strike rates to allow for less income but potentially more equity participation and upside 3) add to long dated long calls to add incremental equity participation.

Chart 4: Natural underlying yield break down by asset classes3

Beyond generating option premiums, the option-writing strategy also provides a disciplined means of enhancing equity exposure through the use of equity and equity index options. In 2026, the Fund will continue to roll options, however may potentially look to widen strike levels should equity risk assets remain well supported, allowing for greater participation in a rising equity market while maintaining a meaningful level of income generation. Although realised volatility remains near historical lows, resulting in lower option premiums in absolute terms, the incremental impact of using wider strikes is limited under these conditions, helping to preserve the effectiveness of the option strategy.

In addition, we believe option writing on global market indices helps income stability, effectively capturing premium even as implied volatility in global markets declined.

Although the Fed is expected to continue cutting rates in 2026 – we see the magnitude of rate cuts to reflect the strength of the US economy – growth has been upgraded in the US, earnings remain resilient, AI capex guidance remains strong whilst job creation is moderating somewhat but may not be enough, at present, to push for the Fed to cut aggressively. Given expectations of elevated rates, income opportunities remain abundant across global markets. High yield bonds and option-writing continue to offer attractive sources of income, whilst equities offer exposure to strong expected earnings growth with some dividends. As such, we believe multi‑asset income investing will remain highly relevant in 2026.

Within this framework, the Fund seeks incremental equity exposure through a globally diversified, income‑oriented approach, providing defensive income‑generating characteristics amid ongoing market uncertainty. Key sources of uncertainty include global growth dynamics, debates surrounding the sustainability of the AI investment cycle, changes in the Fed leadership, geopolitical and trade developments, labour‑market trends, and the evolving policy path of the Fed. By aligning sector exposures to durable secular trends, keeping valuation discipline at the forefront, and sustaining diversified income streams, the Fund aims to deliver high income and competitive returns within a controlled risk framework for 2026.

1 Source: Bloomberg, FactSet, data as of 31 December 2025. Performance is in USD and total return. Equities indices represented by MSCI indices. Preferred securities = ICE BofAML US All Cap Securities index; Emerging Market Debt = JPM EMBI. Asian Dollar Bond represented by Markit iboxx index. Global high yield bond = Bloomberg Global High Yield total return index unhedge. Global Investment grade bond represented by FTSE indices. Commodities = TR CRB Index. US dollar = US dollar index. Past performance is not indicative of future performance.

2 Source: Manulife Investment Management. For the period ended 31 December 2025, the annualised yield of the Fund’s AA (USD) MDIST (G) class was 8.12%. Dividend rate and dividend are not guaranteed. Dividends may be paid out of capital. Refer to important note 2. Please note that a positive distribution yield does not imply a positive return. The natural underlying yield is a function of the Fund’s underlying portfolio yield, comprising income and equity holdings as well as options premiums generated from call and put writing, amongst others.

3 Manulife Investment Management, Barclays Point. As of 31 December 2025. Performance breakdown and yield breakdown by asset class are as of total portfolio return and yield. Due to rounding, the total may not be equal to 100%. The above yield does not represent the distribution yield of the Fund and are not an accurate reflection of the actual return that an investor will receive in all cases. A positive distribution yield does not imply a positive return.

Asset allocation outlook - Q1 2026

Read more2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Outlook: Clearer picture, better growth

This year’s outlook spotlights a world in flux – U.S. stimulus, Europe’s rebound, China’s policy pivots, and Japan’s innovation surge all shape a landscape full of both opportunities and challenges.