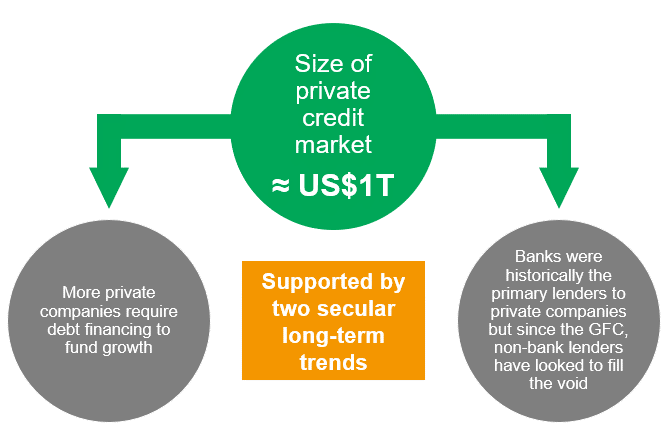

Private credit has historically provided investors with income and diversification benefits through an attractive combination of differentiated yield, floating rate returns, and the potential for a high level of asset-based principal protection with low volatility.

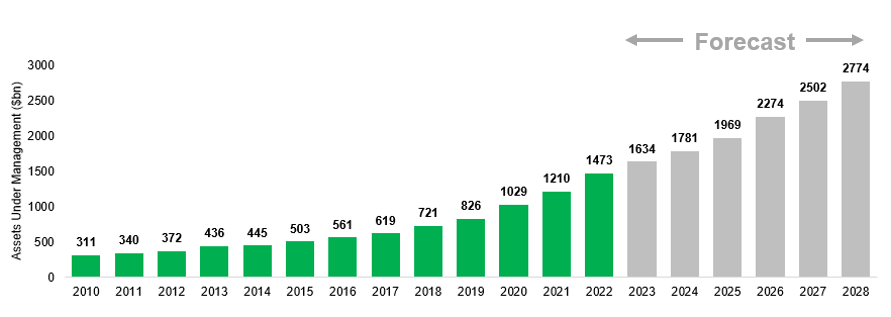

Private debt assets under management and forecast, 2010–2028(f)1

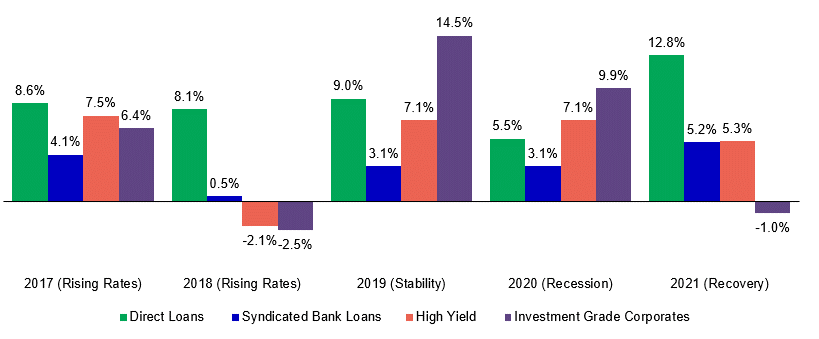

Historically, in both rising interest rate and stable environments, private credit has outperformed its public market counterparts. In addition, private credit has also historically minimised drawdown effects during recessionary environments.

Private credit’s performance during the global pandemic2

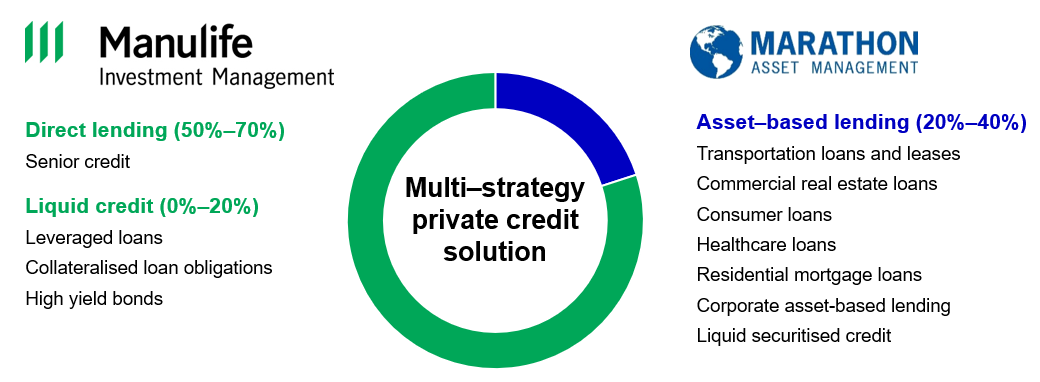

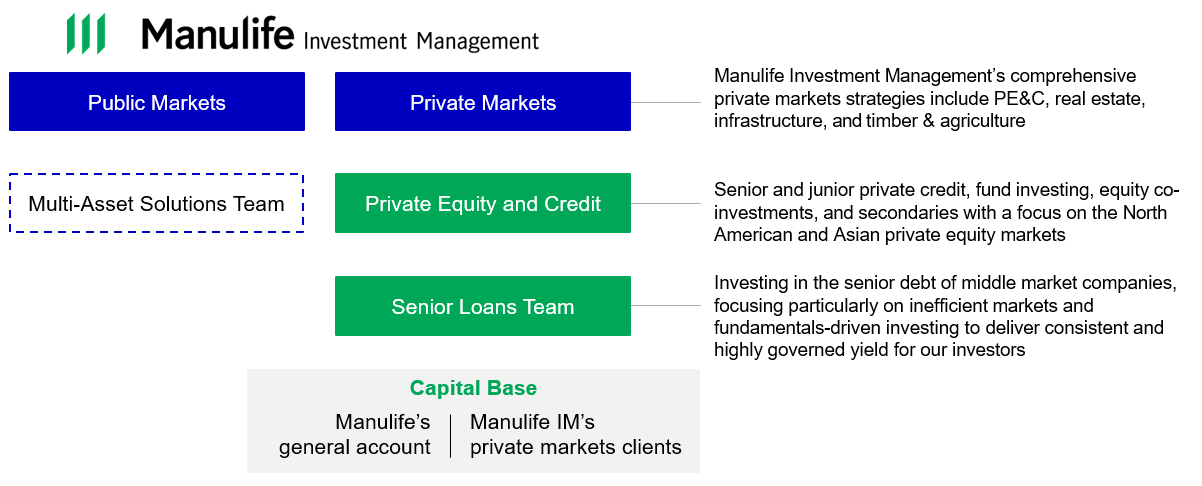

The Manulife Private Credit Plus strategy is a diversified private credit fund-of-funds solution3 that seeks to deliver income, and to a lesser extent, capital appreciation by investing in middle market companies, alongside select complementary, performance-enhancing opportunistic credit exposures.

This multi-strategy portfolio is designed to be rooted in a diversified portfolio of US middle market senior secured loans, sourced across Manulife Investment Management’s Private Equity and Credit (PE&C) platform and enhanced through opportunistic asset-based lending sourced through our third-party manager, Marathon Asset Management.

For illustration only. Under normal circumstances, it is intended to invest within these parameters but they are subject to change in accordance with relevant investment guidelines.

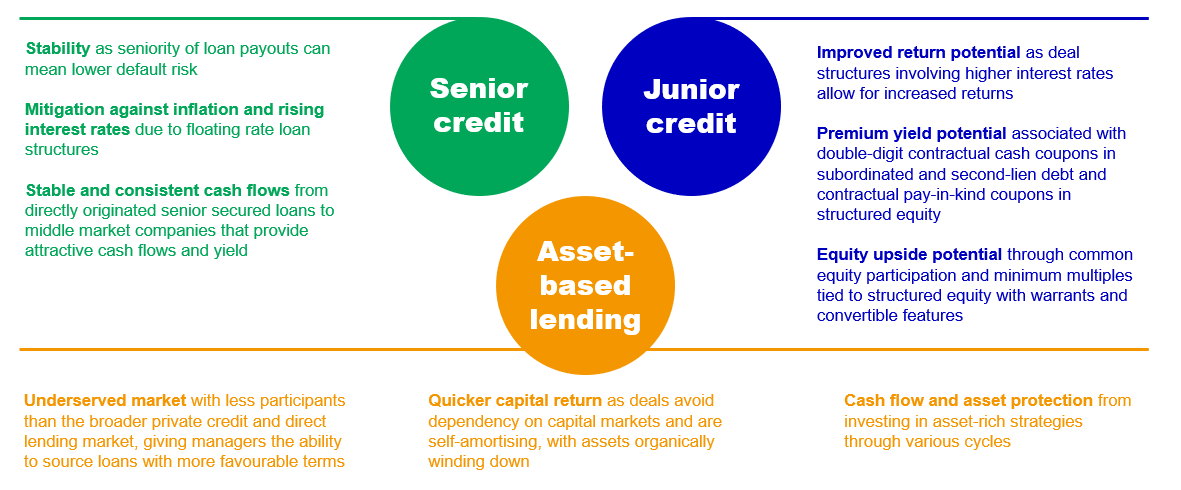

Core credit segments are key differentiators:

How the MPCP strategy can benefit investors:

Middle market loans represent one of the largest growing sectors in the US economy4

Potential risk diversification by investing across a broad spectrum of private credit5

Consistent distribution to be paid on a quarterly basis6

Positioned to deploy capital quickly as the strategy is seeded with US$100 million

Private equity and credit outlook 2024

Mezzanine: low leverage and high rates point to attractive risk/return

Direct lending outlook: four expectations for 2024

Mezzanine financing can shine when macro clouds loom

Finding investment opportunities in a rapidly changing world

Think big: smaller investors deserve diversification through alternative investments

1 Source: Preqin Forecasts. The data above is the most recent provided by Preqin as of 30 Sep 2023. *2023 figure is annualised based on data to Sep. 2023-2028 are Preqin's forecasted figures. Past performance does not guarantee future results. Diversification does not guarantee a profit or eliminate the risk of a loss. Preqin’s AUM forecasts are the results of internal collaboration between Preqin's dedicated Data Science and Research Insights teams. The Preqin dataset includes historical AUM across asset classes and geographies, as well as fundraising and deals. This data was overlaid with historical time series for a range of macroeconomic data, such as GDP, inflation, and central bank policy rates across major global economies including the US, UK, the eurozone, China, and Japan. Various modeling techniques were explored in order to select the methodology most appropriate to the dataset. Ultimately, an ensemble of linear models, with adjustments based upon experience within the Data Science and Research Insights teams, was selected. Adjustment was included to account for the conservative estimates of the model, compared to challenger models. Preqin will continue to develop this model, with future iterations expected to highlight a range of potential sensitivities, allowing users to amend the various inputs and produce their own forecasts.

2 Source: Cliffwater Direct Lending Index, Credit Suisse Leveraged Loan Index, ICE BofA High Yield Index and Bloomberg US Corporate Bond Index, as of 31 Dec 2023. Represents calendar year performance. Past performance does not guarantee future results.

3 The strategy operates as a fund of funds and, under normal market conditions, invests at least 80% of its net assets in private credit investments, either directly or by investing in affiliated and unaffiliated underlying funds per the subadvisor's discretion. The investment objective is to seek income and, to a lesser extent, capital appreciation. There can be no assurance that the strategy will achieve its investment objective.

4 Source: National Center for the Middle Market (NCMM) – 2022 Middle Market Indicator.

5 Diversification does not guarantee a profit or protect against the risk of a loss.

6 Distributions to Shareholders cannot be assured, and the amount of each quarterly distribution is likely to vary. It is possible, although not intended, that distributions could exceed net investment income and net short-term and long-term capital gain, resulting in a return of capital.

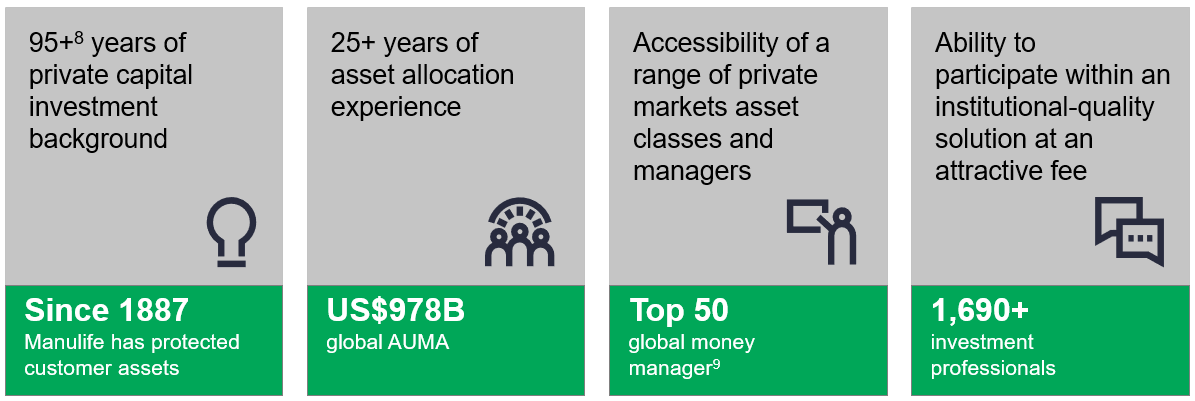

7Source: Manulife Financial Corporation, as of 30 Sep 2023.

8 Includes significant experience investing on behalf of the Manulife general account.

9 Source: 2022 Pensions & Investments Money Manager Survey Report (the largest money managers by asset universe, total worldwide assets, in millions, as of 31 Dec 2021).

10 Global Wealth and Asset Management AUMA as of 30 Sep 2023, which includes $149.0 billion of assets managed on behalf of other segments and $128.6 billion of assets under administration. Assets are shown in US dollars.

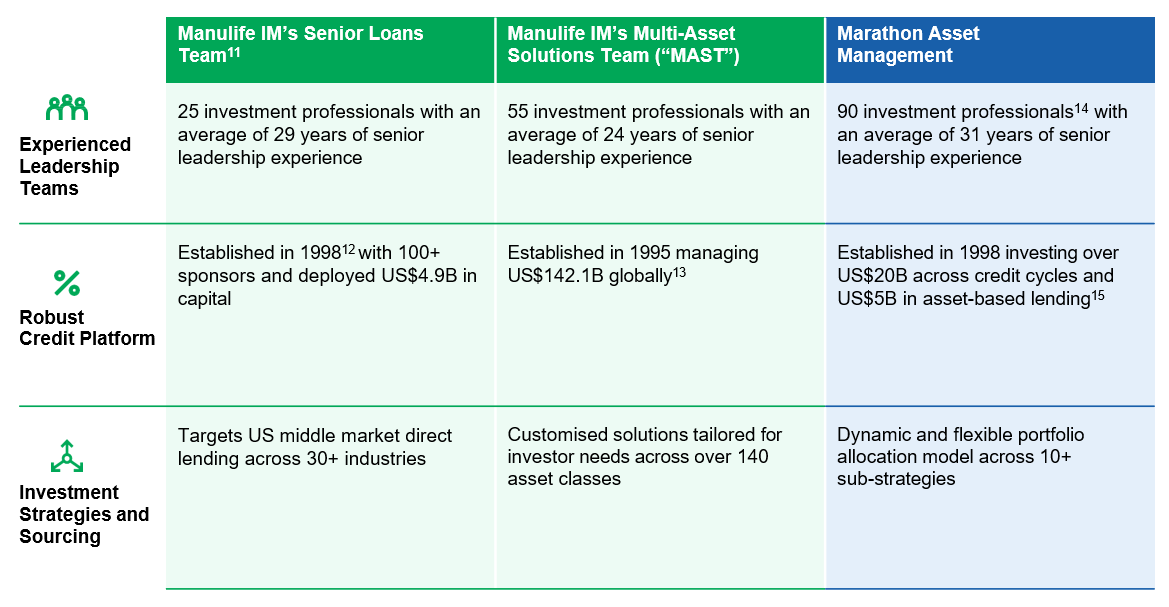

11 As of 30 Jun 2023. Represents senior credit investments made by the PE&C team on behalf of the General Account and managed third party accounts since inception of the Senior Credit Strategy in 2017 through 31 Mar 2023.

12 Credit platform was established in 1998. Senior credit platform was launched in 2017.

13 As of 31 Mar 2023 in US$. AUM includes US$2.8 billion non-discretionary advice for the Manulife General Account by MAST Index team, and C$2.2 billion External Clients AUM advised by MAST LDI team, but managed by other MIM desks.

14 Personnel figures are as of 3 Apr 2023.

15 AUM is estimated as of 31 Dec 2022, and includes undrawn commitments netted for investments in affiliated vehicles. Represents total assets managed across Marathon Asset Management’s funds including leverage provided by the fund’s financing provider.

Important Information

Investing in the strategy includes several risks and limitations, including but not limited to the risk of loss. Past performance is not indicative of future results and there can be no assurance that the investment objective of the strategy will be achieved or that the investment strategy utilized will be successful.

Any characteristics, guidelines, constraints, or other information provided for this content was selected by the firm as representation of the investment strategy and is provided for illustrative purpose only, may change at any time, and may differ for a specific account. Each client account is individually managed; actual holdings will vary for each client and there is no guarantee that a particular client’s account will have the same characteristics as described herein. Any information about the holdings, asset allocation, or sector diversification is historical and is not an indication of future performance or any future portfolio composition, which will vary. Portfolio holdings are representative of the strategy, are subject to change at any time, are not a recommendation to buy or sell a security, and do not represent all of the securities purchased, sold or recommended for the portfolio. It should not be assumed that an investment in these securities was or will be profitable. Top ten holdings information combines share listings from the same issuer, and related depositary receipts, into a singular holding to accurately present aggregate economic interest in the referenced company.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification or asset allocation does not guarantee a profit or protect against the risk of a loss in any market. The indices referenced herein are broad-based securities market indices and used for illustrative purposes only. The indices cited are widely accepted benchmarks for investment performance within their relevant regions, sectors or asset classes, and represent non-managed investment portfolios.

If derivatives are employed, note that investing in derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments and, in a down market, could become harder to value or sell at a fair price.

Investments in debt instruments, whether senior or subordinated debt, public or private, secured or unsecured, or investment-grade or below investment-grade involve a number of significant risks, any one of which could cause the strategy to lose all or part of the value of its investment. Investments in debt instruments include liquidity risk, interest rate/market value risk, credit risk/market risk, prepayment risk, ratings risk, exchange rate risk, and risk of bankruptcy. Investing in leveraged senior loans also involves additional risk that the collateral securing a loan decreases in value, is difficult to sell in a timely manner, is difficult to appraise and fluctuations in value based upon the success of the business and market conditions, including as a result of the inability of the portfolio company to raise additional capital. Investments in subordinated debt/loans involve additional risks and can be highly speculative, involving a high degree of risk of credit loss.