Real estate investments have a long history of generating stable yet appreciating income and capital growth while providing the potential for portfolio diversification and lower volatility of returns1. As real assets, real estate revenue streams have demonstrated resiliency in the face of rising inflation, which can help preserve capital within investor portfolios.

Through our active asset management approach and focus on sustainable investing, we strive to create value on behalf of our investors while also helping our planet realize the sustainable future that we all envision.

Our real estate investment team has been developing and managing diversified real estate portfolios for nearly a century. By leveraging our long-standing industry relationships and experience, we continuously source opportunities to create value on behalf of our investors.

We believe identifying and assessing material sustainability factors is integral to understanding the true value of an investment. We incorporate sustainability considerations into all our investment and asset management practices across the real estate value chain.

We leverage the diverse resources and expertise of our globally interconnected investment organization to access opportunities across the entire risk/reward spectrum.

We believe alpha-focused active management is driven by deep sector expertise. Our regional partnerships and our entrepreneurial investment approach help us engage and understand local markets and drive deal sourcing.

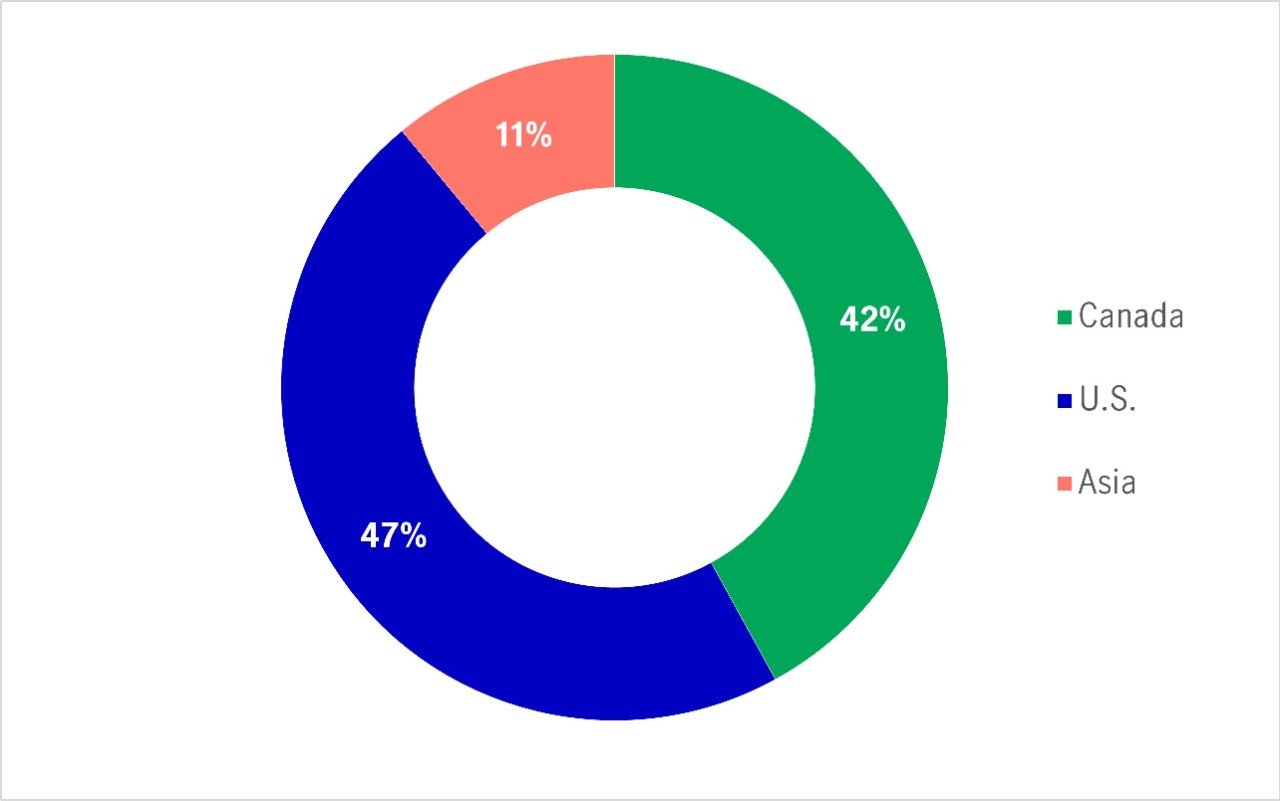

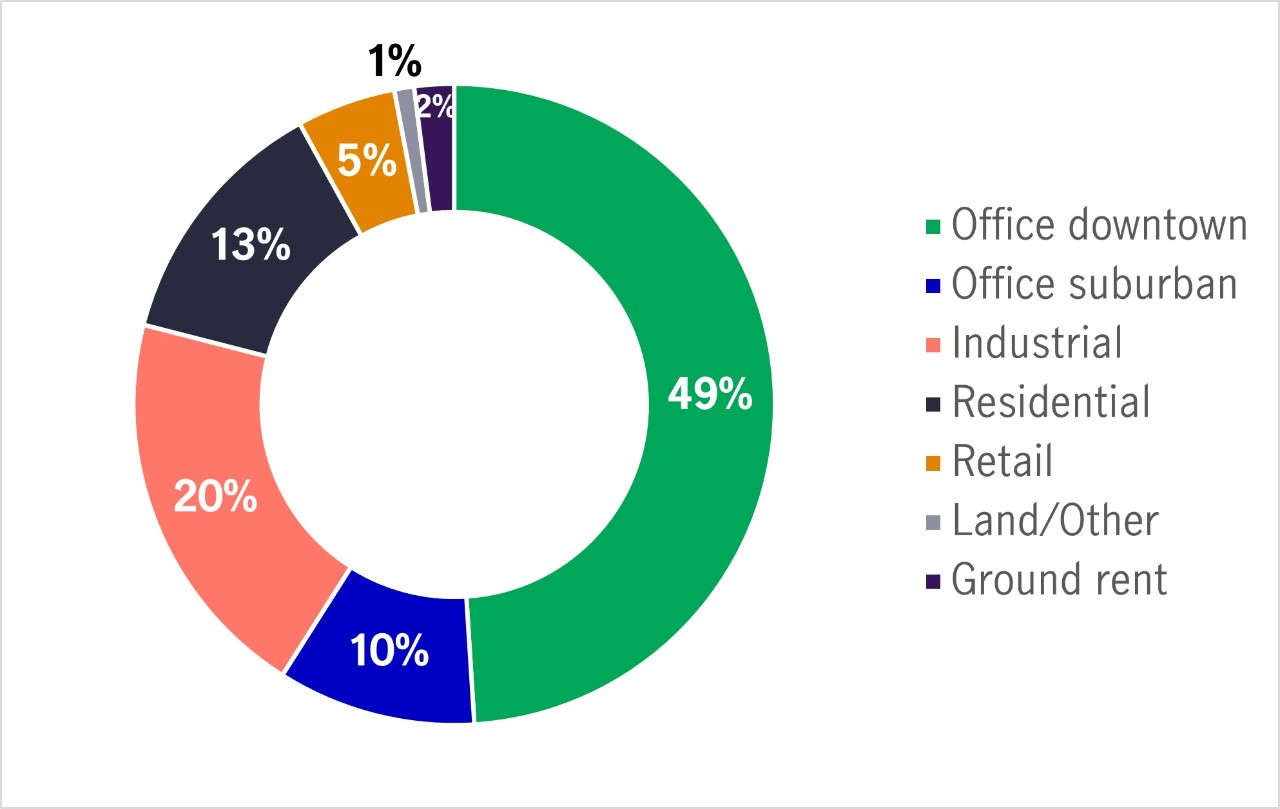

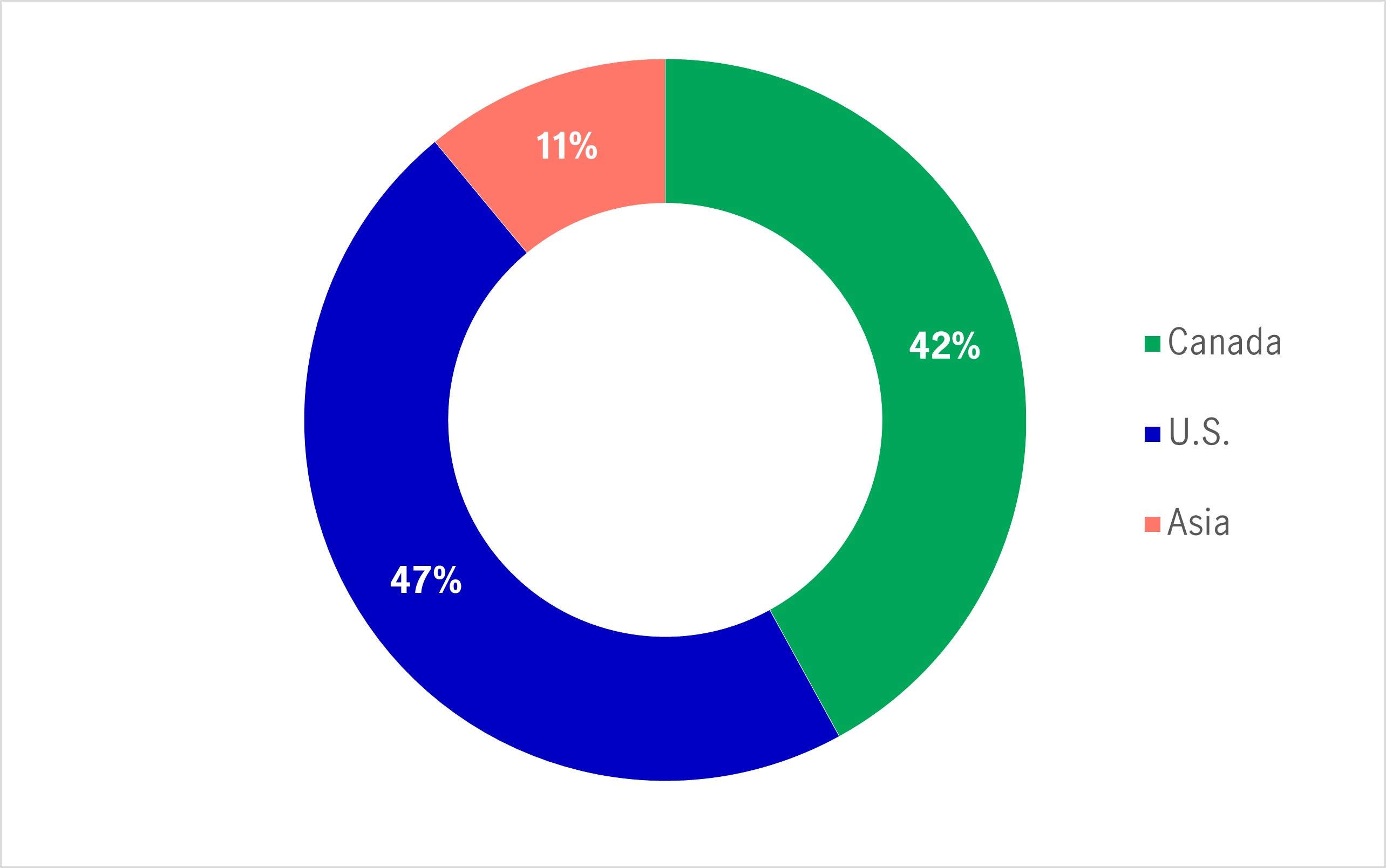

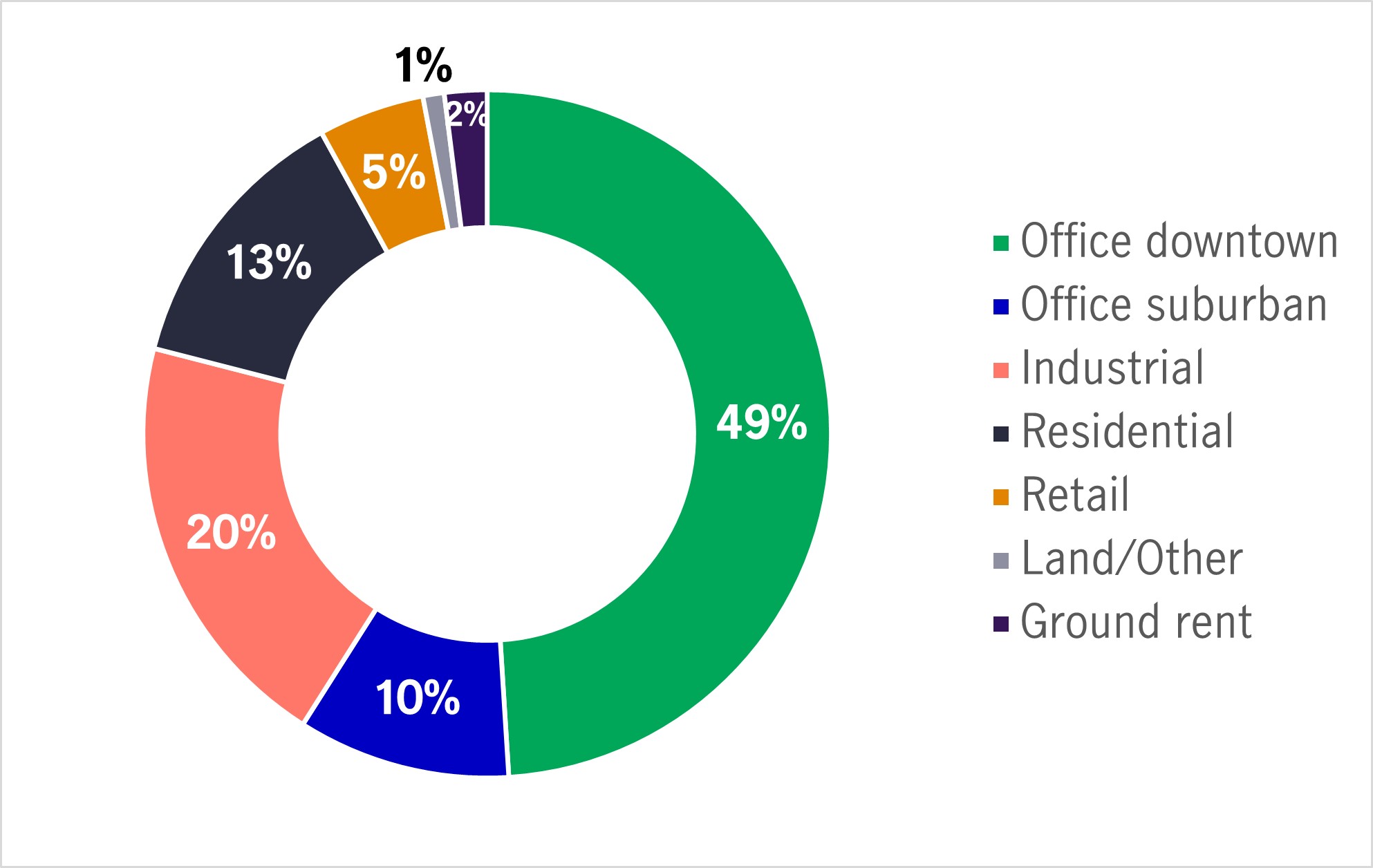

Our global, sustainably operated real estate portfolio includes core, core-plus, and value-add assets across the United States, Canada, and Asia-Pacific. Through our experienced real estate team, we offer investors the ability to invest in products that acquire, develop, and manage properties across office, industrial, multifamily, and retail.

Source: As of March 31, 2022. Based on the total market value of properties. Totals may not total 100% due to rounding.

Source: As of March 31, 2022. Based on the total market value of properties. Totals may not total 100% due to rounding. Diversification does not guarantee a profit nor protect against loss in any market.

Source: As of March 31, 2022. Based on the total market value of properties. Totals may not total 100% due to rounding.

Source: As of March 31, 2022. Based on the total market value of properties. Totals may not total 100% due to rounding. Diversification does not guarantee a profit nor protect against loss in any market.

We seek to generate sustainable income and long-term capital appreciation by investing in stabilized assets across primary markets. Core assets require little to no capital improvements.

Builds on our core strategy by incorporating added growth opportunities through active investment and management of core-plus assets across primary and secondary markets. Core-plus assets require moderate to low capital improvements.

Builds on our core-plus strategy by investing in, managing, and developing value-add assets across primary and secondary markets. Value add assets are actively repositioned through leasing and high to moderate capital improvements.

We seek to generate outsized risk-adjusted returns by leveraging our development and asset repositioning capabilities used for build to core programs to invest in high-risk opportunities.

Our real estate capabilities can be accessed through a variety of investment vehicles, some of which can be tailored to the specific requirements of institutional investors and high-net worth investors.

Separate accounts can offer investors a greater level of control over the strategies employed to meet their objectives and constraints. Portfolios can be tailored to meet investor-specific levels of risk tolerance, return and diversification targets, and cash flow expectations.

Our private equity and credit team allocates to primary, direct, and secondary investments throughout the middle market and beyond. An integrated sponsor-centric approach helps us access deal flow, discern industry trends, and connect insight from one investment opportunity to the next

As publicly traded securities real estate investment trusts (REITs) can offer investors liquidity while providing exposure to a broadly diversified portfolio of real estate and real estate-related assets.

We’re committed to confronting global sustainability challenges. We believe that by integrating sustainability into our investments and operations, and by collaborating with our tenants, industry leaders, and community partners, we can reduce the impact of our operations on the physical environment and support the transition to a net zero emissions economy.

Our experienced investment team has a long history of investing in real estate, and its success has been driven by deep industry experience, a long-term focus, and a disciplined investment approach. Together, our regional approach and investment expertise create a unique foundation for informed decisions and solid performance.⁶

Global Head of Real Assets, Private Markets

Christoph is responsible for defining the firm’s private real assets strategy and managing the operations and development, launch, and growth of investment solutions for clients across the globe. Prior to joining the firm, he was the global head of real estate at Credit Suisse Asset Management, where he was responsible for setting the global direct real estate strategy, raising equity, and developing new products. Before that, Christoph was the CEO of Union Investment Institutional Property GmbH, where he oversaw the institutional business, as well as being a member of the firm’s real estate investment committee. Earlier in his career, he worked at Generali Real Estate for several years and practiced law at Linklaters in Berlin and London.

Global Head of Real Estate, Private Markets

In his role as the global head of real estate, private markets, Marc is responsible for developing and implementing the global real estate investment strategy and increasing the firm’s capabilities in this area on behalf of clients, including Manulife’s General Account. This includes overseeing all aspects of the real estate business, including portfolio management, investments, asset management, and the integration of sustainability into both investments and operations.

Prior to joining the firm, Marc was the chief investment officer (CIO) of real estate, Americas, and the head of portfolio and asset management for the real estate Americas business at DWS. He was also head of the Americas debts investments group. Prior to this, he served as global head of risk and performance analysis at DWS, where he was responsible for the development of allocation, risk, and performance tools. Marc joined DWS from RREEF Real Estate with experience spanning public and private real estate investment management as well as alternative investment management. During this time, Marc providing guidance on workouts, restructurings, and recapitalizations of public companies and properties in and out of bankruptcy.

Why real estate investors can no longer overlook Canada

Resilience management: a multifaceted approach to real estate investing

U.S. real estate can offer investors a balanced blend of benefits

In a low-rate world, real estate can be key

Healthy buildings: an extension of good management

Envisioning the possibilities: the future of real estate resides in flexibility

1 Diversification or asset allocation does not guarantee a profit or protect against the risk of loss in any market. Past performance does not guarantee future results.

2 Based on GRESB results released October 2022 that cover the 2021 calendar year. Manulife Investment Management paid a per fund submission fee, per year. The GRESB Rating is an overall measure of how well ESG issues are integrated into the management and practices of companies and funds. More information about the GRESB Real Estate Assessment, is available here.

3 Rating is as of December 31, 2020. Based on square footage or building size of the gross floor area (GFA) of properties in the global portfolio. Totals from different certification standards do not sum as properties with multiple certifications are only counted once. Certifications are provided by LEED, Energy Star Certification, BOMA BEST, GBCA Greenstar, BCA Green Mark, NABERS, Casbee, BOMA360, Fitwel.

4 Certification achieved in 2021, for 2020-2021 efforts, by the Fitwel Viral Response Module for our efforts to ensure our properties are ready for a safe and healthy return to work. Certification is valid for 12 months. Please visit www.fitwel.org/viral-response-module.

5 Target is an intensity-based reduction of scope 1 and 2 emissions for the properties that are within our operational scope. Scope 1 includes emissions from natural gas, diesel and refrigerants. Scope 2 includes emissions from purchased electricity and steam.

6 Past performance is no indication of future results.