24 January 2022

Luke Browne, Senior Portfolio Manager and Head of Asset Allocation, Asia, Multi-Asset Solutions Team

Risk assets led the way in 2021 with equity sectors having diverged performances. The world seems to have settled into a new normal, treating the pandemic as an endemic. Global economies have learnt some harsh lessons from COVID-19 and from a longer-than-expected higher inflationary environment. In 2022, markets await signs of policy direction, both in terms of monetary and fiscal, in response to the virus and its variants. Luke Browne, Head of Asset Allocation, Multi-Assets Solution Team, Asia believes that while any new variant will likely disrupt asset prices, market volatility can also present new investment opportunities. He identifies tactical opportunities for income, yield, and growth, and the structural case for emerging markets and Asia.

As we look back to the close of 2021, some of us are still wondering how long this pandemic might drag on, which is understandable given renewed restrictions caused by yet another strain of the virus. I believe we are moving to a new normal where policies will transition towards treating COVID-19 as endemic rather than pandemic. While this development will ultimately lead to lighter travel restrictions and receding supply chain disruptions, these trends are likely to occur with a lag. The world also seems to have settled into an environment with higher inflation that could last longer than previously expected.

There are reasons to be cautiously optimistic about 2022, even if we see headwinds during the first half of the year and subsequent waves of the virus and other variants could also become a factor. Governments have tested solutions and taken measures to fight the pandemic and the economic risk from the pandemic is likely to fade with higher global vaccination rates. Given recent progress, reactions are becoming less drastic, and that evolution could mark a shift towards viewing COVID-19 as more endemic than pandemic.

Another area of focus is the rapidly shifting monetary policy landscape. While normalisation was always likely to happen, the swiftness of changes in market views increase the possibility of overshoot, which could in turn sour market sentiment and increase volatility. Another potential source of disruption would occur should market events like high-profile defaults emerge.

Meanwhile, several macro anchors are quickly emerging to the forefront and ESG-related themes are becoming increasingly important to our investment decision-making process: climate change; a clean energy transition; demographic shifts because of an aged and aging population in the region. Other trends like the changing composition of workplace mobility, the accelerated adoption of digitalization and e-commerce, and geo-political considerations are also important. These long-term secular trends together with structural growth factors, all contribute to some interesting investment theses which will be calibrated in our 2022 outlook.

Evolving monetary and fiscal policy decisions and COVID-related restrictions have unsettled market participants. As uncertainty continues, we think investors should stay nimble to take advantage of the specific sectors, asset moves, and economic components that we expect to do well.

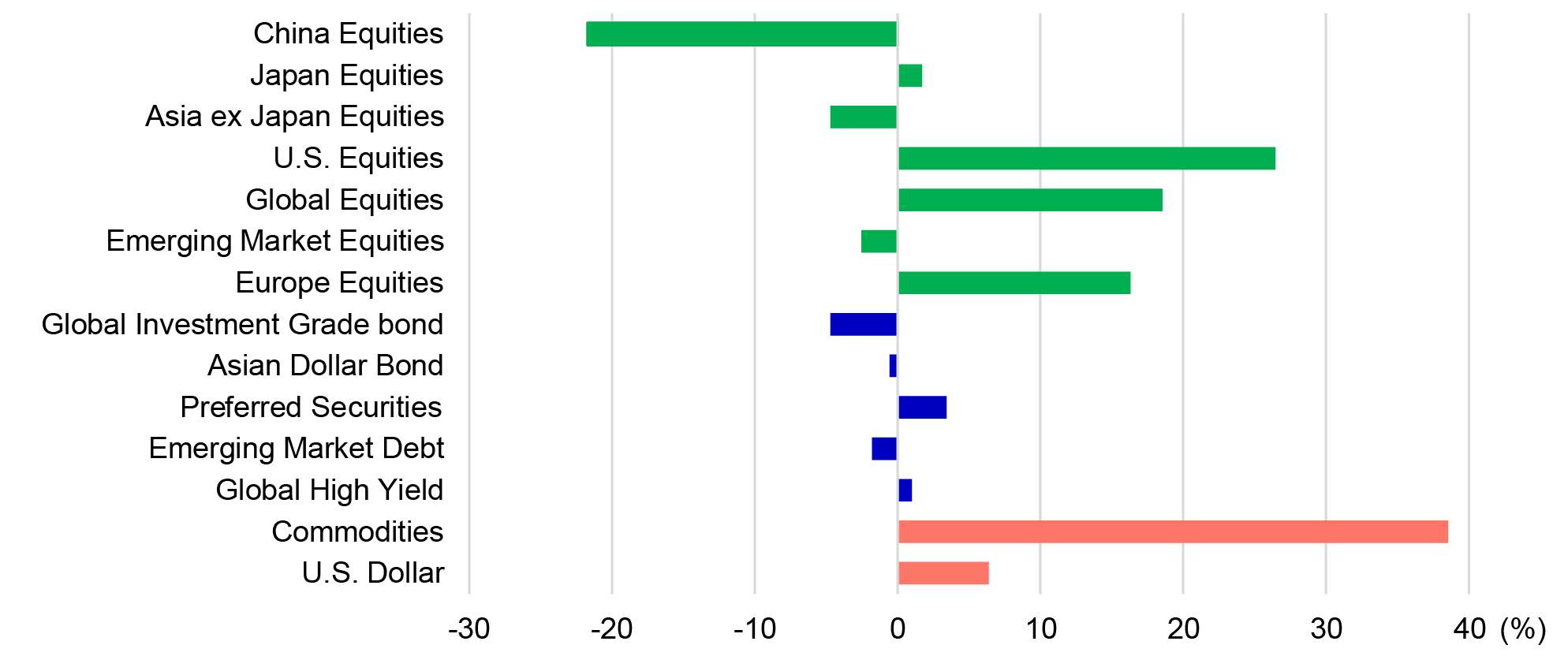

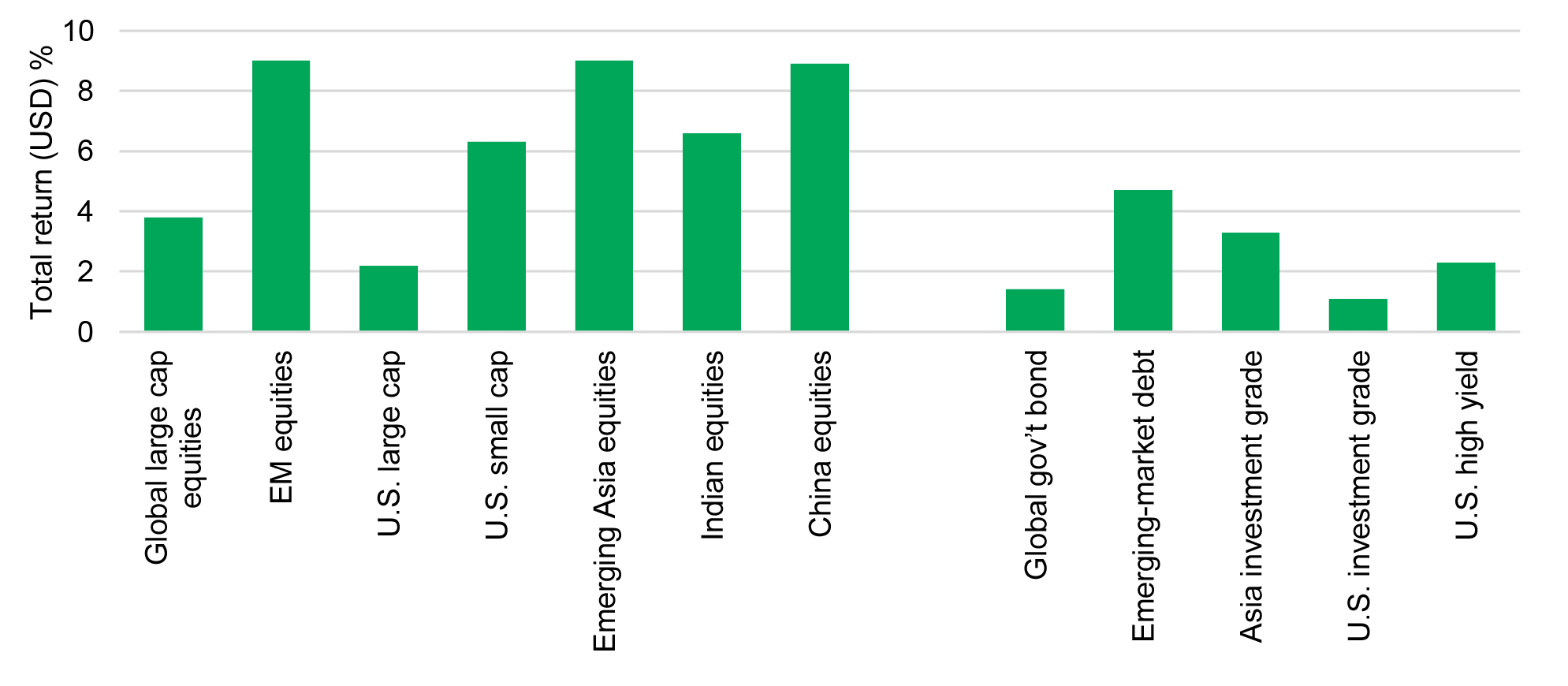

Global asset markets were dominated by the return of risk assets in 2021. Within global equities, U.S. markets outperformed while Europe had started to show signs of recovery. Some regional markets were tested throughout the year, in particular China. Elsewhere, investment-grade credit sector saw negative returns, while commodities had a particularly strong run in the latter half of 2021 as the economic reopening drove demand in the manufacturing sector (Chart 1).

Chart 1: Major asset class performance (%) in 2021

Source: Bloomberg, FactSet, data as of December 31, 2021. Performance is in USD and total return. Equities indices represented by MSCI indices. Preferred securities = ICE BofAML US All Cap Securities index; EM Bond = JPM EMBI. Asian Dollar Bond represented by Markit iboxx index. Global high yield bond = BBgBarc Global High Yield TR USD. World IG / World Gov’t Bond represented by FTSE indices. Commodities = TR CRB Index. Past performance is not indicative of future performance.

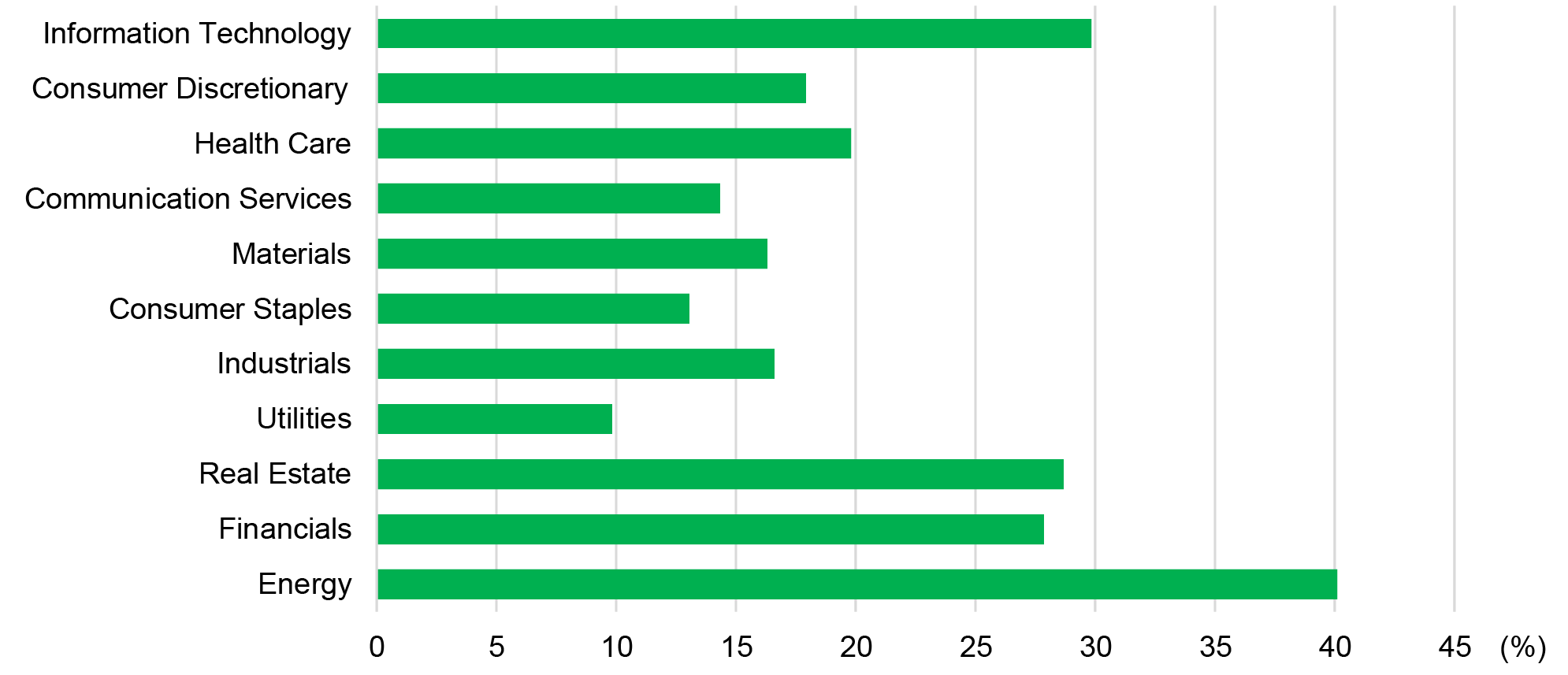

At a sector level, strength in energy, financials, and real estate drove equity performance, which was also supported by the re-opening of the global and regional economies and extraordinary central bank support during the earlier part of the year (Chart 2).

Chart 2: Global equity sectors performance (%) in 2021

Source: Bloomberg, FactSet, data as of December 31, 2021. Performance is in USD and total return. Equities indices represented by MSCI indices. Past performance is not indicative of future performance.

Overall, it's been a very positive environment for investors with a “risk on” mindset.

As we move into 2022, we are watching several developments. These include:

According to our Global Chief Economist Frances Donald, COVID-19’s evolution and its new variants suggest that economists should stop thinking of the virus as a one-off economic shock; instead, they should view it as a semi-permanent constraint on growth. COVID-19 has broadly changed the investment landscape by lowering global growth potential and has resulted in slightly higher inflation and a more persistent need for stimulus.

The pandemic has affected our economies in two primary ways:

There have been some places where households and businesses have become less reactive to each wave of COVID. But in terms of government responses, these are harder to forecast. In the absence of a robust way to forecast such responses, we will need to keep a close eye on lockdowns and other restrictions to help us gauge how the new variant will impact the global economy.

We believe any new variants will likely disrupt asset prices as investors reassess how long before normalization occurs. This type of price action and volatility can also present new investment opportunities.

Monetary policy has shifted quickly since the end of the summer: it has evolved from patience around price pressures and supply chain disruptions, to a growing sense of urgency in the face of uncomfortably high inflation. The path to normalization has also evolved, moving from a gradual reduced pace of asset purchases and possible rate hikes in 2022, to the likelihood of the end of quantitative easing and an initial interest rate hike before this summer. Even quantitative tightening has been discussed.

This hawkish bias has become increasingly pronounced in the most key central banks around the world. The Bank of England kick-started the rate-hiking process in December, and while the European Central Bank (ECB) will take longer to normalize, there’s been a clear shift in tone there too. Even the Bank of Japan (BoJ) has inched towards a firming bias; the People’s Bank of China is going against the grain and has recently eased at the margin. Taken together, it’s increasingly clear that we’ve passed peak central bank liquidity. This development should in turn weigh on global growth and the capital markets.

Unfortunately, it’s less clear whether removing monetary policy will have the traditional effect on inflation. Supply-side issues such as chip shortages or any pressure on energy prices are more “transitory” than “structural” and are therefore less likely to be quelled by higher interest rates. Throughout 2022, our base case remains that while inflationary pressures fade as supply-chain bottlenecks gradually improve, they might remain uncomfortably high, especially in the first quarter of the year.

Interest-rate hikes are coming as the global economy returns to a more stable state. That said, we are more cautious than market about calling for multiple 2022 rate increases in the U.S. because growth and inflation data could ease in the next six months, making it more challenging for central banks to tighten monetary policy further. There is a lot of Fed hawkishness already priced into 2022 – market expectations are for 2-3 rate hikes and a Fed at 2.4% by end-2024. Our Macroeconomic Strategy team’s forecast is still on the dovish side, even though we’ve pulled forward the expectation of rate hikes: we have 2 rate hikes pencilled in for 2022. Longer term, we only expect the Fed to reach 2.5% by 2026 as its terminal rate.

Therefore, we expect the Fed will move faster than the ECB and BoJ, but slower than most other developed and emerging-market central banks. This is supportive of a stronger U.S. dollar (USD) against G4 currencies and modestly higher U.S. yields.

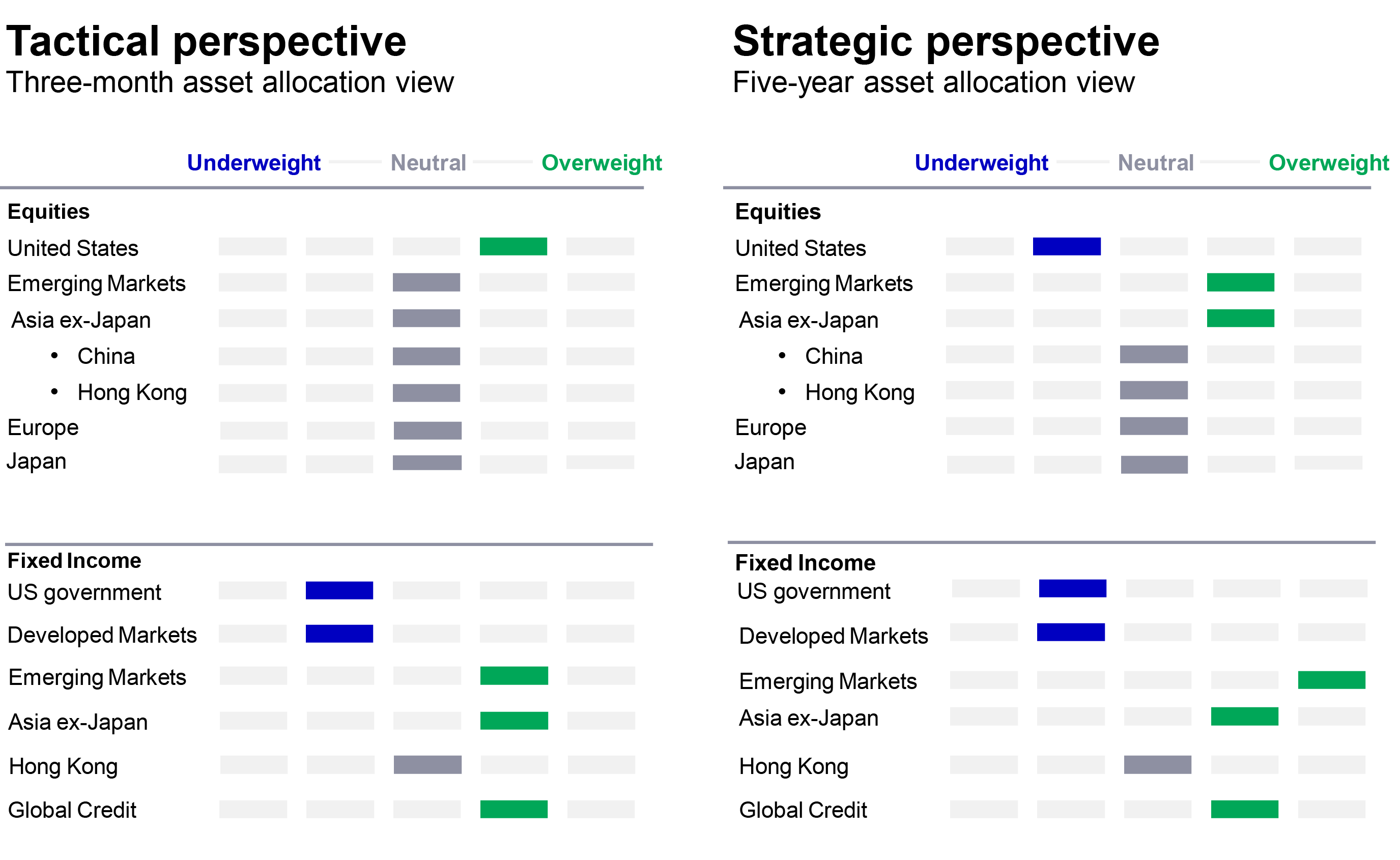

We remain overweight equities, selectively, for now. However, concerns about peak growth, the prospects of asset-purchase tapering by central banks, regulatory concerns in China, the spread of the virus variant, and high inflation remain headwinds to growth. Even with recent market volatility, we remain moderately constructive on U.S. equities and broadly neutral on Europe over the short term. The U.S. economy continues to be driven by healthy consumer and manufacturing activity while high valuations slightly temper our view.

Within fixed income, we remain positive on U.S. high-yield (HY), investment-grade credit (IG), and EM debt. We maintain our favourable view of U.S. high-yield debt largely due to the carry, which the asset class can offer in the current low interest-rate environment. While spreads relative to U.S. Treasuries are tight, we believe that the current economic environment should continue to support yields at or close to these levels, thereby enhancing the risk/return profile of the asset class. For US IG, positive carry from the asset class will likely outweigh any headwinds arising from higher interest rates, especially relative to government bonds. While we think that high-yield debt has a more attractive return profile than investment-grade credit, it’s worth noting that the latter asset class can be used as a tool for investors to add duration to their portfolios. Within this space, we prefer lower-rated credits, but we also believe it’s important to keep an eye on cross-country opportunities.

Source: Multi-Asset Solutions Team (MAST) in Asia, as of 2 December 2021. Projections or other forward-looking statements regarding future events, targets, management discipline or other expectations are only current as of the date indicated. There is no assurance that such events will occur, and if they were to occur, the result may be significantly different than that shown here. Information about asset allocation view is as of issue date and may vary.

From a longer-term perspective, we will look to reduce the size of our exposure to markets that have meaningfully outperformed. Even with recent market volatility, we expect that U.S. equities should continue to perform well in the near-term due to robust economic activity. That said, high valuations remain a concern. We see greater opportunities, for example, in emerging markets and Asia ex-Japan equities that have been affected by negative headlines in certain Chinese sectors.

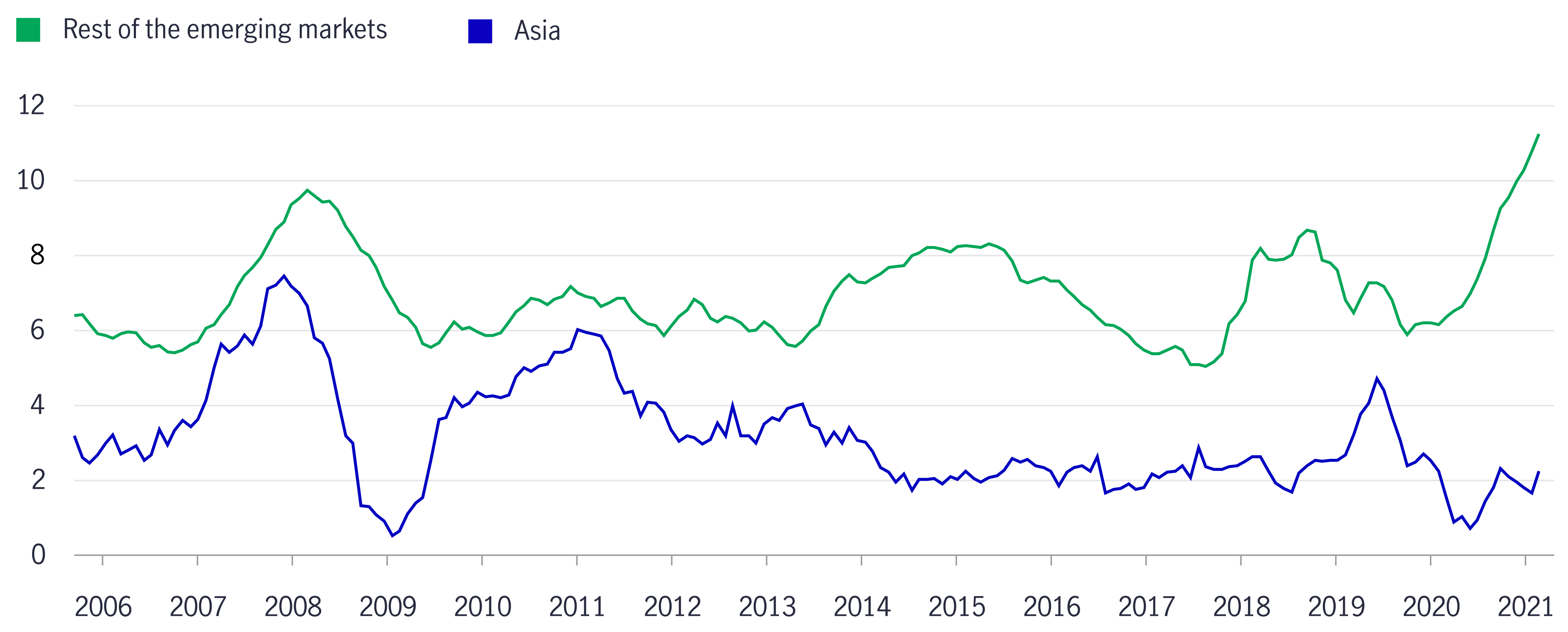

Emerging and Asian markets remain some of the few places where we can allocate capital and seek to achieve the returns that our investors expect. We think emerging Asian equities and fixed income will be supported by accommodative monetary policy stances, and are, broadly speaking, in a better position to withstand Fed tapering risks. This is thanks to stronger external positions and lower reliance on external funding. We see the scope for economic growth in parts of Southeast Asia as COVID-19 concerns ease. In fact, global virus restrictions have boosted demand for consumer durables, extending Asia’s strong export performance.

Another potential spike in the demand for global goods could disrupt supply chains again. But Asia’s excess supply insulates the region from heated inflation, giving central banks room to maintain accommodative monetary settings (Chart 3).

Chart 3: Inflation in Asia has decoupled from other emerging markets

Year-over-year change in CPI in Asia and emerging markets (%)

Source: Macrobond, Manulife Investment Management, as of December 3, 2021.

Being strategically overweight in EM debt remains one of our high-conviction views. We think the asset class could provide relatively attractive total returns over both the short and long term (Chart 4), thanks to the relatively high yield the asset class offers, coupled with additional support from a weaker USD, investors’ need for diversification and rising demand for commodities as growth recovers.

In the fixed-income market, the search for yield will be as important as ever in the coming years. Despite our belief that interest rates will gradually rise, they’re likely to stay near historical lows, making asset classes that provide additional yield or income more attractive. With government debt offering negligible expected returns, we think investors should position their portfolios so they can adjust to changes in the rate cycle.

Chart 4: Equities and fixed income - Expected total return (%) *

Source: Manulife Investment Management’s asset allocation team, as of October 2021. *Based on five-year forecast (%).

Market volatility offers attractive opportunities for investors and asset allocators. Against this backdrop, we think investors should take an active and nimble approach to asset allocation and securities selection and maintain a thorough understanding of the drivers behind a portfolio’s risk-and-return potential.

For example, a portfolio with many asset-class holdings makes sense from a diversification perspective but can still be exposed to concentration risk if the asset classes are clustered around a certain factor or style. We decompose our portfolios across asset classes, sectors and sub-sectors while considering aspects like factor styles, risks, and drivers of return.

In 2022, we expect policy responses to the virus or other variants, inflationary pressures, and China’s growth prospects to dominate asset returns. We believe Asia remains a compelling market over the longer-term, while U.S. equities remain supported by a healthy economy in the near term. We think emerging-market debt is an attractive opportunity as the search for yield continues. With ongoing market uncertainty, investors should take advantage of active management to reshape portfolios for an evolving investment landscape.

Asset allocation outlook - Q1 2026

Read more2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Outlook Series: Manulife Global Multi-Asset Diversified Income Fund

In 2026, a clearer macroeconomic outlook is expected as momentum improves following strong 2025 drivers such as AI growth, energy transition, anticipated Fed rate cuts, and wider fiscal support. While the US Federal Reserve is likely to continue easing policy, diverse income opportunities remain across global markets, extending beyond traditional government bonds to high yield assets and option writing. Within this environment, the Manulife Global Fund – Global Multi‑Asset Diversified Income Fund (GMADI) remains with a clear and heightened focus towards income generation. The Fund seeks to deliver a high and consistent distribution income while maintaining exposure to long term capital growth opportunities.