26 February, 2021

2020 was a volatile year for global equity and fixed income markets, as the COVID-19 pandemic impacted economies across the world. Although global healthcare companies faced their fair share of uncertainties, the sector has demonstrated the ability to address similar clinical challenges with profound health implications. Through the development of diagnostics, therapeutics, and vaccines, healthcare companies worldwide are striving to develop toward solutions that identify, treat, and contain COVID-19. In this 2021 outlook, Steven Slaughter, Lead Portfolio Manager, discusses the attractiveness of allocating to healthcare companies and outlines why the sector should be a fruitful investment moving forward.

In a challenging year, global healthcare equities turned in a resilient performance with solid risk-adjusted returns. Early in 2020, as prevention policies to contain the spread of COVID-19 led to global lockdowns, the virus ravaged the world’s economies and the overall market. The healthcare sector offered relative protection during the downturn, once again proving itself a defensive stalwart. With the pandemic upending everyday life and financial markets, the importance of healthcare came to the forefront, serving as a beacon of light for humanity and the global economy.

Scientists, healthcare executives, and government organisations across the world devoted significant time and resources in an attempt to curtail the virus. This led to significant breakthroughs in diagnostic testing, therapeutics, and vaccines. These monumental advancements along with unprecedented monetary and fiscal stimulus, facilitated economies and global markets to stage a strong recovery throughout the year.

While these COVID-19 related advancements may be unique due to the compressed time frame, addressing similar clinical challenges with profound health implications is nothing new for these innovative companies. Leading healthcare companies pursue treatments and cures for unmet medical needs every single day – these include cancer, metabolic syndrome, rare/orphan diseases, and central nervous system (CNS) disorders, to name a few. Indeed, the ability of healthcare companies to address such unmet medical needs is one of the three guiding principles by which we assess investment opportunities. It also helps shape the sector’s bright outlook.1

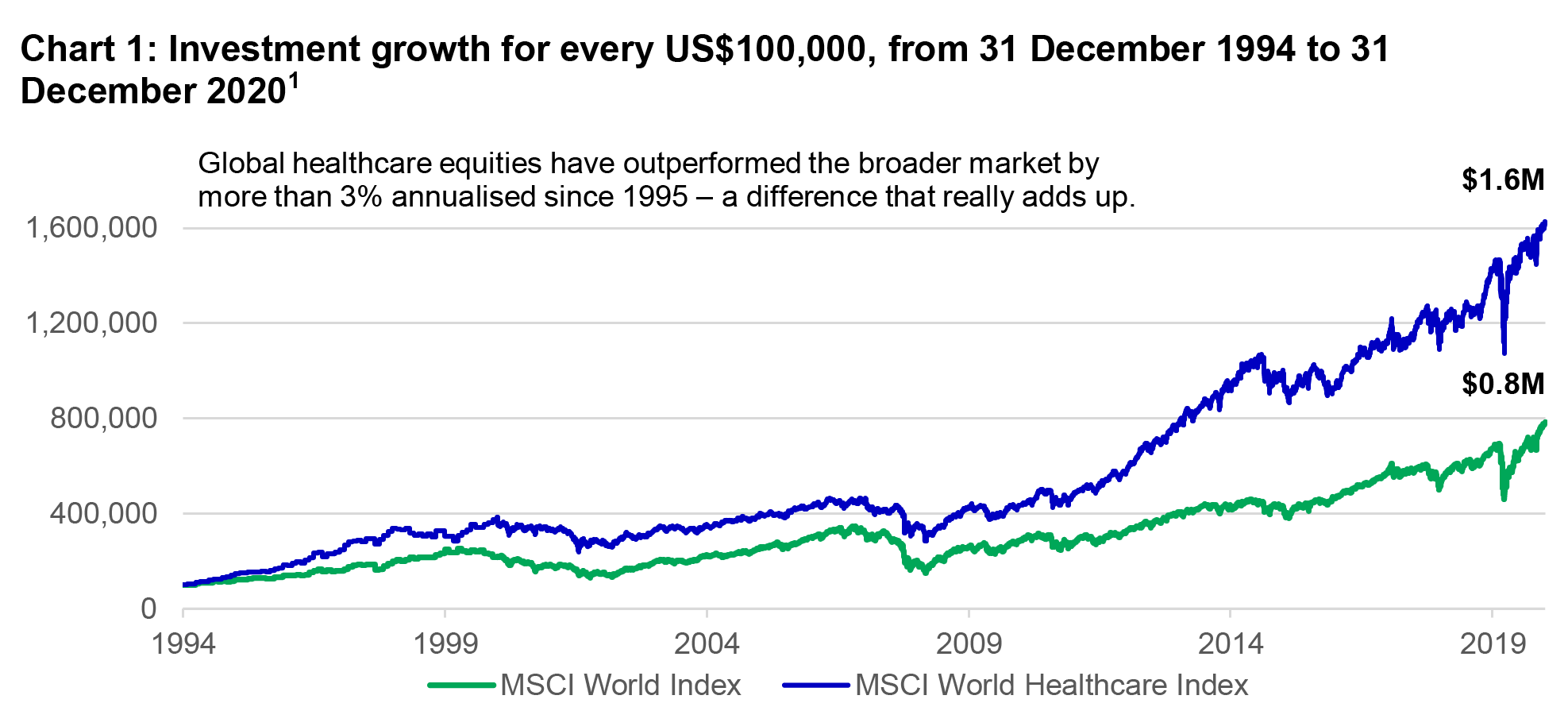

Healthcare has historically delivered strong performance, particularly during economic downturns. For more than 25 years (1995–2020), global healthcare equities have, on average, significantly outperformed global equities.

These excess returns have been more pronounced during periods of heightened market volatility and economic distress. The pandemic-induced drawdown experienced in the first quarter of 2020 was no different, with the sector exhibiting its defensive nature and delivering solid excess returns.

The sector's defensiveness stems from the supply-and-demand dynamic of healthcare products and services. While cyclical industries usually experience a sizable reduction in demand during economic downturns, healthcare demand generally remains resilient, with consumers having an inelastic appetite for medical goods and services. This has been even more prominent during the COVID-19 pandemic with many healthcare products and services experiencing a surge in demand.

Healthcare is unique in that it is a defensive sector that provides a buffer to general market volatility while still producing impressive organic growth. These observations are exemplified by earnings per share and sales growth that have, on average, been historically superior to the broader market3.

This strong organic growth is fuelled by long-term secular trends that will propel demand for healthcare products and services higher over the long-term, regardless of the global economic cycle.

1. The ageing population is driving increases in expenditures

Irrespective of location, the world’s population is ageing rapidly and life expectancy is forecast to continue climbing. This should translate into greater demand for health-related services, rising costs, and an expanding array of treatments and therapeutic options.

2. Medical advancements

As evidenced by the progress seen with the approvals of COVID-19 treatments, diagnostic tests, and multiple vaccines, medical advances continue to drive the sector forward.

3. Profound unmet medical needs remain

As previously mentioned, healthcare companies continue to pursue unmet medical needs beyond COVID-19. These include cancer, metabolic syndrome, rare/orphan diseases, and CNS disorders.

Healthcare equities are also attractively valued based on forward Price-to-Earnings (P/E) multiples versus the broader market indices. Global healthcare companies are currently trading at a discount to the overall market (18.28 times vs 20.56 times). This presents a unique opportunity as healthcare companies have historically traded at a premium to the overall market, as a result of its defensive nature and aforementioned growth prospects.

| Valuation Metrics (P/E) | Long-term Average4 | As of 19/Feb/2021 |

|---|---|---|

| MSCI World Healthcare relative to MSCI World | 106% | 89% |

Early vaccine efficacy data proved promising and flooded the market with optimism late last year. Although robust data and the strides being made in vaccine distribution are very encouraging, we believe there are still some challenges that the market does not fully appreciate. This view is validated through our proprietary fundamental and scientific research, including but not limited to frequent conversations with immunologists/epidemiologists, real-time and detailed reviews of emerging scientific literature; along with dedicated analysis of case reports, hospitalisation data and mortality data. Given this perspective, we believe the general market is underappreciating the likely duration and impact of COVID-19 on the economy and healthcare sector.

What's more, the general population may not fully understand the utility of COVID-19 vaccines. Many common vaccines provide sterilising immunity (protection from infection and transmission). COVID-19 vaccines are 70-95% effective in preventing the disease, depending on the version. However, there is limited data to suggest that they stop transmission as well (i.e., sterilising immunity). This fact, coupled with the various mutations of the virus emerging across the globe (UK, Brazil, South Africa), may present further challenges.

The current vaccines may not confer robust levels of protection against these emerging mutants, thus potentially necessitating development of "booster" versions of the vaccines. Early data also suggests that these variant strains may drive 50-70% more transmission, with extended duration of viral loads found in infected patients.

Due to the reluctance of some individuals to receive the vaccine, the expected time it will take to vaccinate the global population, as well as the vaccine’s inability to provide sterilising immunity, our research suggests that we will not reach “herd immunity” as quickly as the general market may anticipate. We believe a therapeutic cure will be necessary to eradicate this virus. We expect the global economy will eventually get back to normal, although it may require several more months if not years for that end goal to be realised. As such, investors should position their global healthcare allocations with this thesis in mind. In particular, we believe that market participants are underappreciating the likely persistent need for breakthroughs in COVID-19 treatments, testing, and vaccines beyond 2021.

Several biopharmaceutical companies with market-leading COVID-19 therapeutic portfolios shall warrant investors’ attention. In our view, these companies are expected to see consistently strong demand for their COVID-19 treatments over the next few years, well above street estimates. Specifically, there are established biopharmaceutical companies with approved COVID-19 treatments that have demonstrated utility in shortening infected patients’ recovery time. Select innovative biopharmaceutical companies which are currently developing potential COVID-19 therapeutic cures also present a positive outlook, as our research indicates that an end to this pandemic will likely result from a combination of multiple therapeutics and vaccines. On top of strong COVID-19 tailwinds, we believe this is an area of the healthcare sector that offers reasonable valuations with potential for further price appreciation.

Additionally, we believe select emerging leaders in the COVID-19 diagnostics space offer a unique investment opportunity. For the world to truly open and return to normal (schools, small businesses, office environment, public events, etc.), on demand and repeated testing will be needed over many months and possibly years. This will drive significant demand for COVID-19 diagnostic testing, and, as such, our proprietary cash flow models are estimating revenues well above sell-side estimates.

Lastly, on the vaccine front, we believe contract development and manufacturing organisations (CDMOs) with exposure to multiple COVID-19 vaccines offer an attractive opportunity for investors, particularly from a risk/reward standpoint. In our view, multiple versions of the COVID-19 vaccine will be needed to control this disease, and these CDMOs will be the beneficiaries of persistent sales and profits. In this regard, such companies may well see recurring revenues as the need for “booster” vaccines is further elucidated.

Preceding the US election in November 2020, potential changes to the US healthcare system as well as policies surrounding US drug pricing were frequently discussed. Given the outcome of the election, we believe the prospect for substantive US healthcare legislation has been reduced. This should prove to be a positive for healthcare investors due to a lower risk of draconian drug-pricing reform or dramatic changes to the healthcare delivery/ payment systems in the US. In brief, it seems likely that the new administration will focus on the pandemic to the detriment of any other sweeping changes to US healthcare. Over the short-term, we believe that the US government will push for expanded Medicaid coverage and prop up the Affordable Care Act, both legislatively and through executive actions. Accordingly, we are less sanguine on the likelihood of substantive drug-pricing reform in the near-to-intermediate term. However, we continue to monitor these developments closely.

Governments worldwide seem cognizant of the fact that we will be reliant on healthcare companies’ efforts around treatments, testing, and vaccines to move past this pandemic. We expect this circumstance to mitigate any excessive pressure to enact sweeping regulatory changes to the sector.

The ongoing COVID-19 pandemic heightens the urgency to effectively manage other pre-existing disease states (cancer, metabolic syndrome, autoimmune disorders, etc.). New modalities in treatment and prevention will also continue to drive long-term governmental outlays toward healthcare products and services. Irrespective of COVID-19, the underlying secular trends of ageing demographics, medical advancements, and profound unmet medical needs continue to support long-term investment exposure to the sector.

We believe select companies within the healthcare space offer the potential for strong long-term outperformance and this is an opportune time to invest in the sector, with a focus on the importance of stock selection as a potential driver of outperformance. We believe these innovative and compelling companies have the ability to survive the next market downturn and, more importantly, create long-term value for shareholders. A bottoms-up, fundamental investment process informed by the assessment of emerging scientific and medical trends, coupled with a disciplined intrinsic valuation analysis, can uncover these robust opportunities. This approach will continue to ensure that an allocation of capital to companies tackling important unmet medical needs will be a key driver of portfolio construction, with deference to appropriate valuation discipline.

1 Morningstar, 31 December 1994 to 31 December 2020.

2 eVestment Alliance.

3 FactSet, from 2005 to 2021.

4 FactSet, from 2005 to 2021.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.