17 January 2023

Luke Browne, Head of Asset Allocation, Asia, Multi-Asset Solutions Team

In the past decade, investors have enjoyed loose monetary policies and near-zero interest rates globally which have driven equity multiple expansion, tighter credit spreads and overall positive returns across asset classes. Luke Browne, Head of Asset Allocation, Asia, Multi-Asset Solutions Team, sees the current environment consisting of a macro regime beleaguered with elevated inflation and higher interest rates. Meanwhile, given the importance of peak terminal rates, all eyes are on when global central banks will end their monetary-policy tightening cycle. Against a backdrop of slowing global growth, elevated inflation and recessionary concerns, we think investors should remain thoughtful in taking exposures and generating income returns amid heightened volatility, implement effective diversification and seek specific outcomes, potentially through a multi-asset approach.

Investors of the past decade have enjoyed relatively easy liquidity conditions from loose monetary and fiscal policies globally and from near-zero interest rates. During this time, macro dynamics played a lesser role in shaping investor portfolios. However, we expect the next decade will be different, with less defined trends and more focus on managing portfolio return drivers through time. Today, investors are seeing elevated inflation globally, with markets experiencing varying interest-rate hike profiles.

The current conditions have put macro back on centre stage when considering portfolio positioning and construction. Macro conditions are influencing heightened market volatility amid the tightening policies of central bank policies. The U.S. Federal Reserve, for instance, has arguably been ahead of other developed market central banks with relatively steep interest rate hikes since March 2022. Meanwhile, slowing industrial activity suggests that growth at most developed and emerging market (EM) economies could slip further in the next one or two quarters. In Asia, China remains challenged by slowing growth, though recently announced policy shifts around COVID control and supporting consumption and property developer liquidity have been encouraging.

As inflation persists, the overriding question facing investors over the coming months is when the global tightening cycle will end. We believe there will come a point when inflation eases sufficiently that policymakers will be able to prioritize supporting slowing economic growth. The European Central Bank, for example, has signaled that it is looking beyond current inflation data to a more holistic view of growth. Inflation remains the dominant factor considered by the Bank of Canada in its decision-making process including the past effect of rate hikes and current real activity. Weaker demand on goods would likely help to quell cost-push inflation before the end of the second quarter of 2023 allowing the Fed to pause on tightening early this year and potentially ease policy in the second half of the year.

A potential upside risk to global inflation that we are monitoring is increased demand for goods and services, basic materials, and metals from China’s reopening rebound.

The extent to which a stagflationary environment lingers is key to the Fed’s rate hike profile, terminal rates, and global growth prospects. These macro considerations could cause yet more challenging market conditions into 2023.

Navigating market uncertainty can be difficult. We highlight key macro anchors that investors can look for in the coming months:

While the next few months may be challenging, there are several market events that could offer opportunities:

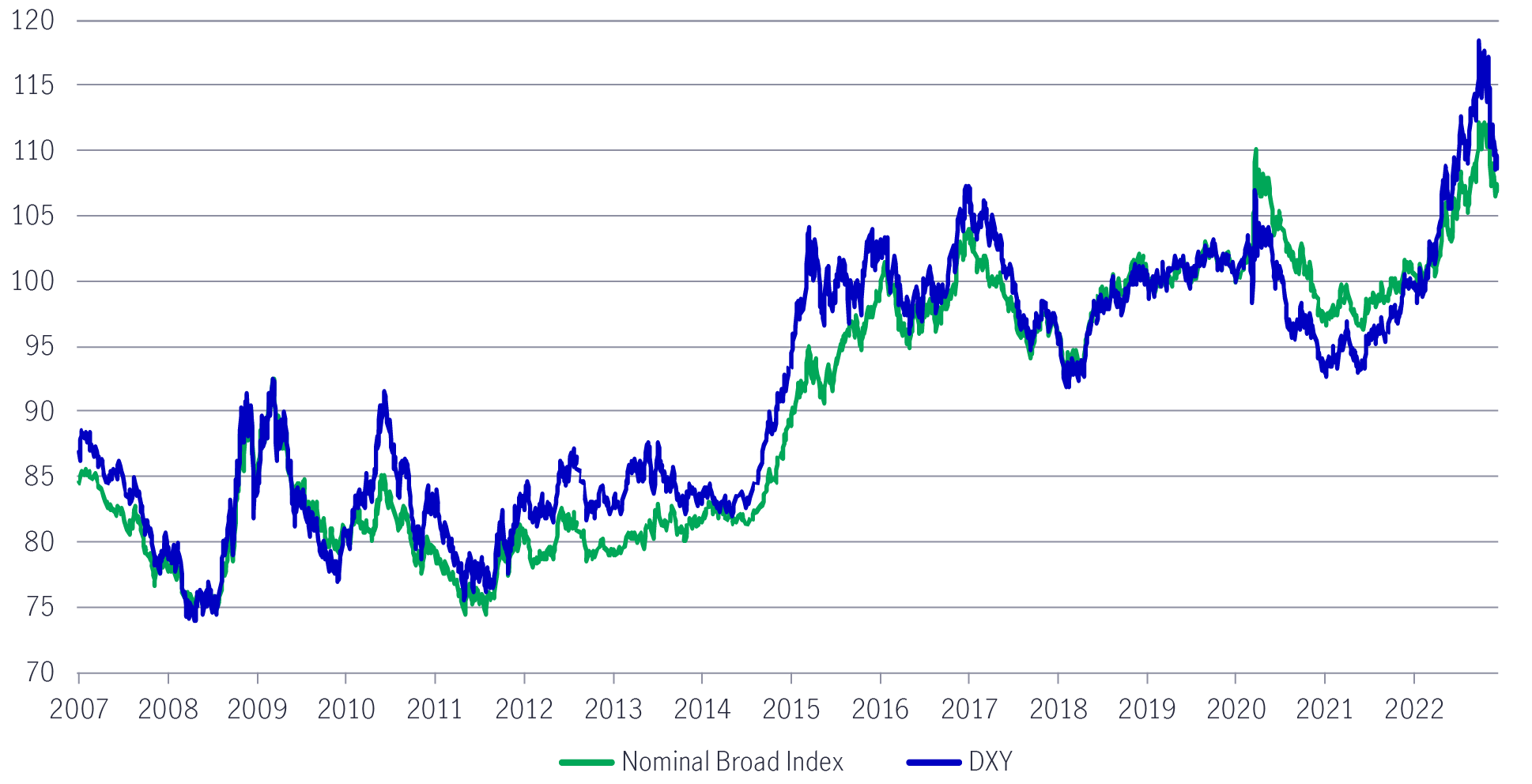

1. A rollover of U.S. dollar strength

We expect movements in foreign exchange to be an important driver of returns in 2023. The U.S. dollar has been on a decade-long uptrend since 2008 and has gained further by 16% to 25% in 2022.1 (Chart 1) The key question for many investors is — will dollar strength persist, or should we expect a reversal in the near future? In our view, respite from the strong U.S. dollar may arrive once we’ve witnessed a peak in inflation expectations, in U.S. Treasury yields, and when the Fed signals a pause to tighten further. Sustained U.S dollar depreciation may potentially trigger allocation to non-U.S. equities. March’s FOMC meeting would be a key event to watch.

Chart 1: US dollar strength gathered pace in the past 18 months

Source: U.S. Federal Reserve, Macrobond, Manulife Investment Management, as of December 9, 2022. DXY refers to the U.S. Dollar Index. It is not possible to invest directly in an index.

The risks to our views, however, would be if the Fed’s dovish pivot comes later than expected in which U.S dollar strength could persist well into 2023. Other factors that could extend the dollar’s strength include sustained U.S. economic outperformance, limited narrowing in the U.S yield advantage, flight to safety and/or EM central banks replenishing their foreign exchange (FX) reserve buffers.

2. Is now the time to return to EM markets?

Emerging markets faced several headwinds in 2022: supply chain disruptions, weaker demand for goods and services, U.S. dollar strength, geopolitical uncertainty and slowing Chinese growth — all these factors have contributed to a 27% decline in EM equities in the first nine months of 2022.2 EM remains interesting for spread and potential foreign exchange opportunities but risks around a global recession mean EM allocations are continuing to be trimmed and potentially further assessed in 2023. Whilst select EM markets are featured as positions within our tactical portfolios of late, we remain cautious with a slight U.S. bias to equities and debt for the near term, given our views towards the dollar and recessionary concerns having more of an impact on the asset class.

More recently, EM equities staged a remarkable rally in November (+14.8%) recovering almost all the ground lost over the previous two months.3 The rebound could be attributed to a combination of lower U.S. bond yields (10-year Treasury yields declined 44 bps to 3.61%), a weaker U.S. dollar, as well as China’s re-opening after easing its COVID restrictions.

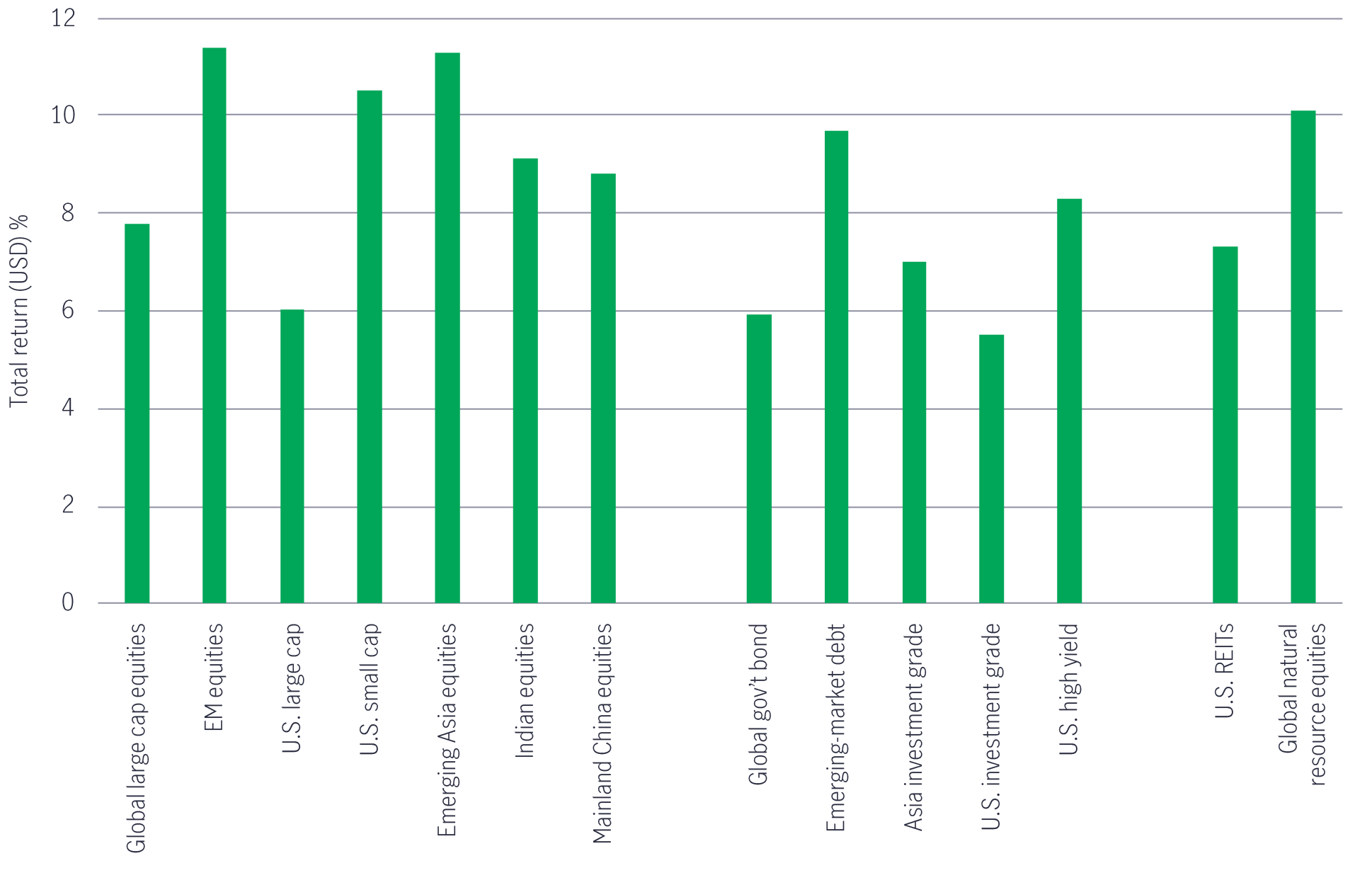

Investors may be questioning to what extent can U.S. equities continue to lead global equity markets or does China's reopening catalyze interest in the broader EM complex and non-US equities. It’s worth noting that past market drawdowns have left EM valuations at significant discounts to fundamentals and a structurally weaker U.S. dollar could provide a modest tailwind to the region. While it may be too early to determine if the recent rebound in EM is sustainable, the asset class’s growth and dividend profiles are still attractive over our five-year forecast period (Chart 2).

Chart 2: Equities, fixed income & alternatives - Expected total return (%)4

Source: Multi-asset solutions team, Manulife Investment Management, as of October 2022. Note: Forecasts are based on annualized returns (%) over a five-year horizon. REITs refer to real estate investment trusts.

3. Value vs growth stocks? Which style will outperform?

Value investments, from utilities to consumer staples and healthcare, have outperformed last year as dented investor sentiment and heightened volatility — coupled of course with tighter financial conditions — take a toll on growth stocks.5 But can value stocks continue to outperform, particularly with the inflationary landscape shifting and an end to monetary-policy tightening somewhere on the horizon? Fears of a recession have halved valuations of growth stocks in the last two years.5 Will 2023 be the year where duration-sensitive growth stocks stage a comeback? Priced at these distressed levels, the market seems to assume muted to zero revenue and earnings potential for these companies (including tech) but there could be more pain to come. Ultimately, time will tell if investors believe valuations truly reflect the fundamentals.

In a nutshell, it all comes down to the two H's for the Federal Reserve: how high and for how long will interest rates rise? Although Fed officials at the December meeting, raised the projected terminal federal funds rate to between 5.00% and 5.25% by the end of 20236, we are carefully considering how quickly interest rates peak, and for how long they hold — these two “H’s” will heavily impact our asset class positioning across and within markets.

In the meantime, we believe investors should stay nimble and access appropriate diversification across asset classes, geographies and/or factor styles. A more agile investment approach might benefit from the flexibility to shift between asset classes when markets rotate and interest rates change.

Our dynamic asset allocation views

(Based on Foresight November 2022 and Q1 2023 Asset Allocation View by the Multi-Asset Solutions Team)

On equities, we take a “barbell approach” with select countries and sectors. We are relatively more positive towards U.S. dollar assets, Southeast Asian equities within Asia ex-Japan, and select sectors within US equities (including energy and utilities). Despite headwinds to growth, the prospect that policy tightening could end may prompt a rally in U.S. equities. U.S. stock valuations are also fairly priced relative to historical levels and could provide an attractive tactical entry point.

We think value-orientated styles would work well in a slowing economy, such as those with defensive properties like consumer staples and utilities and would be less constructive on duration-sensitive assets (i.e., technology) which are often hurt by an aggressive rate-hiking cycle. High-quality equities, those stocks that offer the prospect of capital appreciation in addition to dividends, can potentially offer relative protection if earnings come under pressure.

We also consider income-oriented securities — both high-quality investment-grade fixed income and dividend equities — that offer defensive attributes to help weather an environment of slowing growth and high inflation. Furthermore, we remain constructive on real assets which can offer a degree of inflation-sensitivity amid the current macro backdrop. These include assets such as metals or mining, energy, infrastructure, global REITs and real estate assets.

In Asia, there are economies that have been thriving relative to others. India’s stock markets, for example, reached all-time highs in 2022. With early signs of inflation broadly easing, growth in the Asia-Pacific region has held up relatively well and may allow for a shallower and shorter tightening cycle. There are also opportunities in Japanese equities, supported by any reversal of the yen’s breathtaking depreciation and continued monetary and fiscal support.

We see tactical opportunities in Chinese debt and in China and Hong Kong equities, given recent easing of COVID restrictions and measures to prop up its property sector. Although recent market moves have been quite extended, we believe that sentiment will continue to drive these markets higher in the short run. Chinese debt has been trending to deeply distressed positions; however, the latest supportive measures allow Chinese property developers a 6-to-12-month window to recalibrate their financials and have encouraged a recovery across Chinese credits while markets move from being very bearish to somewhat less bearish currently. On a longer-term perspective, we need to see an improvement in economic activity, a sustained recovery in property sales and a revival of consumer confidence before we can be confidently overweight allocations into China and Hong Kong.

On fixed income, we believe U.S. investment-grade credit is becoming increasingly attractive in terms of yield and capital appreciation, and it can be used by investors to add duration to their portfolios as rates are expected to peak or fall in a late cycle.

We have also seen exposures to alternatives, real assets, and natural resources, that can provide an inflation-hedge and diversification properties in portfolios. For example, prices of oil and agricultural commodities will likely stay well-supported over the medium to long-term due to geopolitics and supply bottlenecks. Publicly listed infrastructure is also becoming an attractive income alternative.

Our strategic asset allocation views

(Based on Foresight November 2022 and Q1 2023 Asset Allocation View by the Multi-Asset Solutions Team)

Recent market corrections have narrowed the disparity between the income profiles of EM and developed market (DM) debt. In other words, the EM debt’s relative return profile is slightly lower for the time being. However, we remain structurally overweight in EM debt. The U.S. dollar can continue to serve as a safe-haven asset amid monetary policy uncertainty, but we believe there’s scope for U.S. dollar to weaken once policy tightening comes to an end. Within fixed income, emerging market bonds can offer higher carry and a selection of both U.S. dollar-denominated or local currency debt.

What’s more, we observed that income-oriented portfolios can benefit from exposures to alternatives/real assets and natural yields (the cash generated from invested income sources). We think REITs (Real Estate Investment Trusts) can generate stable and higher-yielding income over the long term, while offering traditionally less volatility than equities and an element of inflation protection.

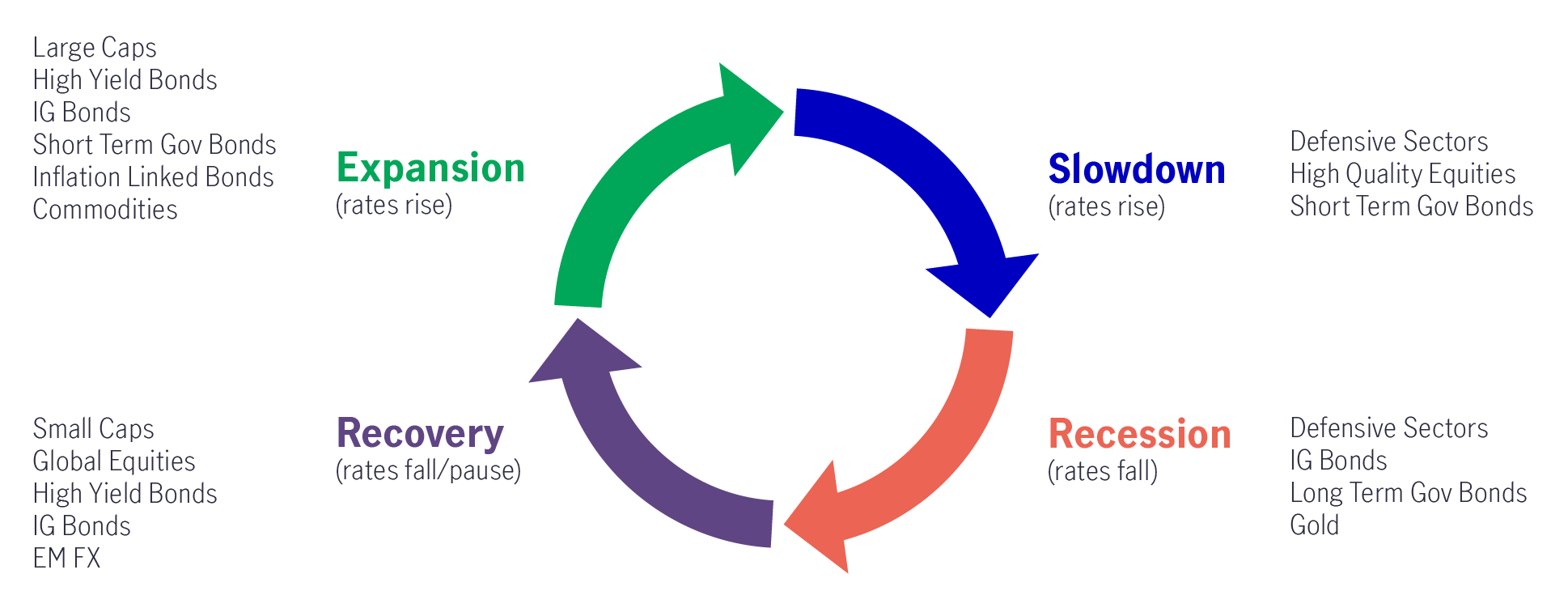

The past has shown us that the investing environment is constantly changing and increasingly complex. Rates rise and fall, and economic cycles fluctuate. Each sector of the economy or asset class can perform differently from another at any given time in a market cycle (Chart 3). This is the reason why having an agile investment approach is so important during times of uncertainty — the flexibility to shift across and within asset classes during market fluctuations.

Chart 3: Asset allocation during the stages of the economic cycle

For illustrative purposes only

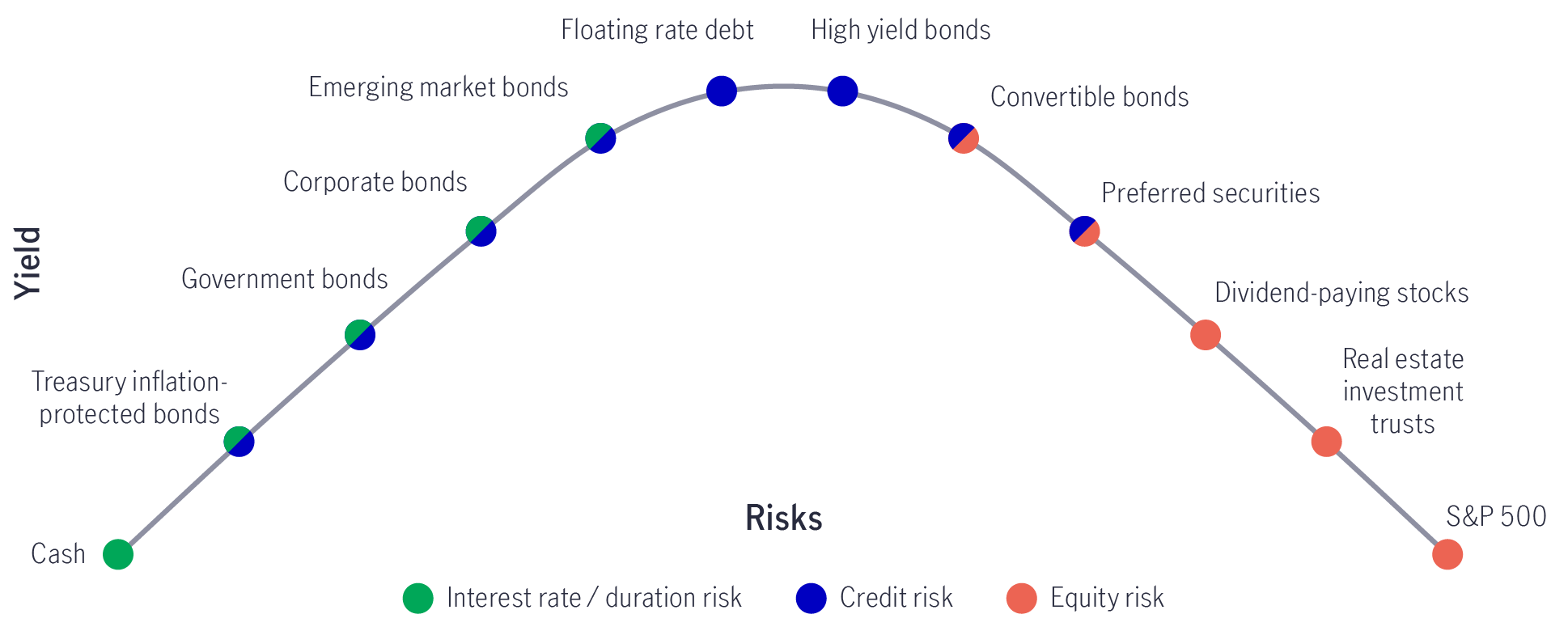

Investment freedom allows investment managers to find opportunities that fit an intended outcome, position within the capital structure, those that offer natural-yielding income or better risk-return profiles, or even those that are less sensitive to the rise and fall of interest rates. Indeed, the sources of income can be spread across a wide spectrum of assets, depending one’s desired levels of risk and yield preferences. (Chart 4)

Chart 4: Income investing can provide a wide spectrum of yield and risk profiles

For illustrative purposes only. The chart depicts general long-term directional and ranking relationships among asset classes on the dimensions of yield and risks. The relative positioning among these asset classes will vary over time. Source: Bloomberg and Manulife Investment Management, data as of 30 November 2022.

Diversification has often been used to introduce portfolio resilience — especially in times like these. In recent years, however, diversification has moved beyond traditional investments and can include factor, premia, relative value, alternatives and/or real assets.

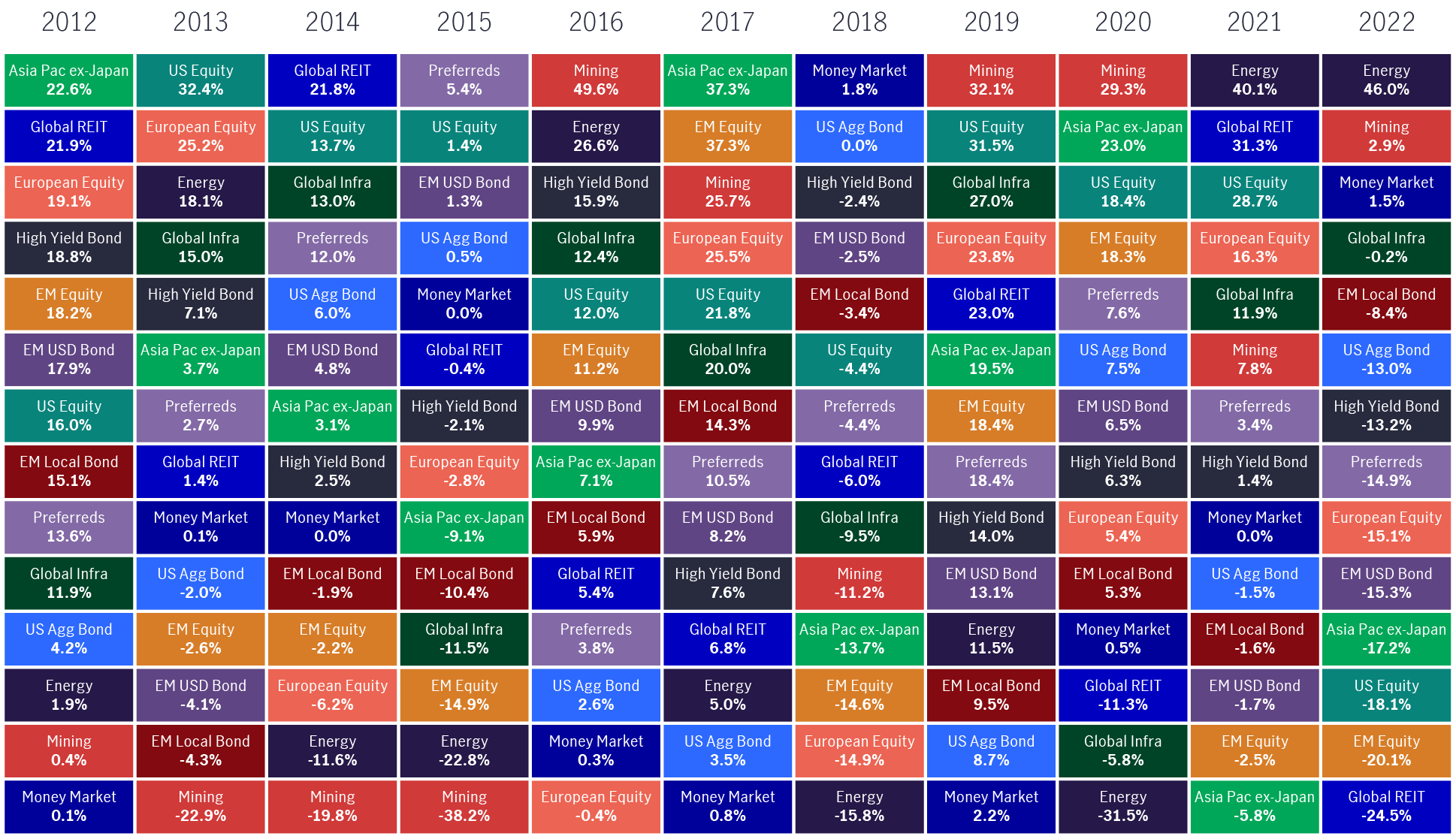

A look at the past decade of returns indicates that no single asset market can always outperform. The top performing asset class can be different at various points in time. (Chart 5) However, unpredictability can afford opportunities though investors should be thoughtful of when and where to allocate in their investment approach. For example, an allocation to the energy sector over the last five years would average to less than 2% total return; however, the same exposure to energy has returned over 46% in 2022. Hence, diversification — or perhaps better to frame as the opportunity set — requires a deeper understanding of both the individual asset class and cross-asset behaviors over time.

Chart 5: Asset class returns vary, understanding where to allocate is key

Source: Morningstar. As of 30 December 2022. EM equity, Asia Pac ex Japan and European equity are measured by MSCI indices; US equity is measured by S&P 500 Index; Global REIT is measured by FTSE EPRA Nareit Global REITs Index; High Yield Bond & preferreds are measured by ICE BofAML indices; US Agg Bond, EM US Dollar Bond, EM Local Bond and Money Market are measured by BBgBarc Index. Energy, Infrastructure and Mining are measured by MSCI World Energy Net TR, S&P Global Infrastructure Index TR, and S&P/TSX Global Mining TR. Past performance is not indicative of future. It is not possible to invest directly in an index.

In conclusion, the current macro regime is considerably different from the previous decade with greater inflation and higher interest rates. Furthermore, it is unclear when central banks will stop monetary tightening — this will ultimately impact asset class returns. Uncertainty, however, can afford opportunities, allowing a thoughtful approach of when and where to allocate risk budgets. Each asset class has its distinct risk-return profile and behaviour during different economic cycles. A multi-asset approach that focuses on a specific outcome with diversified sources of returns and opportunity set, may hold the key to helping investors generate and protect income streams during these less-than-certain times.

1 Bloomberg, as of 2 December 2022.

2 Morningstar, as of 30 September 2022. EM equity is measured by MSCI indices.

3 MSCI, MSCI Emerging Markets Index (USD) factsheet, 30 November 2022.

4 Model inputs are factors in Manulife Investment Management research and are not meant as predictions for any particular asset class, mutual fund, or investment vehicle. To initiate the investment process, the multi-asset solutions team formulates five-year, forward-looking risk and return expectations, developed through a variety of quantitative modeling techniques and complemented with qualitative and fundamental insight; assumptions are then adjusted for economic cycles and growth trend rates. The charts shown here may contain projections or other forward-looking statements regarding future events, targets, management discipline, or other expectations, and are only as current as of the date indicated. There is no assurance that such events will occur, and if they were to occur, the result may be significantly different from that shown here.

5 MSCI, MSCI index factsheets, as of 30 November 2022. Value and growth stocks are measured by MSCI World indices.

6 Manulife Investment Management, The Fed reiterates its hawkish bias, 15 December 2022.

Global Macro Outlook Q3 2023: The long and winding road

At the time of writing, only the eurozone and New Zealand have slipped into recession (as defined by two consecutive quarters of negative growth). But don’t pop the champagne just yet: We see this as a case of recession postponed rather than canceled. Read more.

Asian High Yield: Building resiliency amid volatility

Although emerging from a difficult period, Asian-high-yield is positioned to weather the current market volatility due to regional economic strength and unique asset class characteristics.

Global Healthcare: Enhanced innovation in a post-COVID environment

We discuss the attractiveness of allocating to the healthcare sector in the current economic environment and outlines why it warrants a long-term allocation.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.