21 December 2022

John Addeo, Global Chief Investment Officer, Fixed Income Strategies (Public Markets)

Higher inflation and slowing growth, with the US Federal Reserve (Fed) continuing to raise rates alongside geopolitical uncertainty, have triggered notable selloffs in global equity and fixed-income markets. With rates moving higher and a challenging growth outlook ahead, we believe that while it is crucial to manage risk, an income-oriented solution like the Manulife Global Fund - Global Multi-Asset Diversified Income Fund (the Fund) should continue to provide portfolio resilience during periods of market volatility, offering a defensive income solution through natural yield opportunities for those investors who want to keep pace with inflation and achieve a sustainable income.

As markets continue to search for peak terminal rates, driven by accompanying Fed statements around tapering the magnitude of rate hikes going forward, sentiment has turned marginally positive in anticipation of a Fed that may not need to do as much heavy lifting going forward.

Rates and yields, as well as the US dollar, have since softened, allowing for opportunities to trim some of the higher-yielding securities in the Fund for higher quality investment grade (IG) bonds and preferred securities names in order to manage the risk profile of the portfolio without sacrificing too much yield.

We believe the narrative is shifting from risks to highlighting opportunities over the next 12 months, particularly across parts of global equities and emerging market (EM) debt where valuations for the latter look attractive. For now however the Fund maintains its US bias given solid yield opportunities and a better US growth profile versus the rest of the world. EM remains interesting for spread and potential forex opportunity but risks around a global recession mean allocations here are at present continuing to be trimmed for a potential relook again into next year. The extent to which the stagflationary trough lingers is key to the Fed’s hike profile, terminal rates, and global growth prospects, which could cause yet more challenging market conditions into 2023. We believe exposure to income-oriented solutions, that offer more defensive attributes will help weather some of the volatility over the course of 2023.

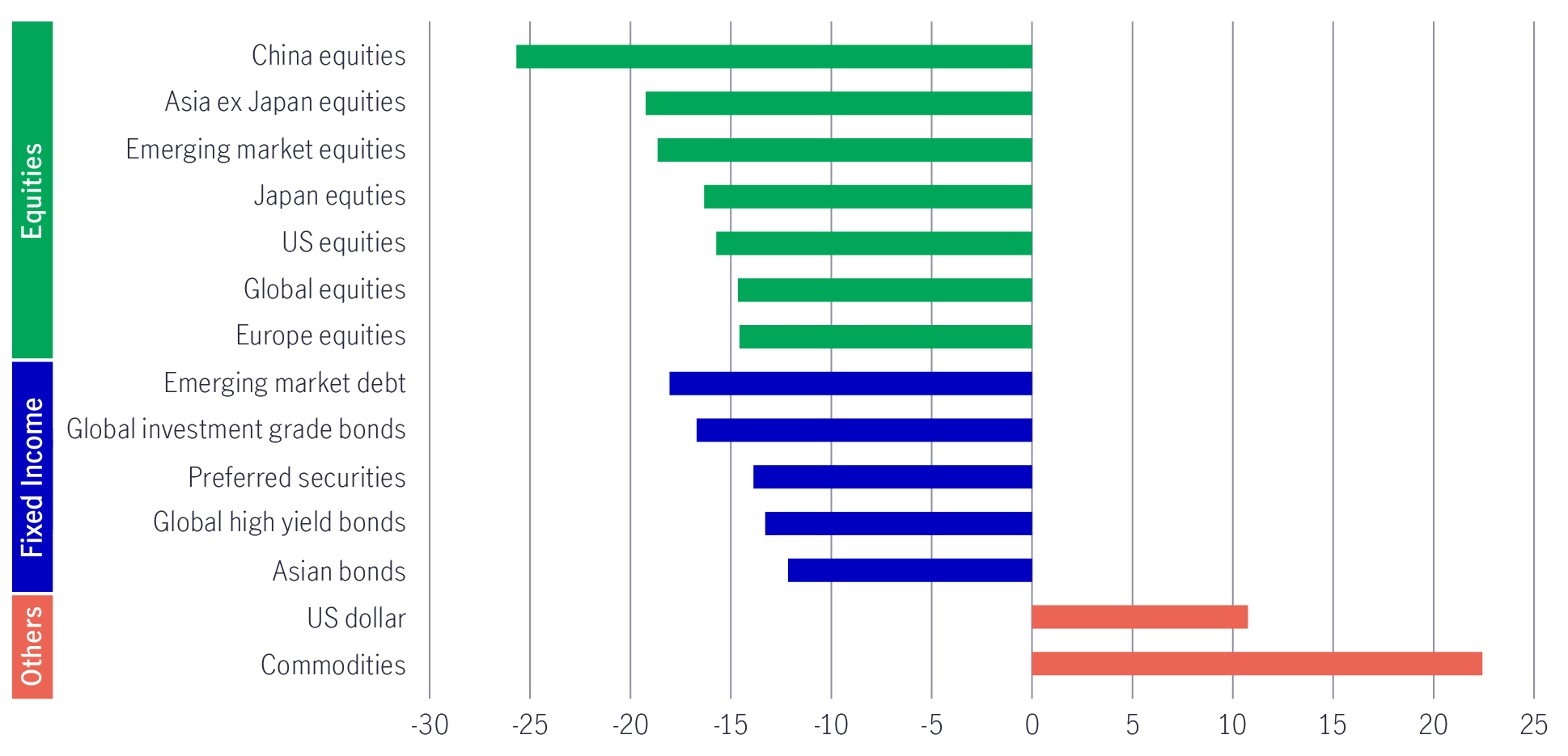

It is unusual to see double-digit losses across equity and bond indices simultaneously. However, global equities and fixed income retreated by more than 14% and 16%, respectively, over the year to date. Among the few gainers this year were the US dollar and commodities, posting gains in excess of 10% and 22% for the first eleven months of 2022.

Chart 1: 2022 year-to-date global asset class performance (%)1

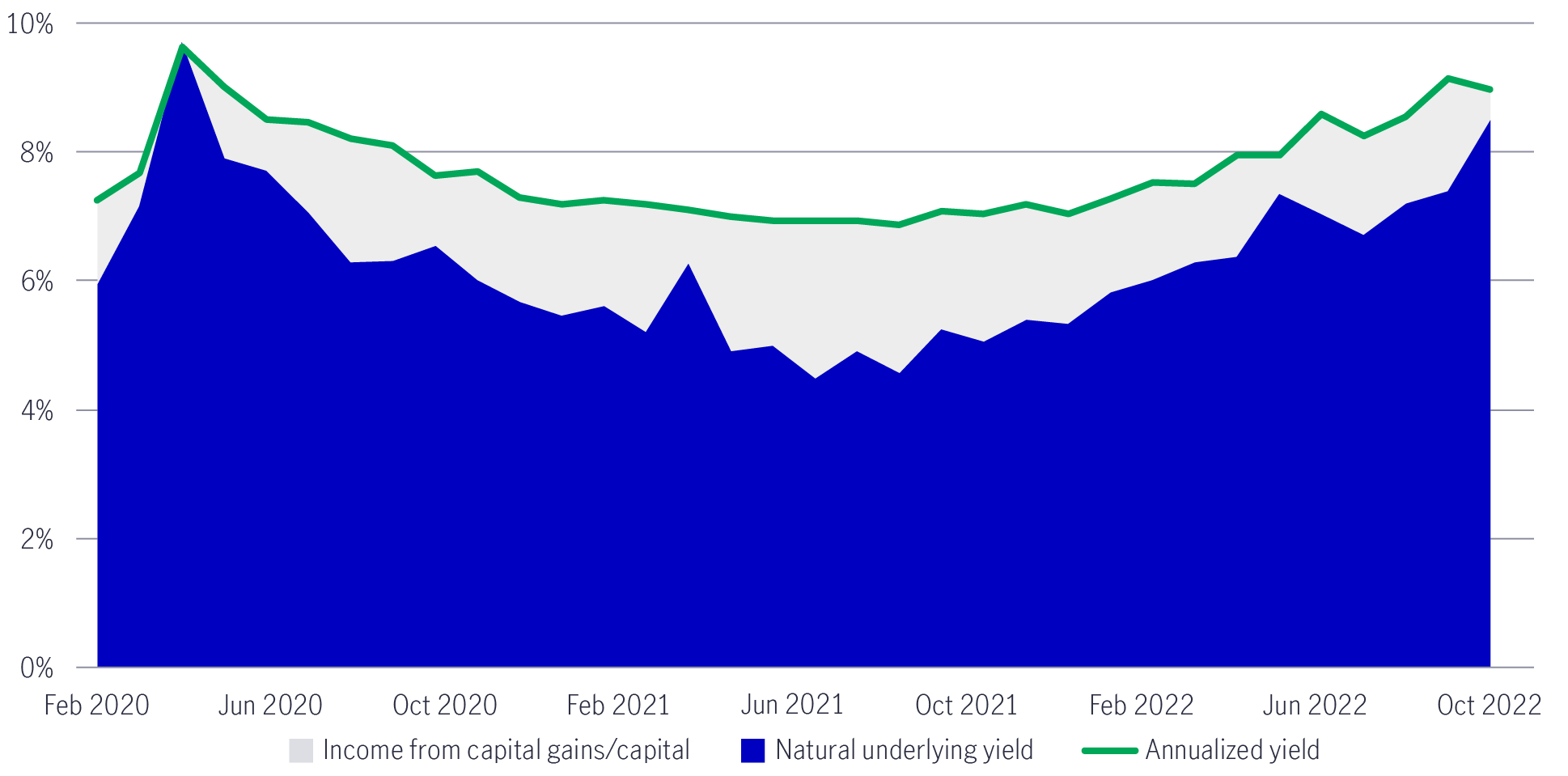

The Fund retreated by 12.58% year-to-date2 although delivered its primary income objective of a 7%-8% on average payout over the course of 2022, whilst also maintaining its competitiveness versus similar high income generating peers. Against a backdrop of market volatility, the Fund has demonstrated a strong downside capture profile during the weakest months given its exposure to lower volatility, lower beta equities and the premium received from managed option-writing strategies and coupon payments. The Fund’s dividend yield of 8%-9%3 remained stable in the second half of 2022, with the majority of its payout generated by underlying natural yields (7% at the end of November 2022). Achieving high natural yields is particularly important for income stability when markets are volatile because the Fund relies less on capital appreciation or paying out of capital to meet its high-income objective. The Fund has historically achieved this through a diverse opportunity set of natural income sources.

Chart 2: Natural underlying yield as a major source of income3

As a result of the Russia-Ukraine conflict, lower growth and higher inflation resulting from elevated commodity prices and uncertainty are likely to derail any short-lived momentum – albeit prices have moderated since the summer 2022. Global growth and earnings forecasts are being reduced, with Europe most vulnerable, whilst the US will also remain challenged.

A potential threat to inflation remaining elevated could potentially come from the additional demand for goods and services, basic materials, and metals from China should mobility levels pick up – this could be an additional variable in respects a more lingering elevated global inflation trend that the Fed will need to address.

We expect a pause in the Fed’s rate-hiking cycle around the first quarter of 2023 and a peak of close to 5%, with current expectations of a Fed cut in the third quarter of 2023. We remain rather cautious, however, given the Fed will remain hiking into a slowing, weakening global growth profile, albeit the magnitude of hikes could taper somewhat. Besides the Fed, we maintain our view that other developed-market central banks (such as the Bank of Canada) will begin easing before the end of 2023 as growth deceleration overtakes inflationary concerns.

In the next section, we’ll detail the positioning of different sleeves in the Fund.

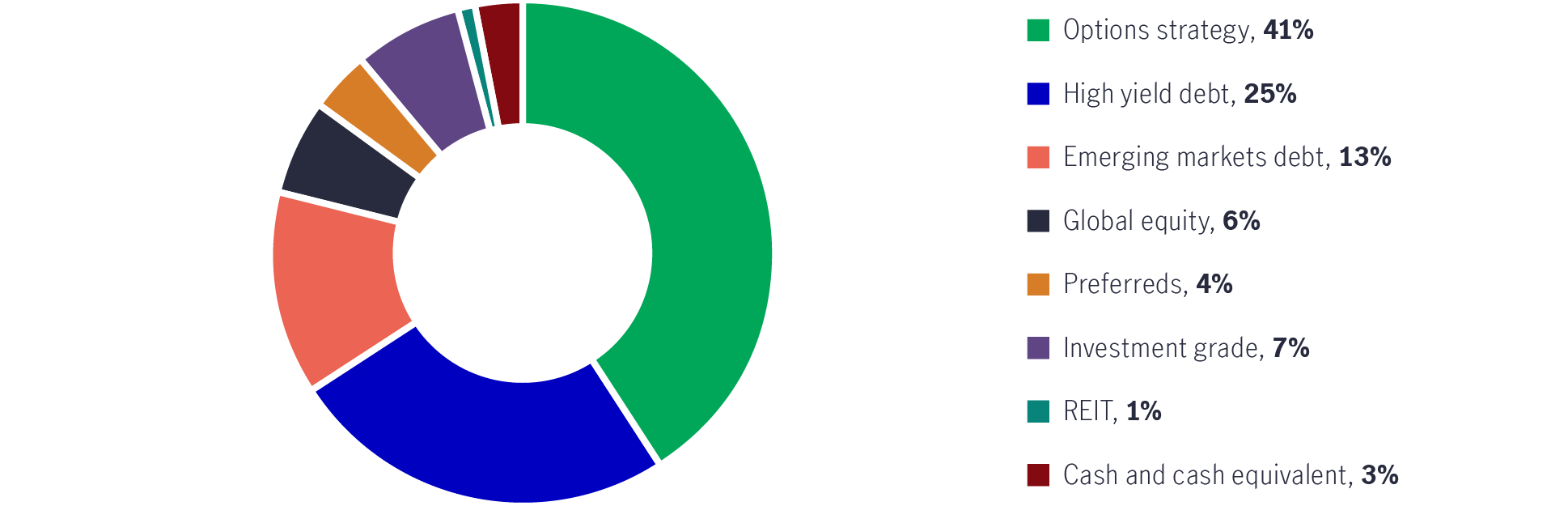

The Fund has a fixed-income bias, which provides a key source of income, with approximately 55% exposure across the asset class. The portfolio holds developed market high-yield (HY) bonds, preferred securities, and emerging-market (EM) debt (mostly USD denominated credits over sovereigns) with underlying yields of 6.9%, 8.0%, and 8.3%, respectively4. In 2023, fixed income should remain a key income source.

We expect a pause in the US Federal Reserve’s (Fed) rate-hiking cycle around the first quarter of 2023 and a peak of close to 5%. Given its dominant high yield credit exposures, the Fund has a naturally lower duration profile and, therefore, is less sensitive to rising rates. Credit risk remains the primary risk within the fixed income bucket, where the team believes they can add value in terms of yield and spread opportunities into 2023.

In high yield, the new issue market was more active during November which helped market performance. The team added to a new issue in a secured bond from a large communications issuer yielding 12%. The team added to their exposure in a secured technology issuer at a yield of 9%. As high yield continues to rally, the team sold some of their higher quality issuers to fund purchases in preferred securities. The Fund continues to seek for yield whilst aiming to ensuring investors are not exposed to outsize risks.

The team is in favour of US fixed income. High-yielding bonds are naturally less rate sensitive and are a large part of the Fund’s fixed income exposure and one of the major contributors to overall portfolio yield5. The team has trimmed some positions in lower-quality high yields and shifted to higher-quality high yields (as well as investment-grade bonds and preferred securities), improving the quality of the portfolio without sacrificing too much yield. Although expectations are for fewer spread opportunities from the US, they could remain a solid contributor to yield. The team also likes the defensive resilience within preferred securities, particularly across North American power producers, insurers, banks and midstream energy given their attractive yields but relatively lower default risk.

Chart 3: Yield by asset classes6

Regarding EM debt, the team has reduced exposures throughout 2022. Pockets of Eastern Europe and Asia remain challenged – albeit more recently the Asia credit rally has been a contributor to the Fund, whilst exposure to commodity economies has been patchy as base metal prices have been impacted by slowing global and China demand.

In Emerging markets, the team has exited positions in higher quality shorter duration issuers to fund purchases of preferred securities and new emerging market positions in a Peruvian oil and gas producer and a Brazilian metals and mining issuer which have credit specific attractive fundamentals as well as yields that are aligned with the income objective of the Fund.

In regard to opportunities in Asia, the portfolio has held onto some challenging positions across the credit spectrum, given a view towards supportive China property policy on the horizon. The recent announcements by the Chinese authorities, which aim to support the healthy development of the housing market and retrieve equity refinancing of developers, have helped to regain some of the lost Asia credit performance year-to-date. A tactical recovery in pockets of the Chinese markets has led to a positive retrace amongst the China developer credits in the portfolio. However structurally property transactions and the demand for new home sales remain weak. We are closely monitoring if there will be further measures on a potential COVID-exit strategy and policy easing measures to support the economy and property market.

Recent decision making around Asia credits has been to lock in profits from some of the Chinese developers that have rallied strongly and rebalanced into some of the laggard China developer names.

Furthermore, Macau credits have also added positively to performance as license renewals have been expedited, removing a long-standing overhang for the sector. Southeast Asia high yields and frontier credits also traded on more constructive macro sentiment and fund inflows.

Key developments to monitor over the coming months will be China’s commitment to COVID policy relaxation amid surging winter cases, signals from China’s top leaders’ meeting on the 2023 economic growth target and policies towards major sectors, and of course the end of year FOMC December rate decision.

Levels of uncertainty suggest continued market volatility ahead. However, valuations within some sectors have more than halved without a corresponding decline in earnings or cash flow. This suggests a disconnect between market conditions and fundamentals in some quality franchises.

Given an underweight in IT equities for a considerable period, the Fund has been adding incremental exposure to IT since June 2022, which is largely valuation driven. The recent pullback has provided an opportunity to add into tech positions with select existing holdings and establish positions in new names where there is a meaningful discount to fair value valuations whilst also exhibiting positive upside reward versus risk.

The equity portfolio within the Fund is developed market dominated, a blend of growth and non-growth holdings, albeit with a slight defensive value tilt that we believe will hold up better within an environment of slowing growth and high inflation. Income-oriented dividend equities, cyclicals, and value, as well as energy and defensives, remain relatively more attractive in this environment of macro and policy uncertainty. We also prefer lower-beta equities that offer sustainable dividends, like consumer staples, utilities, and real estate.

The option-writing strategy remains a core harvester of income premiums and a notable contributor to overall portfolio yield. In terms of yield contribution, 41% of the yield was generated from the option-writing strategy7.

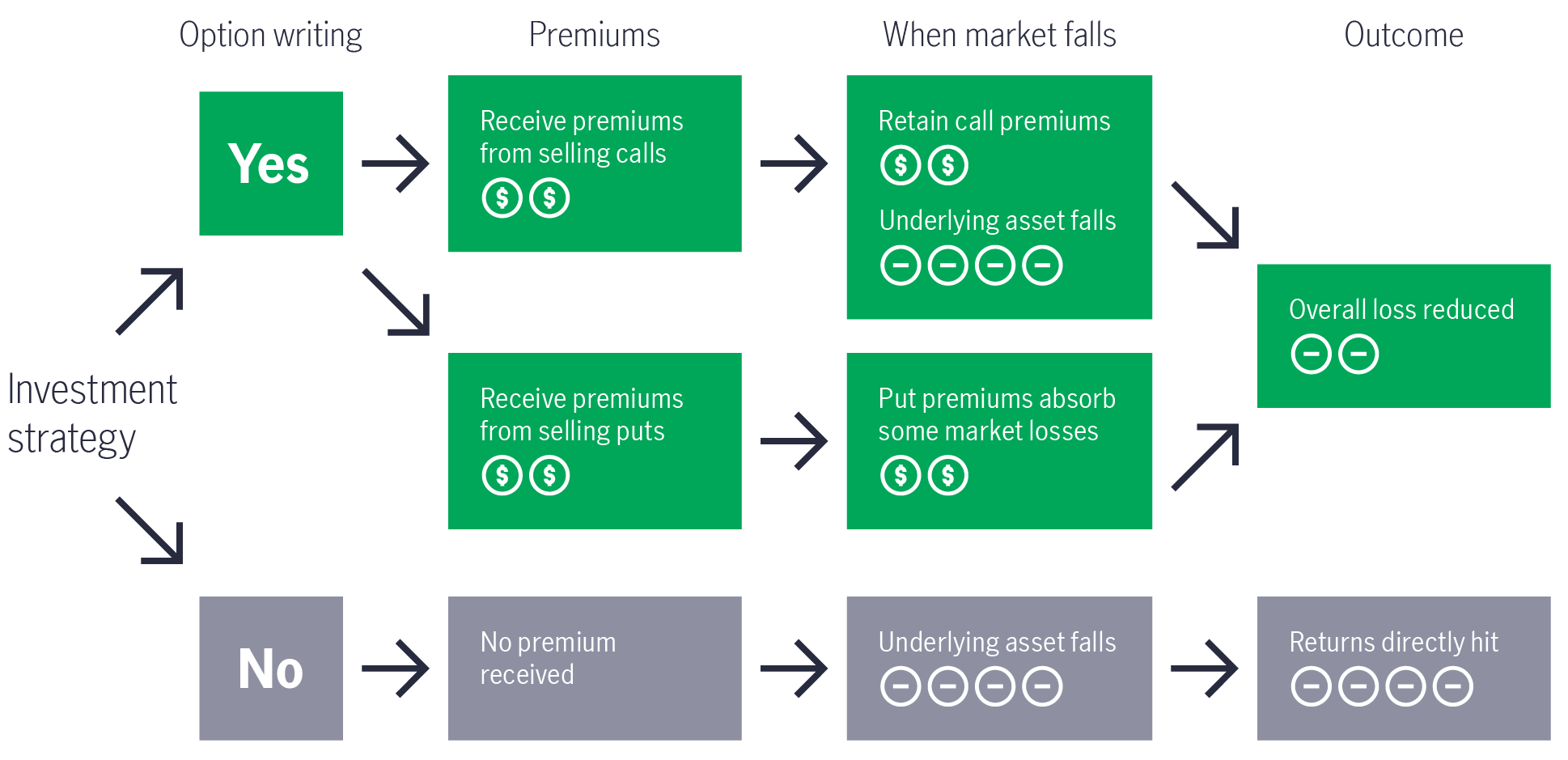

With an option writing strategy in place, the Fund could offset some of the negative market drawdowns with premiums harvested via selling both puts and calls, which help stabilise income. In the event of a market decline, the put premium will likely be eaten away while the call premium likely remains to be realised as income. Conversely, when the market rises, the opposite should happen. Call premiums are likely eaten away while the put premium likely remains to be realised as income.

The more volatile the market, the higher the option premiums received. These higher premiums can allow us to sacrifice some additional premia when we have a directional view of the market while maintaining a reasonable amount of income potential overall.

Going into 2023, we believe the market will remain volatile. This option strategy should benefit from earning high premiums and continue to add value through index and/or country-level option writing, which can be tactically adjusted to navigate market risk.

Chart 4: How option writing can provide downside protection

For illustrative purpose only.

Source: Manulife Investment Management

Investors are watching closely to see if the current uncertainties will be resolved – especially the timing of a Fed rate pause or focus towards slowing growth. Investors will also want to know whether inflation and the global growth slowdown can be controlled towards a soft landing. Until we get answers to these questions, financial markets are expected to remain volatile. Therefore, our Global Multi-Asset Diversified income-oriented solution will maintain its appeal in the year ahead. Through a mixture of high yield, preferred securities, REITs, equities, and options, investors could benefit from a certain degree of defensiveness and potentially gain a higher income as the Fund’s primary objective aims. If the market becomes risk on, the upside capture may not be as significant versus the more growth-oriented peers given the current allocations. However the team will look to pull the relevant levers should it be more appropriate to improve the upside capture profile of the portfolio which could be implemented via more growth oriented equities, less equities with a call writing structure, or additional exposures to spread opportunities in EM – this approach would likely take on relatively more downside risk - the team has less conviction on this implementation given the current uncertainties around recession and inflation but would look at opportunities as they arise.

We believe tactical positioning will be more prevalent as we move into 2023, and we can nimbly add and reduce risk in the portfolio, as well as capture yield opportunities as they arise. The trade-off between generating yield, which is the Fund’s primary objective, and capital appreciation through tactical equity allocations, or tactical decision making around options writing, could be the key determinants of the total return and yield generation for the Fund into 2023.

1 Bloomberg, MSCI, as of 30 November 2022. Performance is in USD and total return. Equities indices represented by MSCI indices. Preferred securities = ICE BofAML US All Cap Securities index; Emerging market debt = JPM EMBI Global Diversified Composite (USD). Asian bond = Markit iboxx Asian USD dollar bond (Far East) TRI. Global high yield bonds = Bloomberg Global High Yield total return index unhedge. Global Investment grade bonds = Bloomberg global aggregate total return index unhedged USD. US dollar = US dollar index. Commodities = Refinitiv/CoreCommodity CRB(R) index total return. Past performance is not indicative of future performance.

2 Source: Manulife Investment Management, as of 31 October 2022. Distribution yield applies only to AA (USD) MDIST (G) Share class. Dividend rate is not guaranteed. Dividends may be paid out of capital. Refer to important note 2. Please note that a positive distribution yield does not imply a positive return. Past performance is not indicative of future performance. Annualised yield = [(1+distribution per unit/ex dividend NAV)^distribution frequency]–1, the annualised dividend yield is calculated based on the latest relevant dividend distribution with dividend reinvested, and may be higher or lower than the actual annual dividend yield. Diversification or asset allocation does not guarantee a profit nor protect against loss in any market.

3 Based on AA (USD) MDIST (G) share class; inception date 25 Apr 2019. The intention of the Manager to make a monthly distribution and the distribution yield for the Fund is not guaranteed and the Manager may review the distribution policy in future, depending on prevailing market conditions. Annualised yield = [(1+distribution per unit/ex dividend NAV)^distribution frequency]–1, the annualised dividend yield is calculated based on the latest relevant dividend distribution with dividend reinvested, and may be higher or lower than the actual annual dividend yield. Diversification or asset allocation does not guarantee a profit nor protect against loss in any market. Historical dividend yield is not indicative of future dividend pay-outs. Please refer to our website (https://www.manulifeim.com.sg/) for more details.

4 Manulife Investment Management, as of 30 November 2022.

5 Manulife Investment Management, as of 30 November 2022. Within fixed income sleeve, high yield bonds were the largest fixed income sector in the Fund, accounting for 53% of the fixed income exposure. In terms of yield contribution, 25% of yield was generated from high yield debts.

6 Manulife Investment Management, as of 30 November 2022. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Dividend yield is not guaranteed. Dividend may pay out of the capital.

7 Manulife Investment Management, as of 30 November 2022.

Important Information

Manulife Global Fund (the “Company”) is an open-ended investment company registered in the Grand Duchy of Luxembourg. The Manulife Global Fund – Global Multi-Asset Diversified Income Fund (“the Fund”) is recognised under the Securities and Futures Act of Singapore for retail distribution. The Company has appointed Manulife Investment Management (Singapore) Pte. Ltd. as its Singapore Representative and agent for service of process in Singapore.

The information provided herein does not constitute financial advice, an offer or recommendation with respect to the Fund. The information and views expressed herein are those of Manulife Investment Management (Singapore) Pte. Ltd. (Company Registration No. 200709952G) and its affiliates (“Manulife”) as of date of this document and are subject to change based on market and other conditions. Manulife expressly disclaims any responsibility for the accuracy and completeness of, and the requirement to update, such information.

Investments in the Fund are not deposits in, guaranteed or insured by Manulife and involve risks. The value of units in the Fund and any income accruing to it may fall or rise. Past performance of the Fund is not necessarily indicative of future performance. Opinions, forecasts and estimates on the economy, financial markets or economic trends of the markets mentioned herein are not necessarily indicative of the future or likely performance of the Fund. The Fund may use financial derivative instruments for efficient portfolio management and/or hedging. Investors should read the Singapore prospectus and the product highlights sheet and seek financial advice before deciding whether to purchase units in the Fund. A copy of the Singapore prospectus and the product highlights sheet can be obtained from Manulife or its distributors. In the event an investor chooses not to seek advice from a financial adviser, he should consider whether the Fund is suitable for him.

Distributions are not guaranteed. Investors should refer to the Singapore prospectus for the distribution policy of the Fund. The Directors of the Company shall have the absolute discretion to determine whether a distribution is to be made in respect of the Fund as well as the rate and frequency of distributions to be made. Distributions may be made out of (a) income, or (b) net capital gains, or (c) capital of the Fund, or (d) gross income while charging all or part of the fees and expenses to capital, or (e) any combination of (a), (b), (c) and/or (d). Past distribution yields and payments are not necessarily indicative of future distribution yields and payments. Any payment of distributions by the Fund is expected to result in an immediate decrease in the net asset value per share of the Fund.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Asset allocation outlook - Q1 2026

Read more2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Outlook Series: Manulife Global Multi-Asset Diversified Income Fund

In 2026, a clearer macroeconomic outlook is expected as momentum improves following strong 2025 drivers such as AI growth, energy transition, anticipated Fed rate cuts, and wider fiscal support. While the US Federal Reserve is likely to continue easing policy, diverse income opportunities remain across global markets, extending beyond traditional government bonds to high yield assets and option writing. Within this environment, the Manulife Global Fund – Global Multi‑Asset Diversified Income Fund (GMADI) remains with a clear and heightened focus towards income generation. The Fund seeks to deliver a high and consistent distribution income while maintaining exposure to long term capital growth opportunities.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.