30 June 2022

Paul Kalogirou, Managing Director, Client Portfolio Manager, Multi-Asset Solutions Team, Asia

The term “income” varies across the investor base, depending on your overall income specific objectives, time horizon, and risk tolerance.

Traditionally, income was largely achieved via exposures to fixed-income assets – typically bonds – that generated 3-5% a year at a medium level of risk, held to maturity.

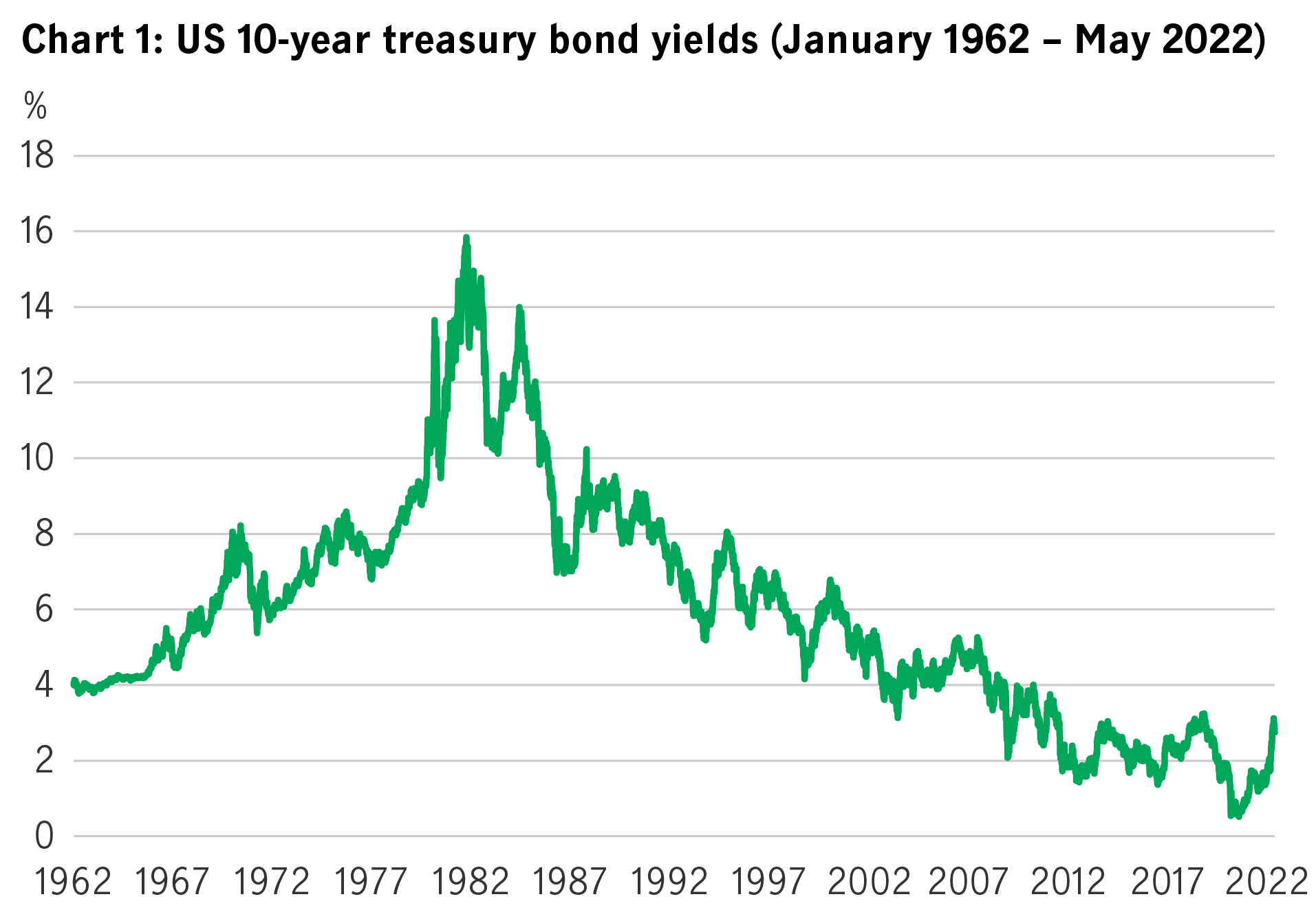

But in the past decade, income investing has broadened towards complementing traditional income with non-traditional income sources across asset and within asset classes. Generating higher yields has become increasingly more challenging given a prolonged period of declining interest rates and Fed quantitative easing. Even in an environment moving towards “normalising” rates, as we have now, average yields are still low in comparison with previous decades (see Chart 1). Coupled with that, heightened inflation is making it more difficult to protect “real-yields” (nominal yields minus inflation).

Source: US Federal Reserve Bank of St Louis, as of 26 May 2022.

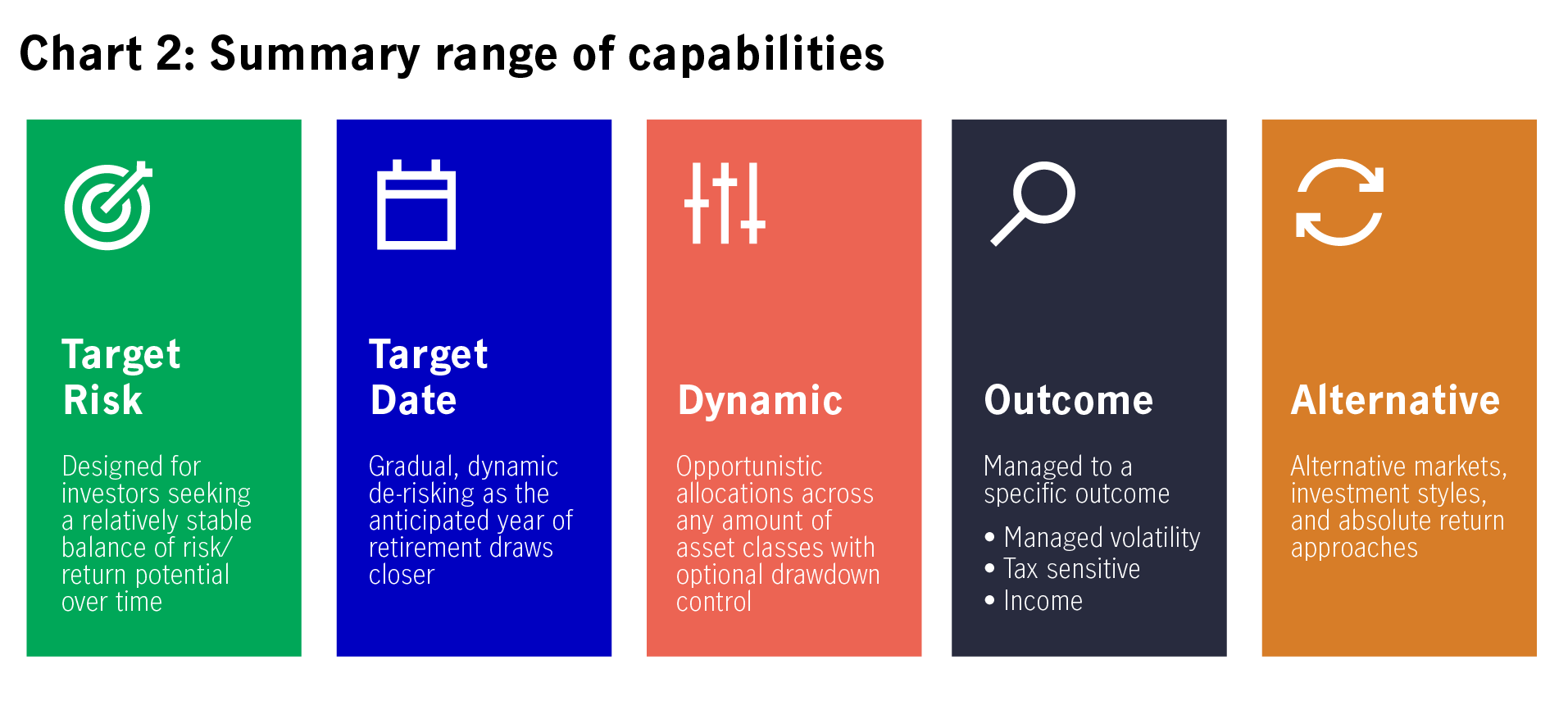

Under the Multi-Asset Solutions Team (the team), we have a range of building block capabilities designed to help clients overcome an investment challenge or meet a specific outcome objective (see Chart 2). “Income” is a key objective we can achieve via an “outcome-oriented” approach. In this piece, we’ll focus on how our globally diversified multi-asset income strategy can deliver a sustainable and high income outcome that investors are looking for, whilst remaining peer competitive within the current challenging macro-economic environment.

Our multi-asset income capability tends to help investors achieve a higher, sustainable income in this challenging (or low growth) environment.

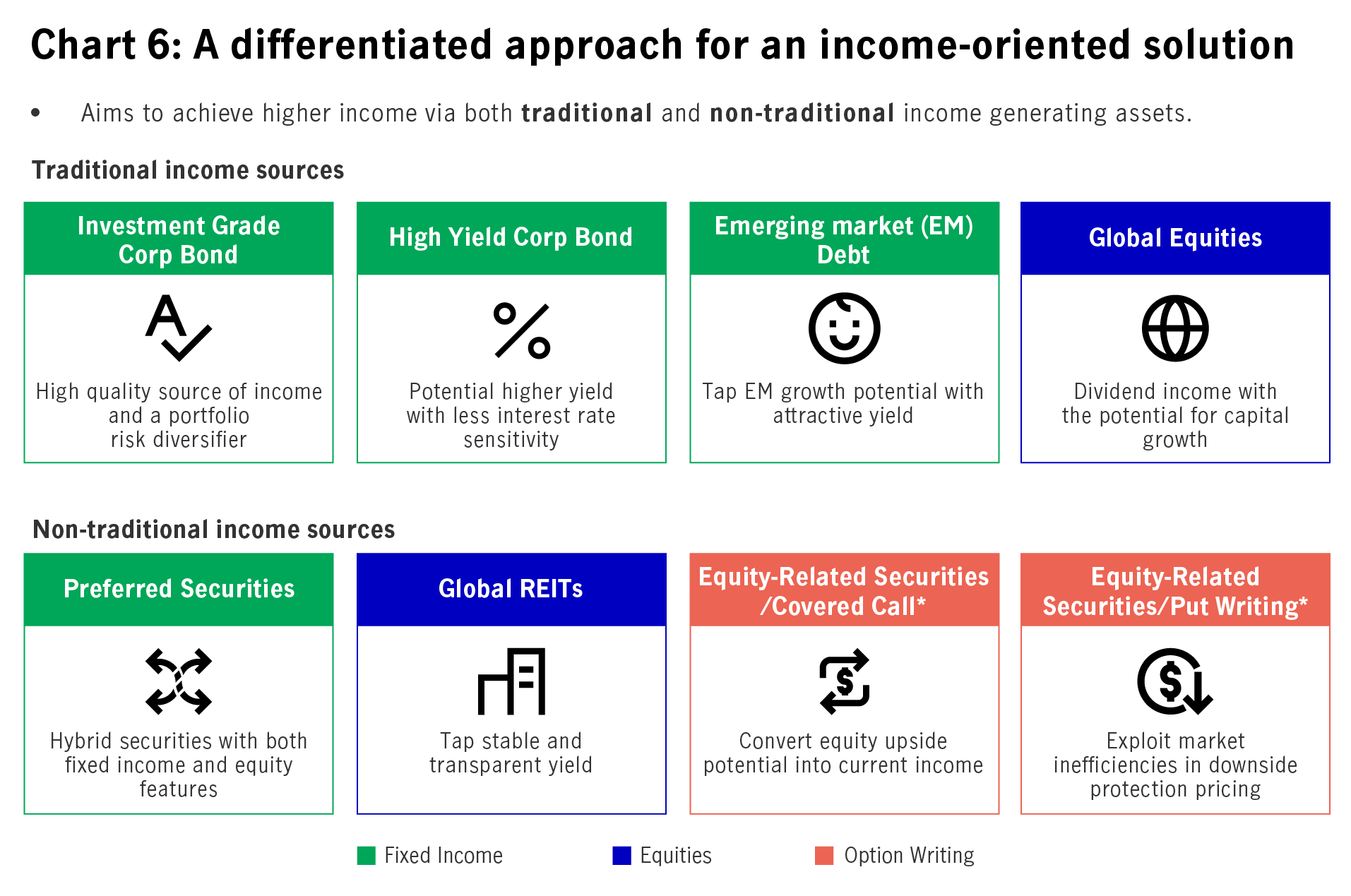

Our global multi-asset diversified income approach is unconstrained and uses traditional and non-traditional income sources to harvest income. With a multi-asset portfolio, investors can gain access to a wider range of income-generating assets, as well as greater depth and diversification within asset classes. For a sustainable long-term income strategy, we strive to achieve higher natural yields (the cash generated from invested income sources) that are closer to or even equal to the distribution payout target, in order to minimise the need to rely on drawing from capital gains or principal capital.

Depending on the income source and current market conditions, the natural yield earned may be lower than the set distribution payout target. In this case, any shortfall must be filled by retained cash, realised capital gains or principal capital. During periods of market volatility, it is challenging to achieve mark-to-market capital gains. Dividends paid out of capital represent a return or withdrawal of part of an investor’s original investment and may result in an immediate decrease in the net asset value (NAV) or investable amount. It equates to selling investments to fund withdrawals. If the natural yield and distribution payout target diverge, the NAV would keep falling, making it challenging to achieve capital growth (or even capital preservation) to meet an investor’s longer-term financial objectives.

In the past three years, we’ve lived through different rate environments and market events. Let’s look at how we derive higher income from these scenarios:

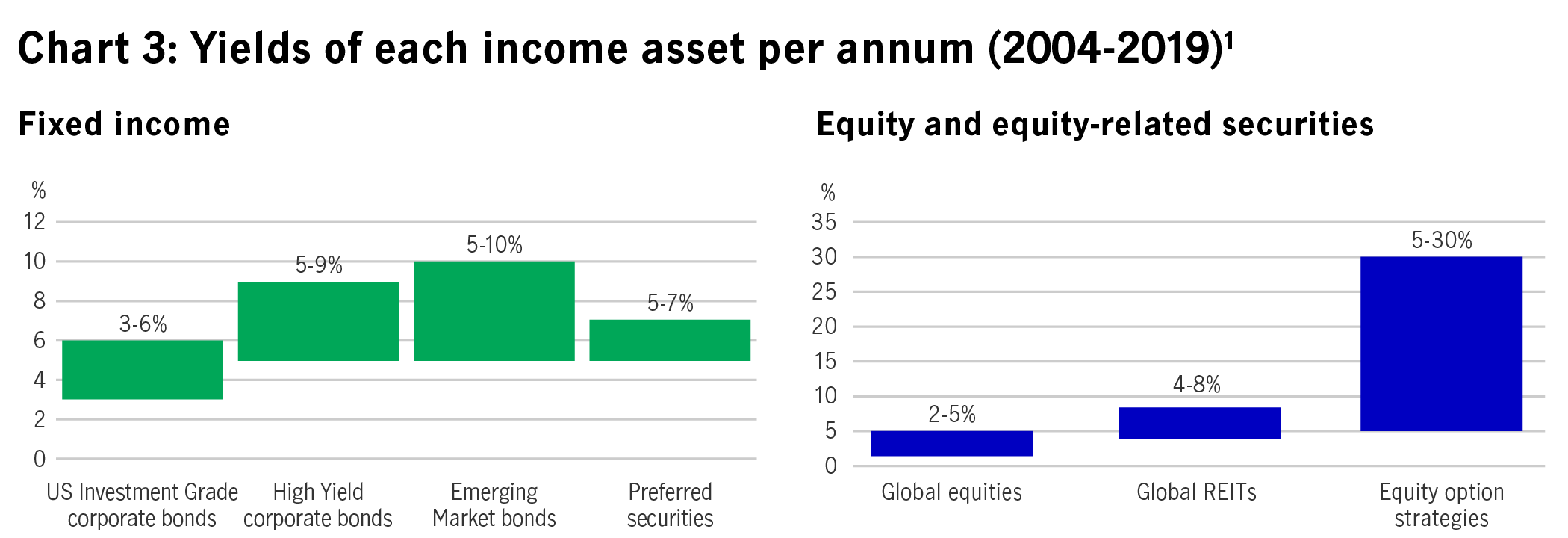

In a low-rate environment, yields of traditional income-generating or high-quality developed-market assets, such as equities and investment-grade corporate bonds, remain relatively low. Out of the traditional income assets, we favour the higher carry offered by U.S. high-yield debt and select USD denominated emerging-market debt.

To deliver relatively high yields and steady income, we are flexibly positioned towards non-traditional income assets like preferred securities, real estate investment trusts (REITs), and equity-option strategies. Non-traditional assets can be beneficial as they provide relatively higher yields and lower correlation to other investments. We believe that by using a global multi-asset diversified income allocation approach, which includes a mix of bonds and equities, can help investors achieve a solid and stable income profile.

In a higher-rate environment, we capture income via exposures to high-yielding bonds. Although bond prices typically fall under higher rates, this can be mitigated by managing the interest rate sensitivity (or duration) exposure. In theory, high-yield bonds are less sensitive to interest-rate rises, hence can be more cushioned against a significant rise in rates. A bottom-up security selection approach to income harvesting allows us to invest into the corporates that can maintain their businesses in this type of environment, whilst providing a sustainable fixed income coupon or dividend yield. In the last six to eight months as of June 2022, for example, the team have been less focused on EM debt but rather having a preference for increased allocations towards US credit because of low US default rate expectations, a relatively stronger US economic backdrop and hence a stronger US dollar, covid-19 concerns in EM, as well the ongoing impact on debt markets around issues in China and Russia.

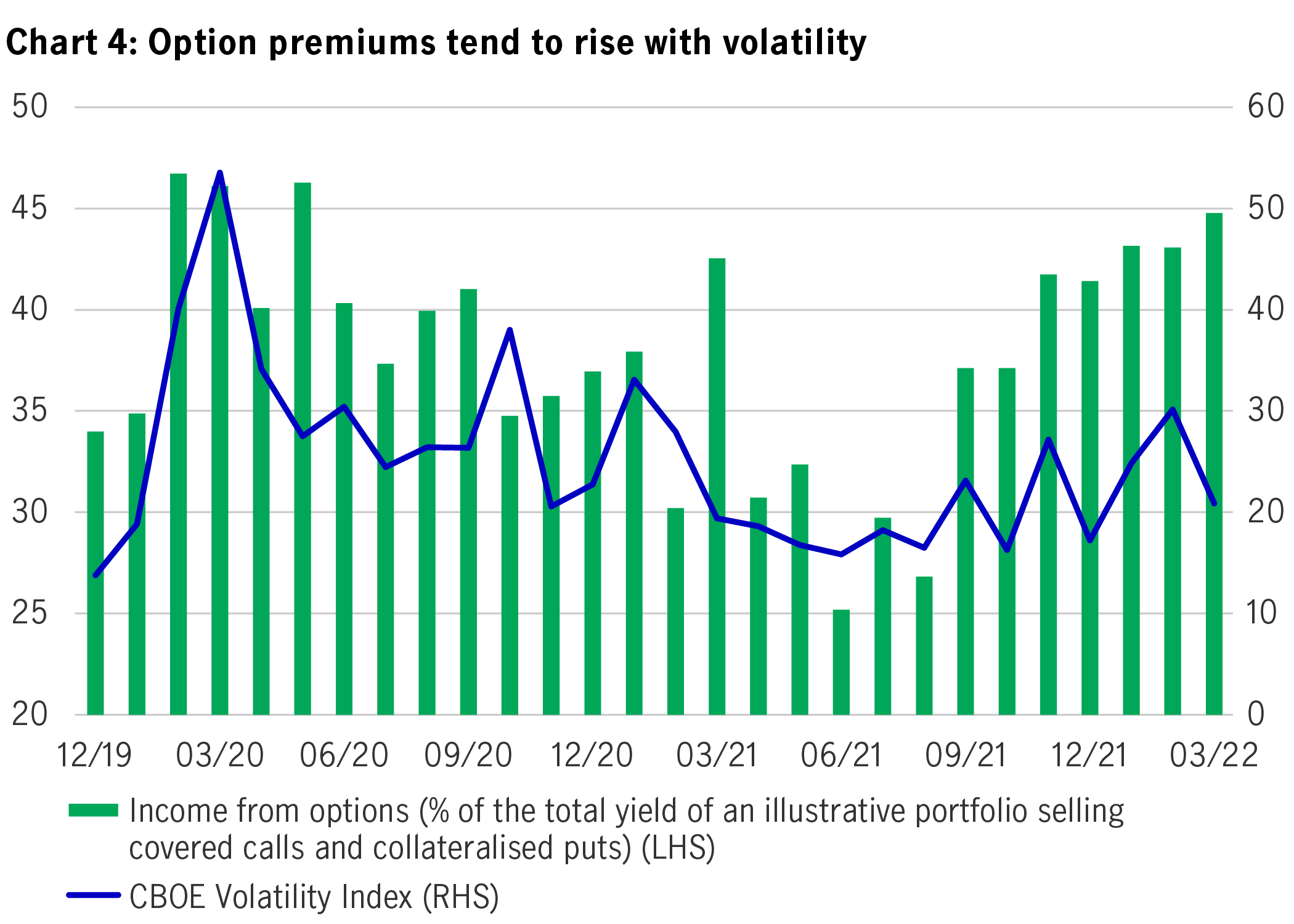

When markets are volatile, investors often become more risk averse and are inclined to sell stocks/bonds or use derivative hedging strategies to mitigate fluctuating share/bond prices. The tactical use of option-writing is key to our multi-asset income strategy and includes selling covered calls and collateralised puts, harvesting premium income through different market cycles. The team’s option-writing strategies are currently implemented at the sector and index level to harvest option premiums in both up and down markets.

When markets rally, the calls written would be struck out and delivered to the owner, however the put premium would be retained. When markets fall, equity prices would be lower and the puts written would be struck out, but the call premiums would be retained, and offset against the equity market loss. Both a covered call and collateralised put writing strategy should be seen as complementary, generating an income profile through volatile market cycles.

Source: Bloomberg, Manulife Investment Management, Barclays Point. As of 31 March 2022.

To take a deeper dive into one option-writing strategy, there are some tactical levers the team can pull during market volatility:

During the 2020 COVID-19 market sell-off, for example, the team were faced with several scenarios. If there was a high level of confidence in a market recovery, the team would overwrite less equities with a call writing structure, or even remove the call option writing fully, in order to allow the equities to participate in expected upside. Or, if the team felt markets could remain range-bound, to slightly lower market prices, the team could have written a blend of sector or index level At-the-money (ATM) or slightly Out-of-the-money (OTM) call options, with an aim to optimize premium harvesting over the period.

Looking forward, under the current climate, market volatility has been picking up as central banks around the world are normalizing rates to tame inflationary pressures, our option-writing strategies will stay focused on harvesting premium income for our investors, which have proven to be rewarding at times of market drawdowns, that might hamper capital payout capabilities for our peers.

Under our global multi-asset diversified income approach, we believe in focusing on achieving natural income from option premiums, coupon rates and dividends. We don’t believe in sacrificing yields by relying on equity market growth, or bond market upside. These returns are not “natural-yielding” assets.

We note that the narrative around inflation has been evolving in recent months: while it used to center on pandemic-related supply chain distortions, discussions are now focused on the potential fallout from the Russia-Ukraine conflict. The former looked set to unwind over the second half of the year and gave us an added measure of conviction that the U.S. Federal Reserve (Fed)—and other central banks—will have the flexibility they need to comfortably slow their pace of tightening. Unfortunately, the war has placed additional upward pressure on prices. Worryingly, the region’s production focus is affecting specific areas of consumer demand (food and energy) that aren’t, academically speaking, considered part of core inflation but are paradoxically core to the consumer, and therefore relatively inelastic. Consequently, as a bigger chunk of the consumer’s disposable income is spent on food and energy, less will be available for discretionary items. The rising interest-rate environment that we’re going into will almost certainly exacerbate the situation and could lead to slowing growth as the adjustment is fully absorbed.

As the growth slowdown exacerbates, our macro strategists expect the Fed to have inflationary concerns as a less dominant factor in their decision making towards growth concerns – the latter which is yet to be felt by the US consumer.

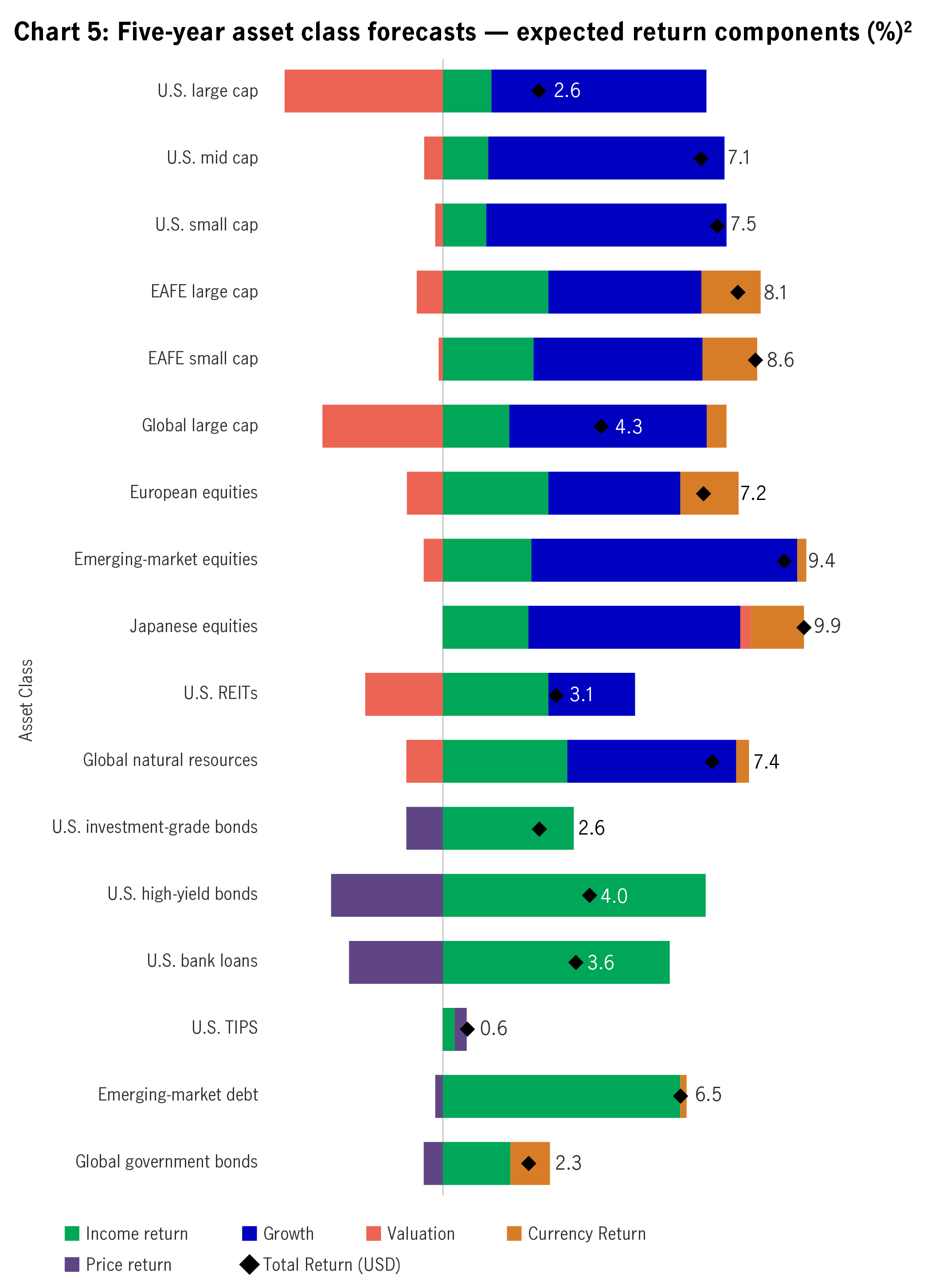

Our view at this point is that geopolitical events and a stagflation outlook will not lead to a global economic recession. However, a rapid deterioration of the conflict in Ukraine and more severe sanctions against Russia may significantly weaken the global economy, and we do believe the odds of slower growth and higher inflation are increasing. In fact, inflation in DMs may peak in the coming months, and markets will be more focused on slowing growth, or no growth. Under such a backdrop, the chart below shows our asset class forecasts including the income return expectation (the green segments) on a five-year basis:

What does it mean for a multi-asset income strategy? As mentioned earlier, our global multi-asset diversified income approach is not reliant on the continued growth of equity or fixed-income markets. We will remain focused on generating higher, sustainable natural yield from a range of assets with lower correlations and expected relatively lower volatilities than strategies that are more reliant on asset appreciation.

We believe the search for income will continue, and remain an attractive segment for investors. Yields are now higher for income investors to capture a higher income versus prior months, spreads are wider, offering potentially attractive spread opportunities, whilst equities are markedly lower, pricing in an already challenged set of headwinds that could provide recovery opportunities over the next 12-18 months.

Amid market uncertainty and volatility, it’s more important than ever to capture a breadth of naturally yielding income sources, in order to deliver a sustainable and high yield, that will meet investors’ objectives, without sacrificing the potential for capital growth. At Manulife Investment Management, we have access to a suite of income-generating sources (see chart below). Each source has its own attributes, features, and risk profiles. Through a globally unconstrained diversified approach, brought together deploying the full asset class expertise and capabilities across Manulife Investment Management, together with a flexible investment mandate, we believe that we can achieve an optimal risk-reward profile.

At any point in time, each market is exposed to distinct economic and interest-rate cycles, which create specific income opportunities. Our seasoned investment professionals across Manulife Investment Management have experience across varying market scenarios, implementing portfolio specific income strategies, to harvest income levels that meet the investment need for our clients. We believe in diversifying across global geographic, sector, factor and capital structure exposures rather than focusing on a single or selection of markets which could bring unwanted outcomes. The flexibility of Manulife Investment Management’s global access, including developed and emerging territories, as well as allocations via traditional and non-traditional income sources, allow us to harvest a sustainable income, while managing concentration risk. We believe this approach can navigate global uncertainties whilst presenting a competitive outcome for our investors.

*While the strategy does not make extensive use of financial derivatives instruments (“FDI”) as part of its investment strategy, it may, from time to time, use them for hedging and/or efficient portfolio management purposes.This usage may expose investors to the risks associated with the non-investment use of FDIs (i.e. volatility risk, management risk, market risk, credit risk and liquidity risk).

1. This material is for illustration purposes only, and is not guaranteed for future return. It is provided for reference only and subject to change. Positive distribution yield does not imply positive return. Source: Manulife Investment Management, Bloomberg, MSCI, as of 31 December 2021. US Investment Grade corporate bonds refers to JPMorgan US Investment Grade Index, Emerging Market bonds refer to JPMorgan EMBI Global Index, High Yield corporate bonds refer to JPMorgan Global High Yield Index, Preferred securities refer to ICE BofAML Fixed Rate Preferred Securities Index, Global equities refer to MSCI World Index, Global REITs refer to FTSE EPRA/NAREIT Global REIT Index, Equity option strategies refer to CBOE S&P 500 30 Delta BuyWrite Index and CBOE S&P 500 PutWrite Index. Typical yield per annum is based on historical yields in 2004-2019, with exception of Equity option strategies, which is based on proprietary research during 2008-2019 by data from Manulife Investment Management. Information is for reference only and no guarantee of future results and is not recommendation to buy and sell.

2. Source: Multi-asset solutions team, Manulife Investment Management, 28 April 2022. For more information, please refer to the important disclosures at the end. TIPS represents Treasury Inflation-Protected Securities. REITs represent real estate investment trusts. Asset class forecasts comprise of inputs driven by proprietary Manulife IM research and are not meant as predictions for any particular index, mutual fund, or investment vehicle. To initiate the investment process, the investment team formulates five-year, forward - looking risk and return expectations, developed through a variety of quantitative modeling techniques and complemented with qualitative and fundamental insight. Assumptions are then adjusted for a number of factors. This chart contains forecasts reflecting potential future events and is only as current as of the date indicated. There is no assurance that such events will occur, and the actual asset class return may be significantly different than that shown here. It should not be viewed as a recommendation or a solicitation of an offer to buy or sell any investment products or to adopt any investment strategy. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Why invest in alternative investments now

A new macroeconomic regime strengthens the case for alternative investment allocations that go beyond the 60/40 stock-bond investor portfolios.

Banking stress has created a yield premium for preferred securities

The banking crisis weighed heavily on preferred securities earlier this year but has now created a potential opportunity relative to riskier areas of the fixed-income market.

The pause before the pivot: positioning bond portfolios for an evolving policy landscape

We believes now is an opportune time for investors to recalibrate their portfolio risk and their future expectations, considering both the current market environment and the next phase looming just over the horizon.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.