Agriculture investments have a long history of generating strong financial results. The low correlation of farmland returns with the returns of other classes means that farmland can provide diversification benefits within investor portfolios. Farmland investments may also offer moderate inflation protection. As a nature-based solution, farmland can provide positive social and environmental benefits by sequestering carbon, maintaining biodiversity, and contributing to rural economic vitality. As the global population grows, demand for food and fiber is expected to increase. Investors can capitalize on this trend while also benefiting from opportunities to reduce greenhouse gas emissions and help mitigate climate change. Being a responsible steward of farmland, we produce sustainable food and fiber, and we seek to operate in a way that improves the environment, nourishes communities, empowers our people, and delivers performance for our clients.

As a leading, fully integrated agriculture investment manager1,our experience, size, and scale allow us to access a wider array of markets, reduce operating risk, and provide low-cost, high-quality asset management.

Our commitment to sustainability and responsible investing has been a core guiding principle embedded in our strategy and operations since the inception of our business.

Our operating history demonstrates that scale may provide enhanced acquisition access, production efficiencies, cost savings, innovation, and revenue enhancement opportunities.

Integrating property management with our business reduces costs and ensures that our commitment to sustainability is carried through from strategy to execution.

Our agriculture investment program has provided competitive performance since inception.2

Our research capabilities inform our investable universe, underpin our investment strategy, and support portfolio management decisions.

Learn more about diversifying your farmland portfolio with permanent crops and farmland plus.

Agriculture provides investors with an opportunity to invest in assets that contribute to solutions to pressing environmental and social challenges, including climate change, nature loss, water scarcity, and rising inequality. We strive to play a positive role in confronting these global challenges through our long-term investments in agriculture and in the surrounding rural communities.

We conduct our business activities in a manner that recognizes the need to preserve and enhance the quality of our environment and local communities.

Working collaboratively with industry peers and nonprofit organizations, we developed an industrywide sustainability standard for agriculture, Leading Harvest. To date, 100% of our U.S. farmland is certified to the Leading Harvest Farmland Management Standard.3

We manage agriculture investments to achieve key priorities of our sustainability and responsible investing program, sustainably managing the resources entrusted to us and supporting climate change mitigation across our farmland.

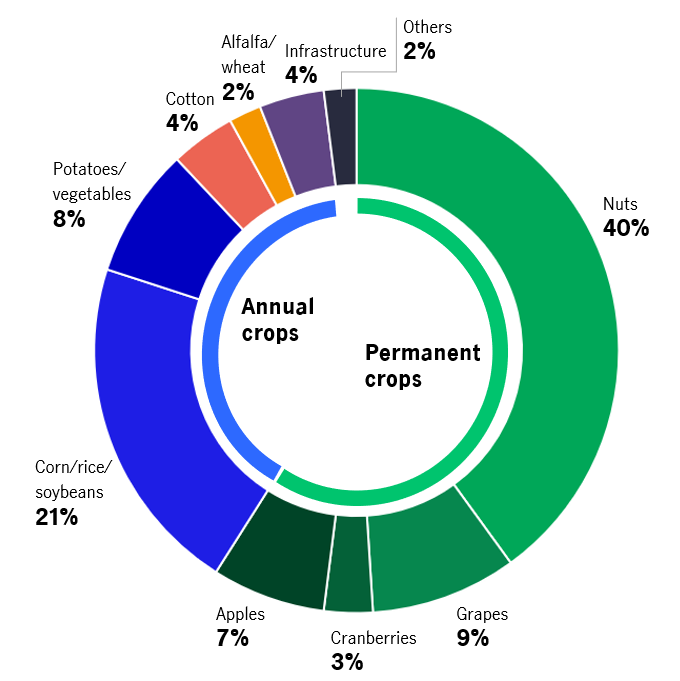

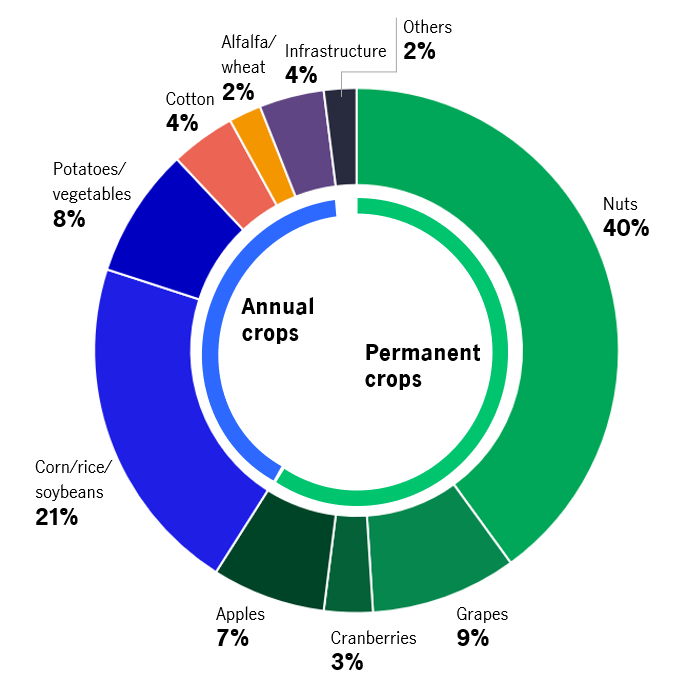

Our global, high-quality, diversified agriculture portfolio includes annual and permanent crops along with farmland plus integrated processing operations. We offer investors the ability to invest in portfolios diversified by crop type, geography, and management style as well as portfolios that target a particular region or market segment.

Replanted every year, they’re generally priced comparably across the globe. They may include commodity corn, soybeans, cotton, wheat, rice, or specialty crops such as vegetables.

Higher-value niche crops that grow on a tree or vine, which vary in pricing by location—and where best management practices can enhance value. They may include tree nuts, cranberries, apples, citrus, or blueberries.

Data as of March 31, 2022. Portfolio snapshot chart displays agriculture assets under management as a percentage of final market value (US$4.1B) by crop for Q1 2022. Totals may not sum to 100 due to rounding. Diversification does not guarantee a profit nor protect against loss in any market.

Operations may include value chain integration focused on processing, storage, packaging, and marketing various agriculture commodities.

These assets may include vertically integrated permanent crop operations or indoor growth spaces.

First row (L-R): Leading Harvest; Global Impact Investing Network; Massachusetts Institute of Technology (MIT); UN Principles for Responsible Investment; World Business Council for Sustainable Development. All logos are registered trademarks of the respective organizations/firms represented.

Focused on optimizing the performance of diversified agriculture portfolios through the integration of our property and portfolio-level expertise.

Global Head of Agriculture Investments

Oliver is responsible for the overall direction and growth of Manulife Investment Management’s institutional agriculture investment program. He’s a member of the senior management team for the firm’s timberland and agriculture businesses and serves on the executive committee. He also leads the farmland management team, serves on the farmland investment committee, and chairs company boards for the firm’s Australian investment vehicles. Previously, Oliver headed the farmland asset management function. Prior to joining the firm in 1997, he spent five years with First Pioneer Farm Credit, where he was responsible for evaluating and appraising farmland and farm businesses for potential loans. Oliver holds the Chartered Financial Analyst designation and is a member of the American Society of Farm Managers and Rural Appraisers, the Association for Investment Management and Research, and the Boston Security Analysts Society.

Managing Director, Deputy Chief Investment Officer, Agriculture

Rick is responsible for the development of new investment strategies and growth initiatives, client investment governance, and identifying and mitigating risk exposures related to the firm’s agricultural investment process, products, and client investments. He’s a member of the natural resource investment committee and investment strategy committee and is also directly involved with business development activities, structuring investment management agreements, and designing client investment goals and constraints. Rick previously led the farmland plus investment team, the client account management team, and the investment underwriting function. Prior to joining the company in 2011, he worked in financial strategy for Forest Systems Management Company. Rick holds the Chartered Financial Analyst designation and is a member of the CFA Society Boston.

Managing Director, Acquisitions and Dispositions, the Americas, Agriculture

Dave leads the firm’s farmland acquisition and divestiture programs in North and South America. In this role, he manages a team that focuses on sourcing and disposing of farmland investment opportunities, managing the due diligence and escrow process, and developing strategic alliance opportunities. Previously, Dave was managing director of U.S. farmland acquisitions and dispositions, and earlier, he was senior vice president at Hancock Farmland Services, providing oversight for the management of the firm’s leased row crop properties in the United States, as well as providing support for acquisitions and sales east of the Rocky Mountains. He was also responsible for oversight of the development and direct farming operations for 2,270 acres (~918 hectares) of cranberries in Wisconsin. Prior to joining Farmland Management Services, he worked as a farm manager for JHUSA. Earlier in his career, he promoted crop protectants to distributors, dealers, and farmers for the company now known as Aventis Crop Science. Dave is a licensed managing broker in the state of Illinois and holds the Accredited Farm Manager designation with the American Society of Farm Managers and Rural Appraisers.

Managing Director, Senior Portfolio Manager and Head of Client Account Management, Agriculture

Matt leads the agriculture portfolio management team that manages individual client accounts and commingled funds. Matt is responsible for developing and implementing client investment strategies for agriculture, evaluating acquisition and disposition opportunities, evaluating portfolio performance, developing and implementing acquisition funding strategies, and managing all aspects of the client relationship. Prior to joining the firm in 2016, he worked for Park Street Capital as a senior vice president and controller for its natural resource-focused investment partnerships. At Park Street, Matt’s responsibilities included investment analysis, valuation, operational and investment due diligence, financial forecasting and analysis, and management of partnership operations and reporting. Prior to this, he worked for PricewaterhouseCoopers in alternative asset management assurance practice. Matt is a CFA® charterholder and Certified Public Accountant and is a member of the CFA Society Boston.

Managing Director, Business Development, Timberland and Agriculture

Julie is responsible for business development activities with a focus on capital formation for the firm’s global agriculture strategy. Julie is also involved in new agricultural product development and is a member of the Agriculture Strategy Team. Prior to joining the firm, Julie was director of agriculture at Conservation Resource Partners and, before that, was the product strategist for timber and agriculture at GMO where she was involved in the development of both timber and agriculture strategies as well as client relationship management and business development with the firm’s Renewable Resources Group. In addition, Julie was an independent consultant in agricultural investment and a portfolio manager with Hancock Agricultural Investment Group, where she served in a number of roles. Julie is a CFA® charterholder and is a member of the CFA Society Boston.

Managing Director, Global Head of Agricultural Operations

Brent provides strategic leadership for the firm’s global agricultural property management platforms. In this role, he is responsible for managing health, safety, environmental, and risk objectives while meeting client needs and maintaining internal profitability. Prior to joining the firm in 2021, Brent was vice president of operations for the agricultural division at Wilbur-Ellis Company, LLC, where he led the company’s U.S. operations and managed the network of retail and distribution logistics, application, manufacturing, and procurement functions. He was accountable for safety, compliance, cost optimization, operational excellence, supply chain effectiveness, and risk mitigation.

Managing Director, Global Head of Valuations, Agriculture

Hugues leads all farmland valuations, financial plans, and farmland analyses for the firm’s global agriculture clients. In addition, he serves as a liaison across diverse functional groups within the organization in preparing, managing, and/or reviewing farmland investment models, property plans and investment analyses. Prior to joining the firm in 2017, Hugues was director of research with MetLife Investments, where he headed agricultural investment research to support the underwriting and analysis for the firm’s agriculture portfolio. Before joining MetLife, he was a senior industry analyst with SunTrust Bank, where he developed a market risk analysis platform for the food and agribusiness portfolios. Hugues holds the Chartered Financial Analyst and Financial Risk Manager designations.

Managing Director, Head of Australasia Agricultural Investments

Andrew leads the ongoing strategy, management, and growth of the firm’s Australasian farmland platform. Andrew has extensive experience in farmland agriculture in Australia and other countries. Prior to joining the firm, Andrew held senior management positions with ConAgra and Mitsubishi. Andrew has been a managing director of Hancock Farming Company and Hancock Natural Resource Group Australasia, the property manager for Manulife Investment Management’s Australian assets since its inception. Andrew serves on the farmland investment committee, company boards for the firm’s Australian investment vehicles, chairing each of the firm’s Australian investment vehicles and is a member of the Australian Institute of Agricultural Science and Technology.

Sustainable investing in agriculture 2022

2020 Leading Harvest Audit Summary Report: Direct Operated Properties

2020 Leading Harvest Audit Summary Report: Tenant Operated Properties

Sustainable and responsible investing framework

Carbon principles: a high-integrity climate benefit methodology

1 Highquest Partners LLC. Based on largest total agriculture assets under management according to the Global AgInvesting Rankings and Trends Report 2019. Most recent data available. Manulife pays a subscription fee for access to the database.

2 Past performance is no indication of future results.

3 Certification as of May 17, 2021, by Leading Harvest and is based on an annual assessment of the conformation to the Farmland Management Standard. Most current data shown. Please visit www.leadingharvest.org. Please read our recent annual sustainability and responsible investing report, which includes our performance against metrics aligned with each of our five key sustainability and responsible investing priorities as well as other external standards, such as the Global Impact Investing Network (GIIN), the Sustainable Development Goals (SDGs), and third-party certification system objectives.