15 August 2025

Murray Collis, Head of Asia Fixed Income

Despite a volatile market environment, Asian fixed income posted positive performance in the first half of 2025. However, with macroeconomic uncertainty still lingering, investors are keen to understand potential opportunities and risks moving forward. In this 2025 Second-Half Outlook, Murray Collis, Head of Asia Fixed Income, analyses the near-term tailwinds propelling returns, as well as the structural fundamentals and shifting geopolitical trends that could support the asset class over the long-term.

The first half of 2025 unfolded against a backdrop of heightened macroeconomic uncertainty. Geopolitical tensions and a shift in US trade policy—most notably the imposition of steep Liberation Day tariffs on 2 April, followed by a 90-day freeze—sparked volatility across global markets. Investors were prompted to reassess their exposure to US dollar assets amid growing concerns over policy direction and fiscal sustainability.

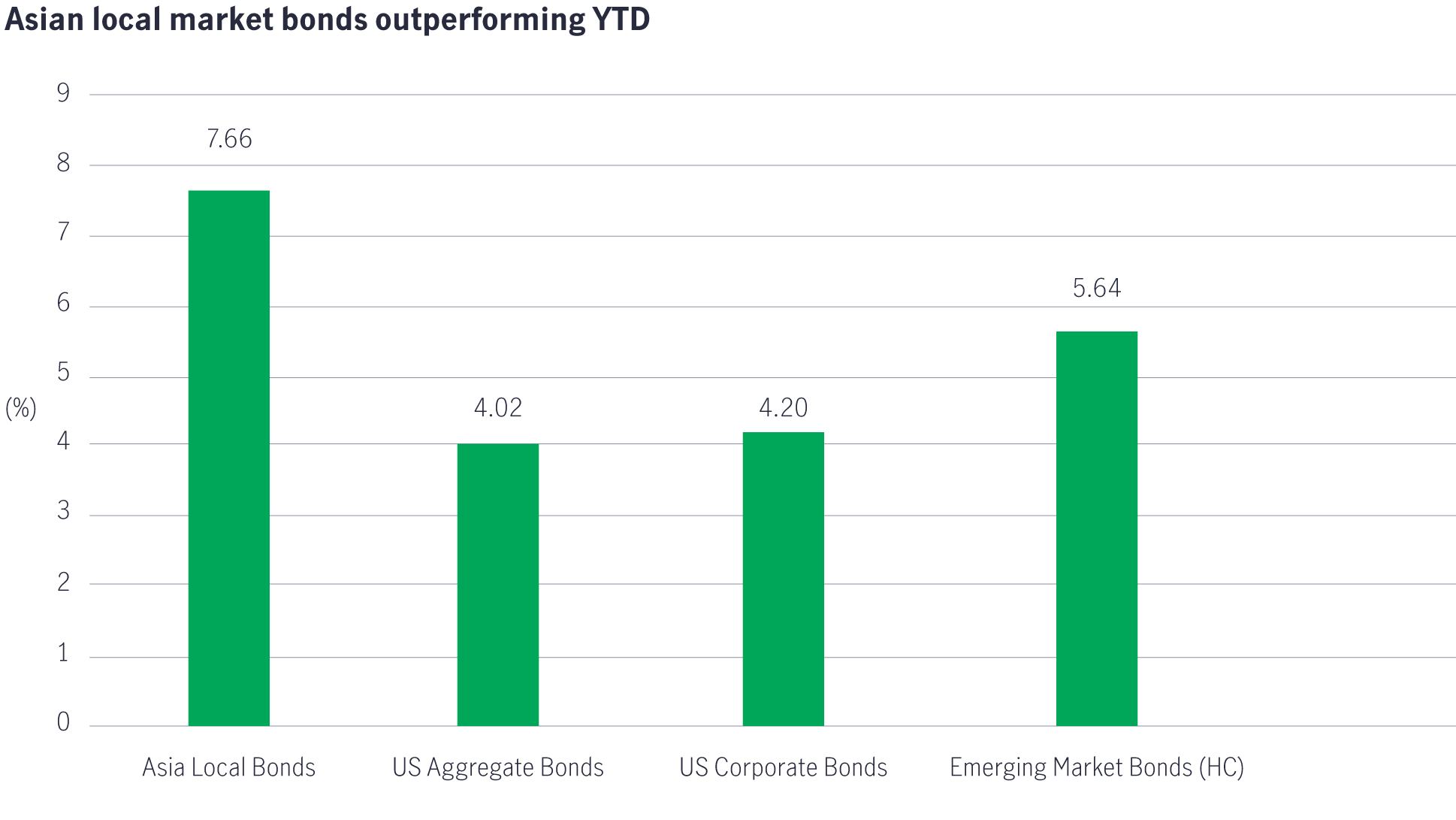

Despite this turbulence, Asian fixed income markets delivered solid first-half returns. As of 30 June, Asian local currency bonds were up by +7.6% year-to-date, while Asian credit remained resilient with a +3.8% gain. Looking forward, we believe Asian fixed income is well-positioned to build on this momentum and deliver attractive full-year returns.

On 16 May, Moody’s downgraded its US sovereign credit rating from AAA to Aa1, following similar moves by Fitch in 2023 and S&P in 2011. This marked the loss of the US’s final AAA rating among the three major agencies. Moody’s cited several key concerns:

As these metrics are significantly worse than other AAA rated sovereigns, Moody’s decided to proceed with the downgrade. This move led global investors to re-evaluate their allocations to US Treasuries, which had long been considered the cornerstone of “risk-free” assets. The erosion of this status, combined with increasing fiscal uncertainty, has naturally directed investors to ponder suitable investment alternatives.

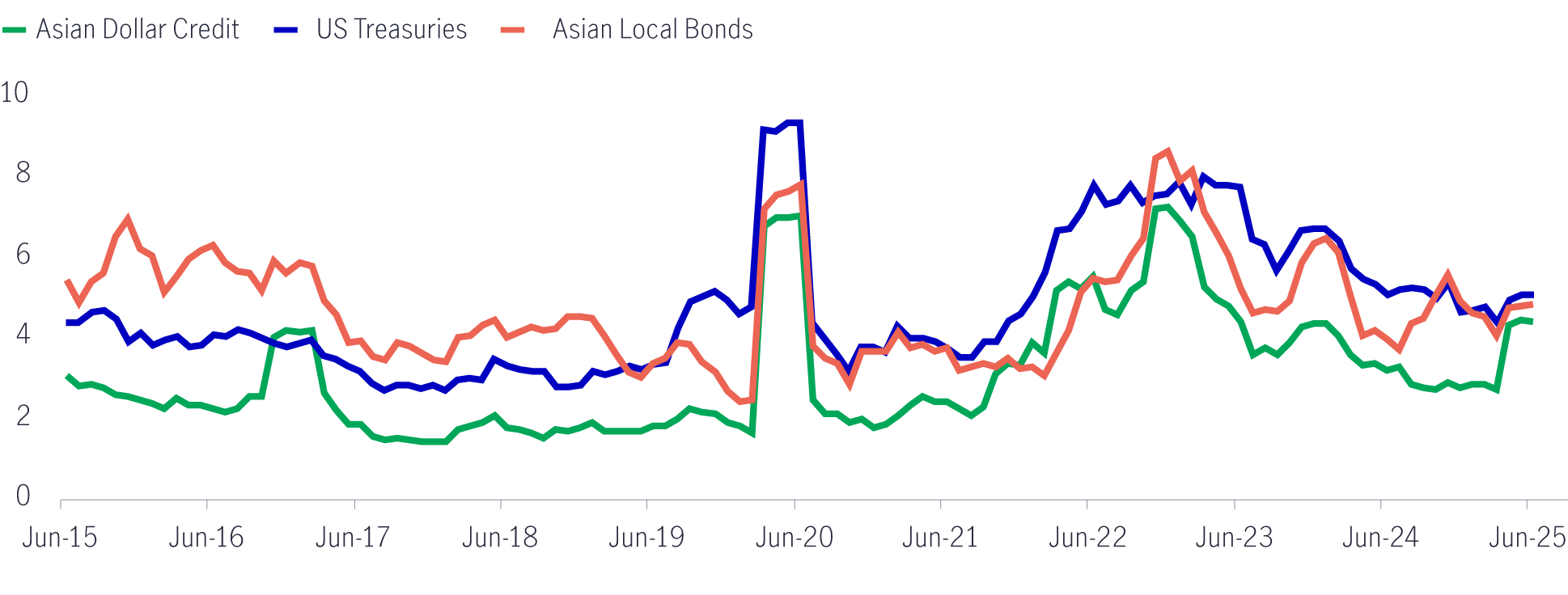

Even before the downgrade, US Treasuries had shown greater volatility than Asian credit and local currency bonds (see Chart 1)—despite their perceived safety. This volatility has been driven by policy uncertainty, rising debt burdens, and shifting global dynamics.

In contrast, Asian bonds have, arguably, offered more stable total returns in recent years, supported by improving economic fundamentals and diversified regional dynamics. This relative constancy makes them an increasingly attractive option for investors seeking to reduce overall portfolio volatility.

Chart 1: Historical 90-day volatility of Asian bonds versus US Treasuries1

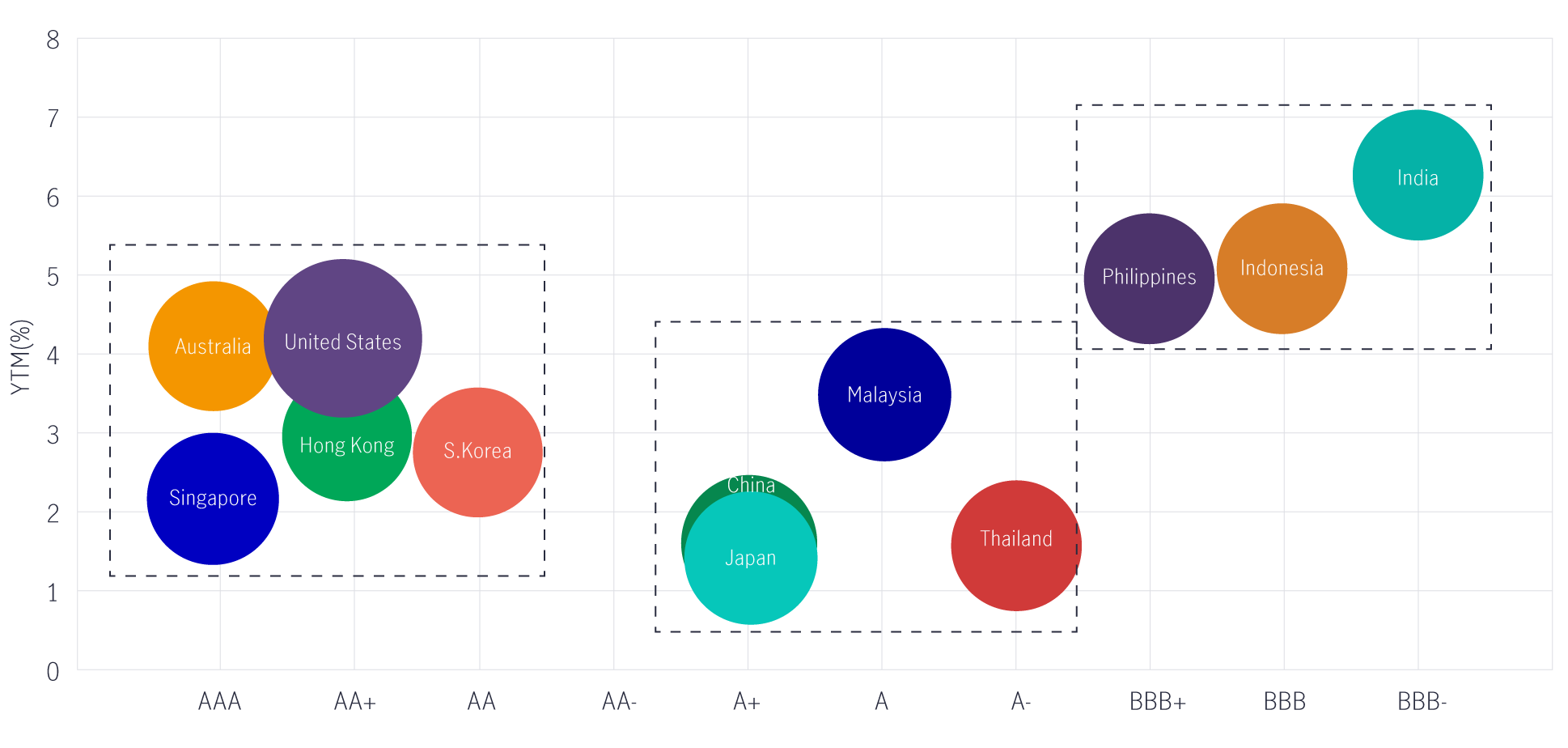

For investors seeking to maintain exposure to AAA rated bonds without taking on additional currency risk, regional markets such as Singapore and Australia offer compelling alternatives.

Both countries retain AAA ratings from all three major agencies due to their strong fundamentals and prudent fiscal management, making them appealing to investors prioritising quality and stability. Select hard-currency credits in these markets—particularly in the quasi-sovereign space—may even trade at negative credit spreads relative to US Treasuries, reflecting their perceived lower credit risk.

Interest in Asian local currency bonds is expected to grow in line with the emerging de-dollarisation trend. These markets offer high-quality alternatives to US Treasuries, along with meaningful diversification benefits.

Chart 2: Sovereign rating with 10-year bond yields2

All 11 Asia-Pacific markets in our universe are rated investment grade (BBB- or above), and can be grouped as follows (see Chart 2):

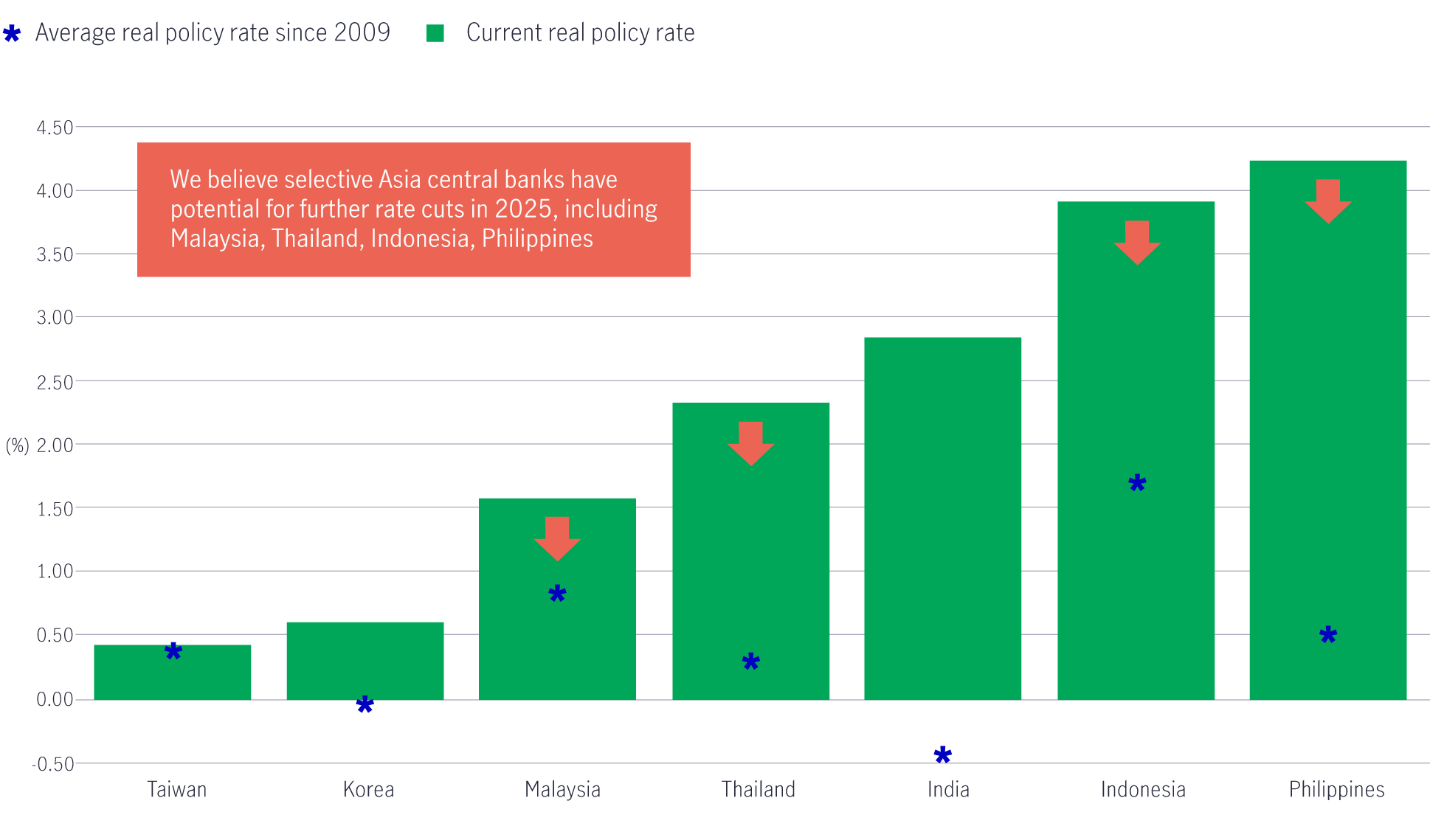

The weaker US dollar has given Asian central banks room to cut policy rates to support domestic growth and mitigate the impact of US tariffs (see Chart 3). Thus far this year, India, Indonesia, mainland China, Malaysia, the Philippines, South Korea, and Thailand have already implemented rate cuts. Looking ahead, we expect that some of these markets may continue to ease monetary policy—further boosting returns in local currency bond markets (see Chart 3).

Chart 3: Key Asian central bank (real) policy rates3

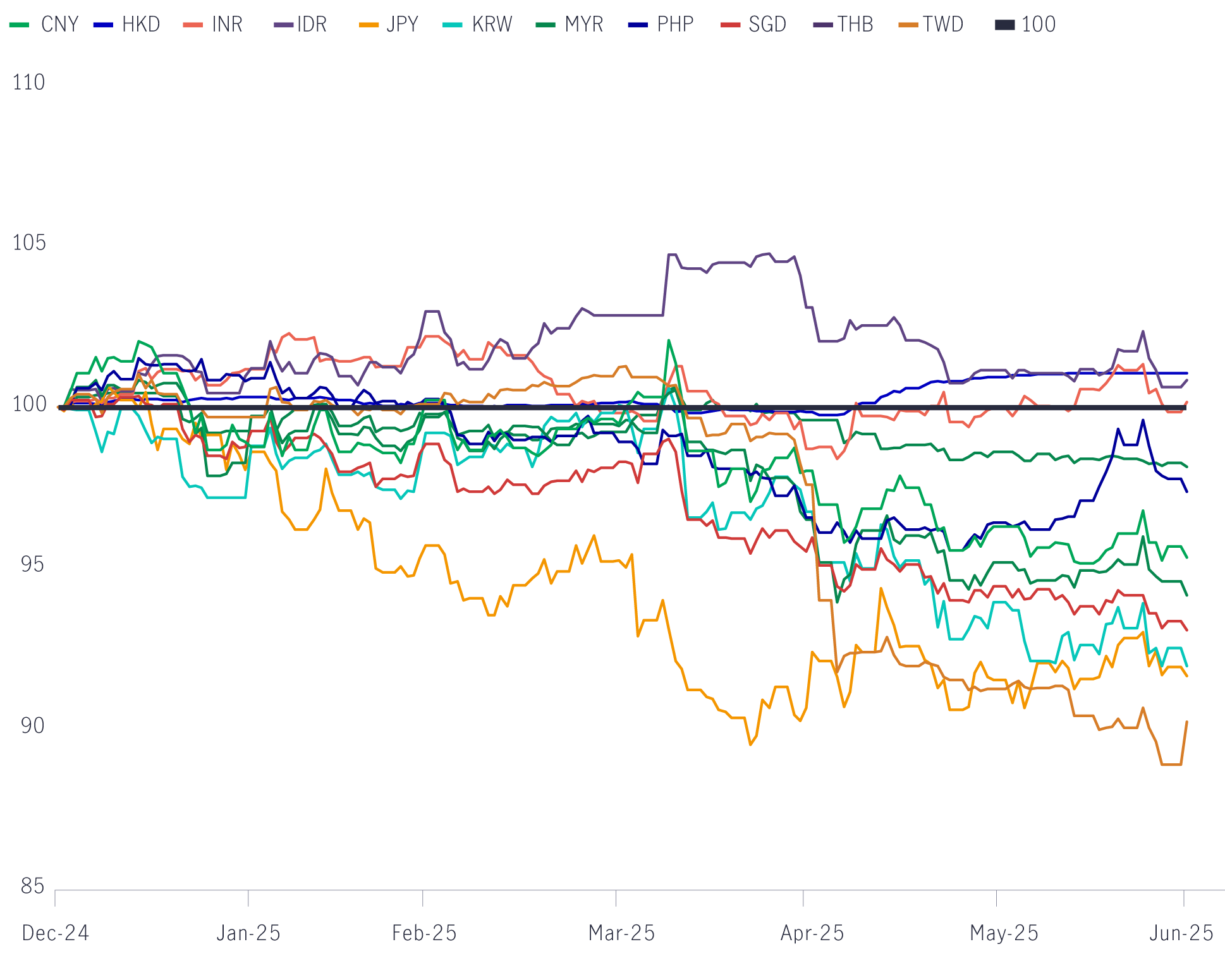

We believe that selective unhedged currency exposure, actively managed, can enhance diversification and improve risk-adjusted returns for US dollar-based investors.

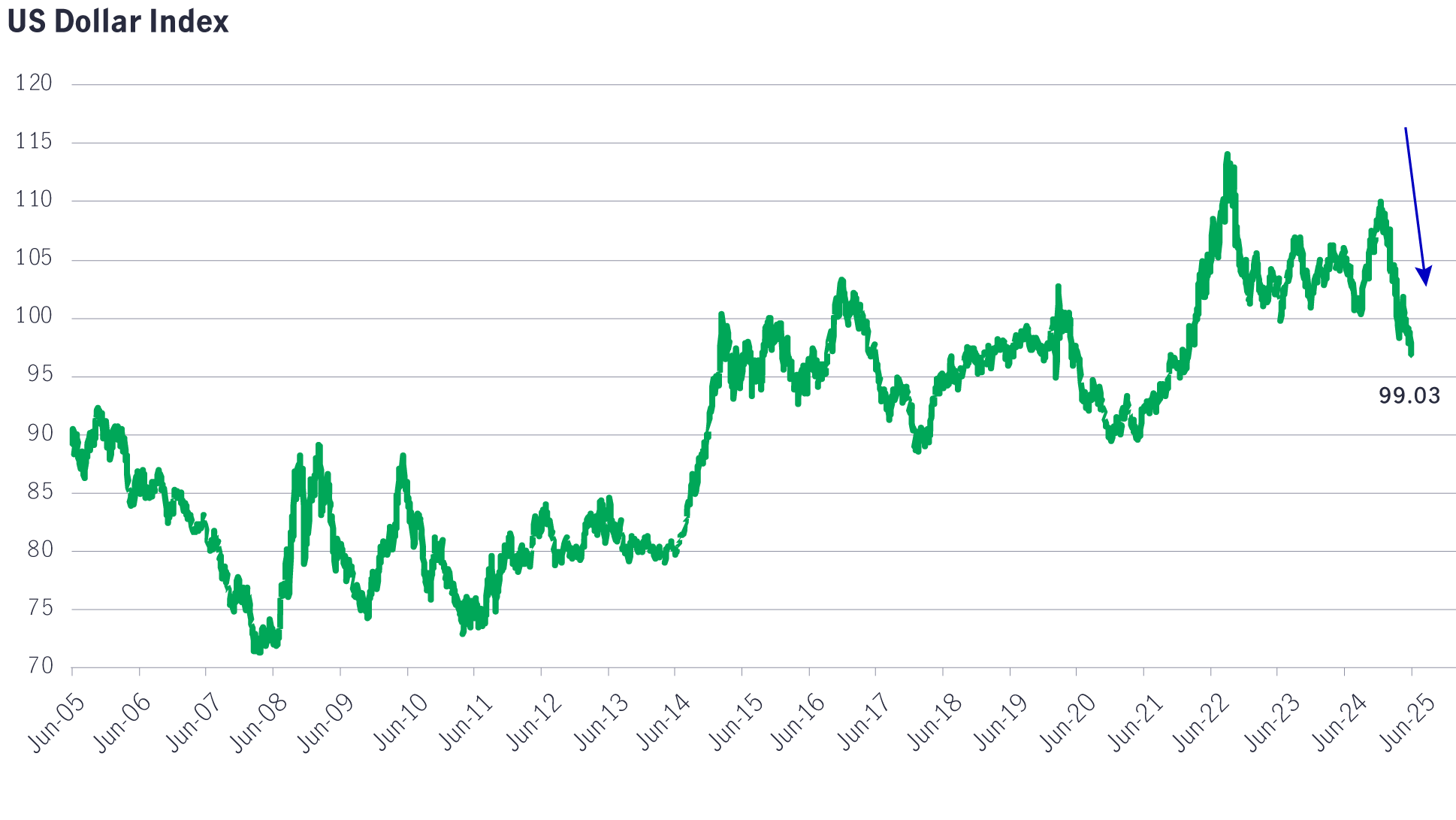

The US dollar has enjoyed a strong run over the past five years, with the DXY index rising from roughly 89 to 108 by the end of 2024. These gains were underpinned by US economic outperformance and attractive asset returns. However, recent fiscal and trade policy shifts have introduced significant uncertainty, culminating in the loss of the US’s final AAA rating.

These developments have increased the likelihood of a slowing US economy and a weaker dollar in the second half of 2025. While a broad exodus from US dollar assets is unlikely in the near term, we are seeing signs of repatriation and increased hedging, contributing to high single-digit gains in several Asian currencies year-to-date.

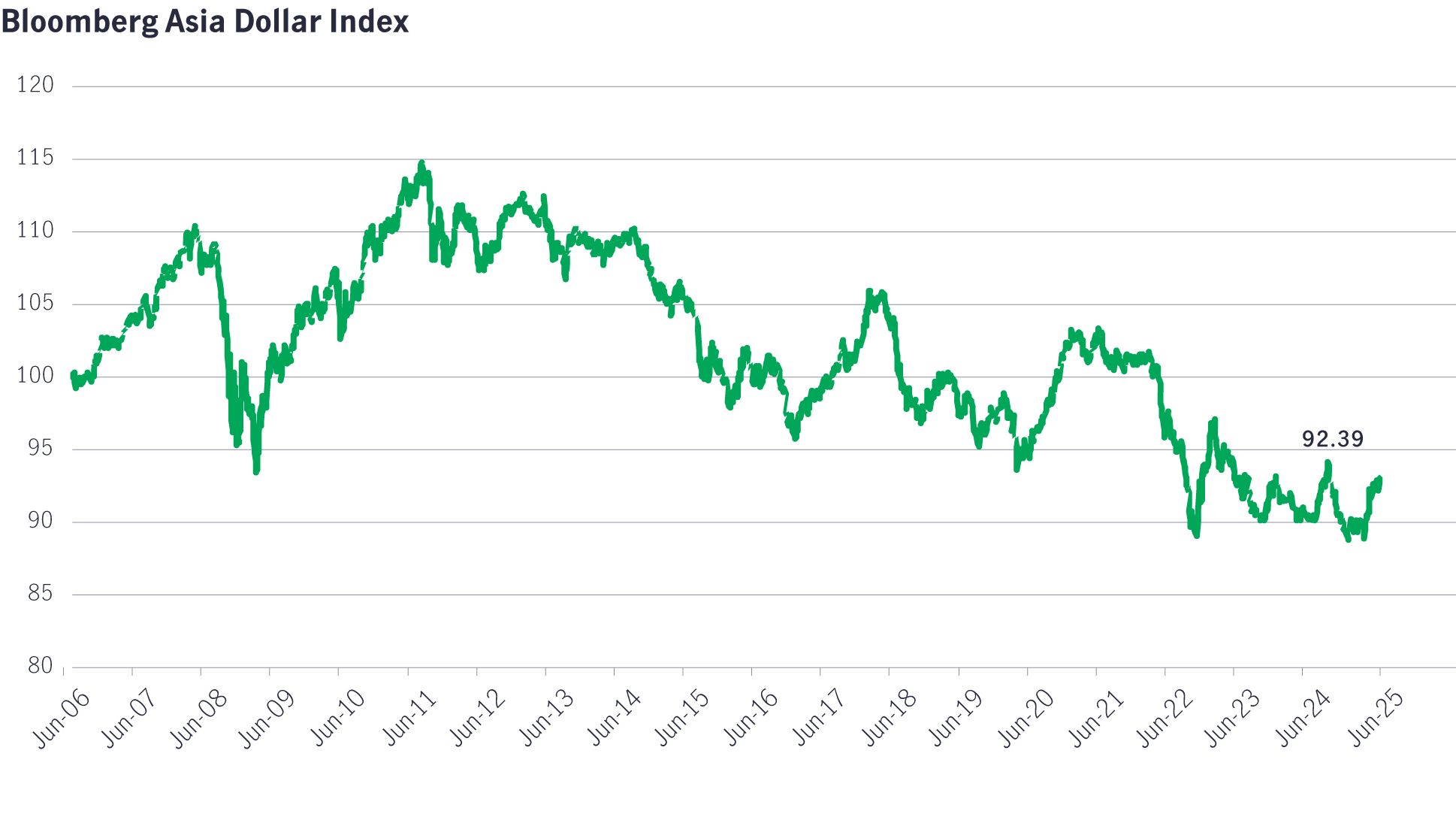

From a valuation standpoint, Asian currencies appear attractive. The Bloomberg Asia Dollar Index has declined from 104 to around 93 over the past decade, suggesting room for appreciation against the US dollar over the medium term (see Chart 4).

Chart 4: Asian currency strength; US dollar weakness4

Monetary easing and US dollar weakness have been key drivers of Asian local currency bond performance in 2025.

Despite concerns over the potential negative impact of US trade tariffs on the region, Asian local currency bonds have outperformed both US and broader emerging market bonds year-to-date (see Chart 5). This resilience has been underpinned by proactive rate cuts from regional central banks and a broadly weaker US dollar.

Chart 5: Asian local bond and currency outperformance5

We see positive returns for Asian local currency bonds extending into the second half of 2025, though perhaps not as eye-catching as the returns achieved year-to-date. Performance in the second half is expected to be driven primarily by rates rather than currency.

Asian local currency bonds continue to offer attractive yields and diversification benefits for global investors. When managed through a total-return approach—actively navigating interest rate, credit, and currency risks—these bonds can deliver compelling income and risk-adjusted returns over the longer term.

Amid growing uncertainty around US fiscal and trade policies and rising concerns over the risk premium embedded in US Treasuries, we are seeing increased interest in Asian local currency bonds from both global and regional investors.

If this trend continues, it could support sustained demand and further enhance performance across the asset class in the coming years.

In the hard-currency space, Asian dollar bonds have continued to offer a compelling value proposition. Compared to US and European counterparts, they potentially offer higher all-in yields with lower duration and spread duration—potentially offering a valuable buffer against market volatility in today’s uncertain environment.

A key driver of returns in 2025 has been the higher carry from Asian credit—both in terms of interest income and capital appreciation (“pull-to-par”).

Despite volatility in global interest rates and credit spreads—exacerbated by US policy shifts and Moody’s downgrade of US Treasuries—Asian credits have delivered solid year-to-date returns, supported by stronger fundamentals and a resilient regional economic outlook.

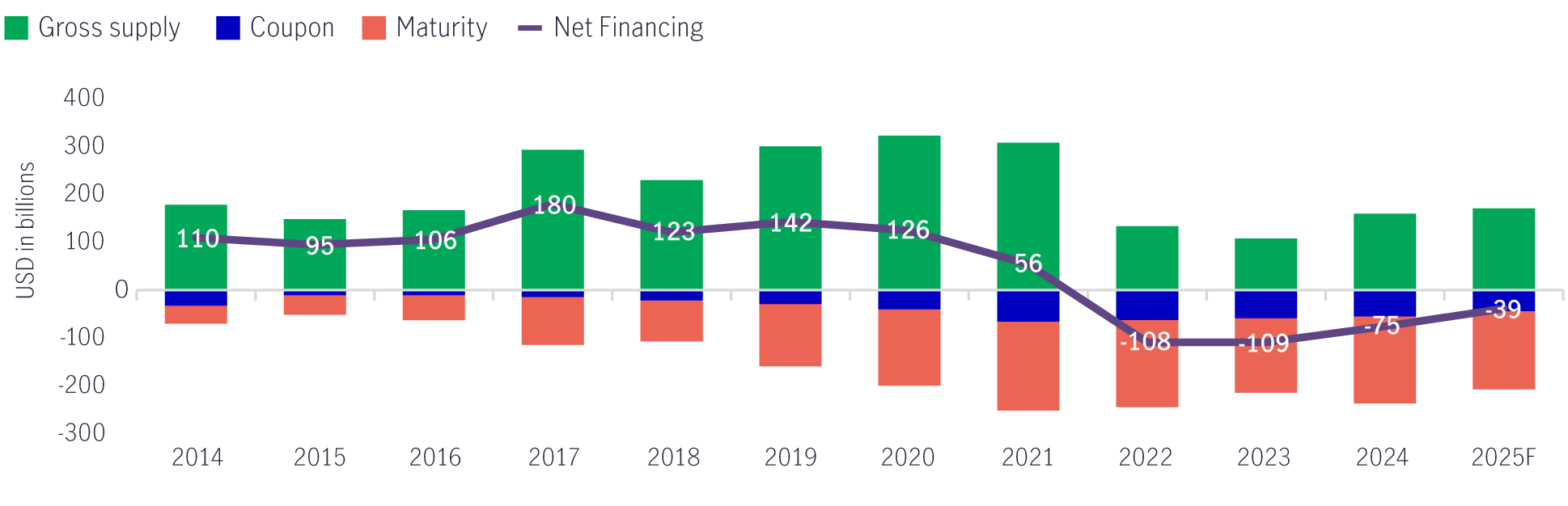

The emerging de-dollarisation trend has created a favourable technical backdrop for Asian dollar credit markets. Corporates across the region are increasingly refinancing in local currency markets, where funding costs have become more attractive. This shift has led to a decline in new US dollar bond issuance, tightening supply in the Asian dollar bond market.

With demand remaining robust and issuance volumes subdued, the supply-demand imbalance has supported price stability and capital appreciation. Looking ahead, if US dollar funding costs remain elevated—as markets currently expect—Asian issuers may continue to favour local currency markets, keeping dollar bond supply constrained in the near term.

Chart 6: Negative net financing expected for fourth straight year6

The first half of 2025 has highlighted growing investor unease around US policy direction, contributing to heightened volatility and a weakening dollar. For strategic investors seeking diversification, the case for investing in Asian fixed income has rarely been stronger, presenting a compelling alternative—both in Asian local currency and credit markets.

Long-term regional fundamentals remain favourable, and the weaker US dollar has provided Asian central banks with room to ease policy further, thereby supporting domestic growth. With solid performance year-to-date and improving investor sentiment, we expect continued inflows into Asian fixed income as global investors, including those based in the region, re-engage with the asset class as a strategic opportunity in the months ahead.

1 Source: Manulife Investment Management, Bloomberg, as of 30 June 2025. Asian Dollar Credit = JACI Composite, US Treasuries = Bloomberg US Treasury Index, Asian Local Currency Bonds = Markit iBoxx ALBI Unhedged.

2 Source: Manulife Investment Management, as of 10 July 2025.

3 Source: Macrobond, Manulife Investment Management, as of 11 June 2025.

4 Source: Bloomberg, as of 19 June 2025.

5 Source: Manulife Investment Management, Bloomberg, J.P. Morgan, as of 30 June 2025.

6 Source: Manulife Investment Management, J.P. Morgan, as of 31 March 2025.

Asset allocation outlook - Q1 2026

Read more2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Outlook Series: Manulife Global Multi-Asset Diversified Income Fund

In 2026, a clearer macroeconomic outlook is expected as momentum improves following strong 2025 drivers such as AI growth, energy transition, anticipated Fed rate cuts, and wider fiscal support. While the US Federal Reserve is likely to continue easing policy, diverse income opportunities remain across global markets, extending beyond traditional government bonds to high yield assets and option writing. Within this environment, the Manulife Global Fund – Global Multi‑Asset Diversified Income Fund (GMADI) remains with a clear and heightened focus towards income generation. The Fund seeks to deliver a high and consistent distribution income while maintaining exposure to long term capital growth opportunities.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.