15 April, 2020

With the spread of COVID-19 around the world and an uncertain outlook for global economic growth, we have seen almost unprecedented market volatility since late February. In response, central banks have introduced massive stimulus measures to help counter the swift decline in financial markets. Paula Chan, Senior Portfolio Manager of Fixed Income, believes that while it will be some time before we can move on entirely from this crisis, it’s an opportune moment to review how China’s bond markets have fared during the market sell-off.

Aggregate bonds in China and the US are the only two major fixed income markets to deliver positive returns this year. US aggregate bonds are up by 2.23%, while China’s aggregate issues increased by 1.14%1.

Over the same period, Chinese government bonds returned 0.93% while Chinese corporate bonds have risen by 0.22%2. In local-currency terms, China’s aggregate bonds are up by 3.02%, with the country’s government bonds gaining 2.81% and its corporate bonds moving 2.08% higher. The renminbi has depreciated by 1.24% against the US dollar during this time.

Manulife Investment Management, Bloomberg as of 25 March 2020, Bloomberg Barclays aggregate bond index returns in USD (unhedged).

Manulife Investment Management and Bloomberg, based on Bloomberg Barclays aggregate bond index returns in USD (unhedged), as of 25 March 2020.

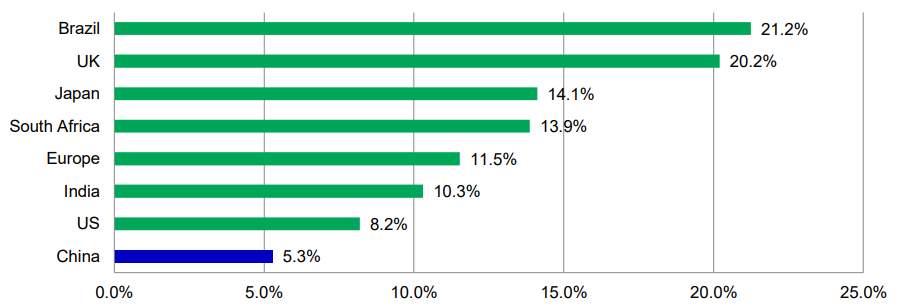

As indicated in chart 2, volatility among Chinese bonds has remained on the low side, even in the extreme market conditions. Based on daily returns since the beginning of the year, the annualised standard deviation for the country’s bonds was 5.3%., the lowest level relative to other global bond markets. Similarly, correlations with other major bond markets have also been low over this period. Again, when we look at year-to-date (YTD) daily returns, the correlation of China’s bonds with US and European bonds was 0.16 and 0.26, respectively3. These levels are comparable with longer-term correlations (10 years of returns).

In its initial response to the economic shock, the People's Bank of China (PBoC) acted with restraint. It made only minor adjustments to monetary policy and refrained from the more aggressive stimulus seen elsewhere, particularly with the US Federal Reserve (Fed). The Fed first cut rates by 50 basis points (bps) on 3 March and quickly followed up with a second cut of 100bps on 15 March, these moves brought its target rate to 0–0.25%.

Towards the end of March, the PBoC reduced the interest rate on 7-day repurchase agreements to 2.2% (from 2.4%), cutting the interest rate it charges on loans to banks by the biggest amount since 2015 and possibly signalling larger monetary-policy moves in the future.

During the initial phase of policy response to COVID-19, China acted quickly by focusing on alleviating the liquidity pressure on firms, particularly small and medium-sized enterprises (SMEs). It also sought to provide targeted support for the regions and sectors hardest hit by the outbreak. To this end, the PBoC injected around RMB$ 1.3 trillion of net liquidity through openmarket operations in early February. It then followed this up with additional programmes, including a reserve-requirement ratio (RRR) cut of 100bps for joint-stock banks and a 10bps reduction in the medium-term lending facility (MLF) rate in February. Meanwhile, the loan prime rate (LPR) rate was also guided 10bps lower in February but was held steady in March.4

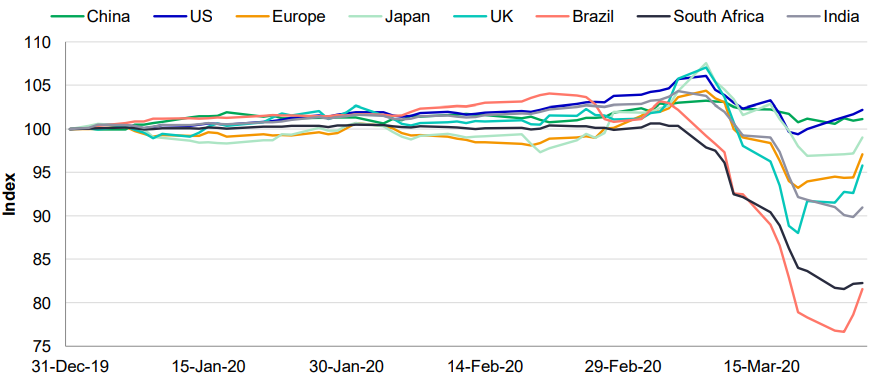

One reason for the more muted response by the Chinese authorities, so far, is the less acute reaction of domestic markets. China’s equity markets have sold off by around 10% over the last month5 compared with losses of over 30% in other territories. Consequently, China’s financial markets have not faced the same level of liquidity pressure that other developed markets have faced. In fact, we have not noticed any significant spread widening among onshore corporate bonds, while the new-issuance market has also been functioning normally.

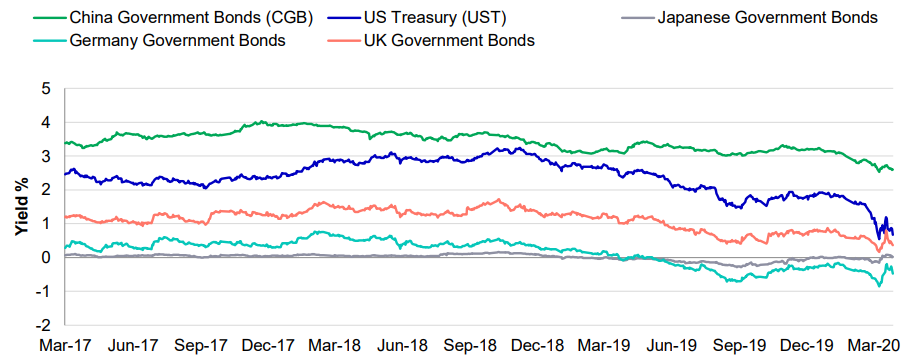

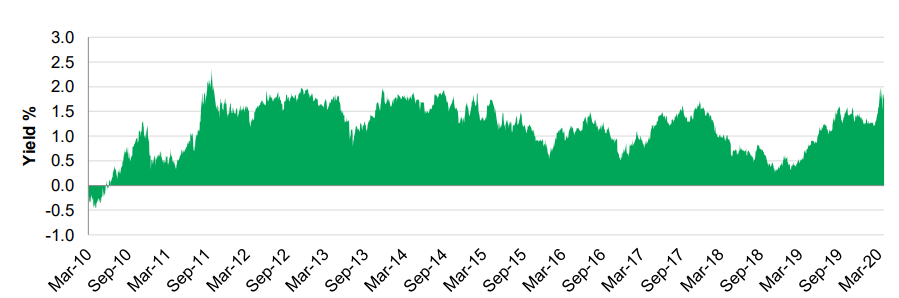

Consequently, 10-year Chinese government bond (CGB) yields have only fallen by around 55bps to 2.59% since the beginning of the year. During the same period, US Treasury yields have declined by 107bps to 0.84%. Accordingly, the current spreads between 10-year CGBs and US Treasuries have stretched by as much as 1.99% - these are the widest levels since late 2011.6

Manulife Investment Management and Bloomberg, as of 27 March 2020.

Manulife Investment Management and Bloomberg, as of 26 March 2020.

While initial policy efforts have focused on alleviating liquidity pressures and helping industrial activity to rebound, we believe that the Chinese government will have to expand its stimulus efforts to lift demand and support growth, particularly with the global economy heading towards a sharp recession, as economic activity has effectively paused. Commentators now expect the economy to experience a sharp contraction in the first quarter of 2020 then see some recovery in the second half of the year. Real GDP growth is likely to be in the low-single-digit range. In our opinion, the outlook for Chinese economic growth will be particularly challenging, as demand for its exports is expected to contract significantly in the months ahead, while further stimulus will be needed to support growth. At the same time, we believe that the amount of support is unlikely to approach the levels of over-stimulus seen in 2008.

Overall, the Chinese government is committed to maintaining a balanced approach that will support growth while ensuring financial stability. Furthermore, any new measures will likely combine both monetary and fiscal initiatives. The bottom line is that the PBoC retains significant headroom to trim rates further as the need arises but should remain prudent and patient while doing so.

The impact of the viral pandemic on China’s economy will be centred around external demand. The downward pressure on China’s export sector should be similar to that experienced during the Sino-US trade war of 2018-2019. China is also likely to deliver more monetary and fiscal support to drive its recovery. Concerning the rapid decline in oil prices, we think this will be a net positive for China, as the country imports around 70% of its oil. Cheaper oil will, therefore, be helpful for its current account and foreign exchange reserves. Additionally, lower energy prices should help to alleviate inflationary pressures and give the country more room to ease monetary policy.

China’s state-owned enterprise (SOE) and localgovernment financing vehicle (LGFV) sectors should remain instrumental in carrying out the government's fiscal stimulus, though with much less headroom compared to the last cycle in 2015. This is due to broadly higher levels of local-government debt. We expect newly injected liquidity to flow primarily to higher-quality SOEs and LGFVs. Lowerrated SOE/LGFV and private enterprises (onshore AA-rated or lower) could face more significant liquidity stress that will likely see default rates tick higher.

In the Chinese property sector, developers are also being negatively affected by operational disruptions from the COVID-19 outbreak, as reduced cash flow from property sales raises refinancing risks. So far, the government has supported the sector by lifting of local sales restrictions and providing ample onshore liquidity. However, smaller developers with limited funding channels and heavy debt maturities will be vulnerable if property sales remain sluggish – we have seen a growing number of defaults by private developers since the outbreak. On the other hand, major developers, that are also active issuers in the offshore bond universe, are well positioned to weather the current downturn, as most have adequate liquidity to meet debt obligations for the next 12 months. The resumption of sales and construction activity is on track for developers under our coverage, though we do not expect a V-shaped recovery, as property demand remains subdued. We also think that the current situation will accelerate market consolidation, which will see leading developers and state-owned companies acquire market share from smaller-scale developers that are at risk of experiencing a liquidity crunch.

The Chinese banking sector is likely to face asset-quality pressure given the weaker real economy, while insurers and securities companies may suffer from capital-market underperformance. Despite this, China’s largest banks remain well positioned given their asset quality and capital adequacy is at multi-year highs. Also, they carry little exposure to LGFVs and those industries suffering from overcapacity. Compared to other major economies, the Chinese financial system should be relatively resilient. In particular, the country’s financial system underwent a deleveraging process from 2017 to 2019, and its equity market has weathered the crisis better than other territories (so far). Finally, the Chinese government has a strong track record in ensuring financial stability.

While the renminbi has weakened by around 1.24% against the US dollar6, we now expect the currency to remain rangebound over the next few months. With the Fed effectively cutting rates to zero, there should be less impetus for the US dollar to appreciate much more from current levels. Additionally, with China applying monetary stimulus at a more measured pace, it is likely to maintain an advantage over its peers in terms of interest-rate differentials, which will support the renminbi despite a much softer outlook for the Chinese economy.

The COVID-19 crisis has again illustrated the low correlation of China bonds versus other global bonds and the value of the CGBs as a relatively safe haven in these unprecedented times. Furthermore, the CGB market remains one of the most attractive from an absolute-yield perspective and will likely maintain this yield advantage over other developed bond markets. Meanwhile, the Chinese government is committed to taking a measured approach to monetary stimulus. Over the longer term, we expect that the demand for Chinese bonds will continue to grow, as the index-inclusion theme attracts more substantial fund flows, and foreign investors remain underinvested in the asset class.

1 Unhedged US dollar terms, year-to-date to 25 March 2020. Bloomberg Barclays US Aggregate Bond Index (US dollar, unhedged), Bloomberg Barclays China Aggregate Index (US dollar, unhedged).

2 Unhedged US dollar terms, year-to-date to 25 March 2020. Bloomberg Barclays China Government Index (US dollar unhedged), Bloomberg Barclays China Corporate Index (US dollar, unhedged).

3 Bloomberg, as of 26 March 2020.

4 SCMP: “China to inject US$174 billion of liquidity into markets amid new coronavirus outbreak”, 2 February 2020; Reuters: “China cuts medium-term rate to soften coronavirus hit to economy”, 17 February 2020; Reuters: “China pumps $79 billion into economy with bank cash reserve cut “, 13 March 2020; SCMP: “China keeps benchmark loan rate unchanged despite coronavirus”, 20 March 2020.

5 Bloomberg, as of 26 March 2020. Based on the Shanghai Stock Exchange Composite Index.

6 Bloomberg, as of 26 Mach 2020.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.